Natural gas deliveries to US LNG plants increased in first-half 2023

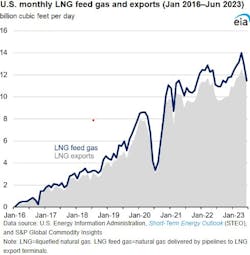

Natural gas deliveries by pipeline to US LNG plants averaged 12.8 bcfd in the first 6 months of 2023, following the 15-million tonne/year (tpy) Freeport LNG terminal’s return to service, as reported by the US Energy Information Agency (EIA) using data from S&P Global Commodity Insights. This average was 1 bcfd (8%) more than the 2022 annual average and 500 MMcfd (4%) more than the same 6-month period in 2022.

LNG feed gas set a monthly record in April 2023 at 14 bcfd, supported by high international demand for US LNG exports, particularly in Europe. LNG feed gas levels declined in May (13 bcfd) and June (11.5 bcfd), mostly due to maintenance at several US LNG plants, including Cheniere Energy Partners LP’s 30-million tpy Sabine Pass and Sempra Infrastructure’s 13.5-million tpy Cameron.

LNG feed gas levels are typically higher than LNG export levels because LNG plants consume some of the feed gas to operate on-site liquefaction equipment. All US LNG plants, except Freeport LNG, have on-site natural gas-fired power generation to produce electricity required for their operations.

EIA estimates that about 14% of LNG feed gas is used for on-site power and other liquefaction-related processes. Freeport LNG is the only liquefaction plant in the US and one of only two LNG plants in the world that uses electric motors exclusively instead of natural gas turbines to drive its liquefaction compressors. Using electric motors helps the plant comply with the Houston-area air emission standards. Freeport LNG purchases electricity from the grid to power its liquefaction processes because it does not have an on-site natural gas-fired power plant. As a result, most of Freeport LNG’s feed gas is converted into LNG.

The agency forecasts US LNG exports to average 12 bcfd in 2023 and 13.3 bcfd in 2024, as two new LNG liquefaction projects are expected to come online: QatarEnergy and ExxonMobil Corp.’s 18-millon tpy Golden Pass and Venture Global LNG Inc.’s 20-million tpy Plaquemines plants. Global economic conditions and demand for natural gas in Europe and Asia may affect this forecast. Trends supporting higher LNG exports from the US include assumed continuous replacement of Russia's natural gas exports by pipeline to Europe.

Limited growth in global LNG export capacity in the next 2 years may increase the need for destination-flexible LNG supplies, mainly from the US. So far this year, mild winter temperatures and above-average storage inventories in the northern hemisphere decreased spot LNG prices, which could be an incentive to import more LNG, particularly in the relatively more price-sensitive countries of Southeast Asia.