Global liquids, gas pipeline construction plans shrink

Planned worldwide pipeline construction to be completed in 2021 dropped sharply from the previous year on a combination of the economic effects of the coronavirus pandemic (COVID-19) and completion of multiple large projects in 2020. Efforts to conserve capital, meanwhile, delayed completion of some projects scheduled to have wrapped this year. Plans for US construction in 2021 made up just 10.5% of the global planned build, compared with 25% in 2020 and 44% in 2019.

Global future planned mileage slipped for the fourth straight year, but was more resilient than operators’ near-term plans, buoyed at least in part by the slippage of some project schedules out of 2021.

Operators plan to install 14,345 miles in 2021 alone (Table 1), with natural gas plans (13,298 miles) making up 93% of the total, based on data collected by Oil & Gas Journal. By contrast, gas pipelines made up 78.5% of total planned construction a year earlier.

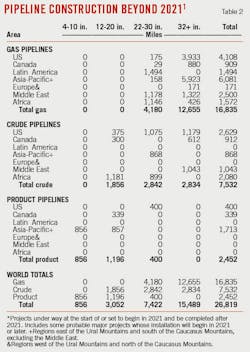

As 2021 began, operators had announced plans to build almost 27,000 miles of crude oil, product, and natural gas pipelines extending into the middle of the decade, a roughly 13% decrease from data reported a year earlier. Combining both current-year and forward estimates (Fig. 1), increases in planned construction in the Middle East, Canada, and Latin America were outweighed by decreases elsewhere.

Outlook

The EIA Annual Energy Outlook (AEO) 2020 forecast the US becoming a net energy exporter in 2020 and remaining so through 2050 due to large production increases and slow growth in consumption. Net exports of US petroleum and other liquids peak at more than 3.8 million barrels per day (b/d) in the early 2030s, according to the forecast, before gradually declining as domestic consumption rises. The US continues to export more petroleum and other liquids than it imports. Net exports of petroleum and other liquids reach 0.2 million b/d in 2050 as domestic consumption slowly increases but remains 1.2 million b/d below the peak levels recorded in 2004.

EIA projected US liquids fuels use reaching a peak of 20.67 million b/d in 2020 (from a 2019 base of 20.34), dropping to 19.72 million b/d in 2036 and then returning to 19.81 in 2040 and a new peak of 20.84 million b/d in 2050. These projections, however, were made before COVID-19.

EIA projected US crude oil production to set annual records through 2026 and remain greater than 14 million b/d through 2036. Lower 48 onshore tight oil development continues to be the main source of production growth, accounting for about 70% of cumulative domestic production through 2050.

The agency projected US dry natural gas production to grow at roughly 1.7%/year through 2029, reaching 39.56 tcf, before tapering off to <1%/year for the remainder of the projection (from 33.81 tcf in 2019). The initial growth rate is much slower than predicted by EIA in 2019, substantial expansion of production having occurred since the 2017 figures used in the 2019 report. EIA predicts 2050 production of 45 tcf.

OGJ tracks applications for gas pipeline construction to the US Federal Energy Regulatory Commission (FERC). Applications filed in the 12 months ending June 30, 2020, (the most recent 1-year period surveyed) increased from the previous year.

- 367 miles of gas pipeline were proposed for land construction. For the earlier 12-month period ending June 30, 2019, 246 miles had been proposed.

- FERC applications for new or additional compression horsepower at the end of June 2020 jumped sharply, totaling roughly 680,000 hp versus 290,000 hp a year earlier.

Bases, costs

For 2021 only (Table 1), operators plan to complete 14,345 miles of oil and gas pipelines worldwide at a cost of $122 billion. For 2020 only, companies had planned roughly 19,000 miles at a cost of roughly $100 billion.

- Projections for 2021 pipeline mileage reflect only projects likely to be completed by yearend 2021, including construction in progress at the start of the year or set to begin during it.

- Projections for mileage after 2021 include construction that might begin in 2021 but be completed later. Also included are some long-term projects judged as probable, even if they will not break ground until after 2021.

Based on historical analysis, and a few exceptions and variations notwithstanding, these projections assume 90% of all construction will be onshore and 10% offshore and that pipelines 32 in. OD or larger are onshore projects.

Following is a breakdown of projected costs, using these assumptions and OGJ pipeline-cost data:

- Total onshore construction (13,888 miles) for 2021 only will cost roughly $112 billion:

- $1 billion for 4-10 in.

- $8 billion for 12-20 in.

- $24 billion for 22-30 in.

- $79 billion for 32 in. and larger.

- Total offshore construction (457 miles) for 2021 only will cost roughly $10.1 billion:

- $319 million for 4-10 in.

- $2.5 billion for 12-20 in.

- $7.3 billion for 22-30 in.

- Total onshore construction (25,686 miles) for beyond 2021 will cost roughly $207.6 billion:

- $6.2 billion for 4-10 in.

- $22.2 billion for 12-20 in.

- $54 billion for 22-30 in.

- $125 billion for 32 in. and larger.

- Total offshore construction (1,133 miles) for beyond 2021 will cost roughly $25 billion:

- $1.9 billion for 4-10-in.

- $6.8 billion for 12-20 in.

- $16.4 billion for 22-30 in.

Action

What follows is a quick rundown of some of the major projects in each of the world’s regions.

Pipeline construction projects mirror end users’ energy demands, and though much of that demand continues to center on natural gas, both crude and NGL are a large part of pipeline construction plans. The following sections look at both natural gas and liquids pipelines.

US, Canada activity

Gas, NGL

Alaska LNG plans to build an 800-mile, 42-in OD pipeline with a capacity of 3.3 bcfd to carry natural gas from the Alaska North Slope (ANS) to southcentral Alaska for liquefaction and export. Multiple interconnection points along the pipeline will provide for in-state gas distribution. The pipeline will have a 2,075-psig (143-bar) operating pressure.

The US Federal Energy Regulatory Commission (FERC) in May 2020 approved construction of the project, which proponents hope to have complete by 2028.

Alaska Gasline Development Corp. (AGDC) is leading the project. Former Alaska Gov. Bill Walker, however, has formed a new company, Alaska Gasline and LNG LLC, with a former AGDC chief executive officer, to return the project to private management, a stated goal of the Alaskan government.

AGDC initially rejected Alaska Gasline’s request to meet regarding the transfer, while acknowledging the desire to return the project to the private sector. The state corporation said it was already in talks with entities interested in executing the transfer with a goal of having the project back in private hands before front-end engineering and design. AGDC said further that a meeting of its board would decide early in 2021 if a suitable successor had been identified and if not would consider reopening the process, at which point it would solicit interest from Alaska Gasline and others.

Large gas pipeline projects in Canada continued to focus on potential exports.

Shell Canada Energy in October 2018 took FID on its 14-million tonne/year (tpy) liquefaction joint venture, LNG Canada, in Kitimat, BC, allowing work to begin immediately. TC Energy. will build, own, and operate the 2.1-bcfd Coastal GasLink pipeline that will deliver gas to the plant. Coastal GasLink is a 420-mile project extending from Montney shale production near Dawson Creek, BC, to the LNG Canada plant. It will be expandable up to 5 bcfd.

Pipe installation is underway on three of the pipeline’s eight segments. Installation of Section 4 pipe was 83% complete as of December 2020, with Section 1 60% complete and Section 3 underway. A total of 78 miles of pipe has been installed. Grading is underway in seven sections. The 2020 start to construction will allow the system to enter service in 2024, according to TC Energy.

GNL Quebec has been developing its Energie Saguenay project since 2014, involving construction of an 11-million tpy LNG plant at Port Saguenay to begin operations in 2025. Natural gas would be supplied via a 465-mile, 42-in. OD pipeline from northeastern Ontario to Port Saguenay to be built by Gazoduq Inc., connecting the plant to western Canadian production. Gazoduq expects construction to begin early-2022 and system operations by early 2025.

Quebec’s Environmental Review Board is evaluating Energie Saquenay and the supply pipeline separately, with evaluation of the plant already underway and the pipeline to be taken up later. The separation of the two evaluations has sparked criticism.

Natural gas pipeline projects in the US continued to face delays or cancellation due to the combined effects of strident opposition and the COVID-19 pandemic.

EQM Midstream Partners LP’s Mountain Valley Pipeline (303 miles, 42-in. OD, northwestern West Virginia to southern Virginia) was scheduled for fourth-quarter 2018 startup but instead has been navigating a variety of vacated or suspended permits and lawsuits and remains incomplete.

Mountain Valley in December 2020 received FERC permission to resume construction in a limited area. EQM had requested FERC reduce a 25-mile zone around the Jefferson National Forest in which construction had been barred to two smaller section totaling 7 miles and had this request granted.

In January 2021 the US Forest Service gave permission for the line to cross Jefferson Forest. Bureau of Land Management and final FERC authorization for the work was still pending. EQM is now targeting late-2021 startup for the largely completed project.

Dominion Energy Inc. in July 2020 cancelled its 1.5-bcfd Atlantic Coast Pipeline project, citing “too much legal uncertainty.” The 600-mile, 42-in. OD pipeline was to carry Marcellus gas from West Virginia across Virginia to North Carolina.

National Fuel Gas Supply Corp.’s Northern Access Project (96.49 miles, 24-in. OD, McKean County, Pa., to Erie County, NY), announced nearly 5 years ago, remains in limbo. The state denied the project’s water quality permit. But then in February 2019 a US appeals court vacated the denial, saying that the state had exceeded the 12 months allowed to make its decision.

In late 2019 FERC granted a 3-year extension to complete the project, allowing work to continue into late 2022 if needed. But in December 2020, National Fuel paused development citing litigation regarding the project’s Clean Water Act certification. The company said it remained committed to completing the project and would file for an additional extension in the future.

In March 2020 Pembina Pipeline Corp. received FERC approval for its proposed 7.8-million tonne/year Jordan Cove LNG liquefaction plant in Coos Bay, Ore., and 229-mile, 36-in. OD Pacific Connector gas pipeline, connecting Jordan Cove to the Ruby and Gas Transmission Northwest pipelines near Malin, Ore. Pembina expects to complete the project in 2025.

Pembina filed a Petition for Declaratory Order with FERC in April 2020, finding that the Oregon Department of Environmental Quality had waived its authority to issue certification for the Jordan Cove LNG Terminal and Pacific Connector Pipeline under Section 401 of the Clean Water Act. The Oregon Department of Land Conservation and Development had in February objected that the Jordan Cove plan is inconsistent with the state’s environmental policies, an objection raised under its Coastal Zone Management Act.

In October 2020 a federal court refused a landowners’ request to summarily overrule the FERC approval and also refused to stay project approval while court challenges are argued. The decisions meant five consolidated lawsuits brought by a combination of property owners, environmental groups, a tribal group, and the State of Oregon, will go forward in the US Court of Appeals for the District of Columbia Circuit.

The Permian basin, like most other hydrocarbon producing centers, experienced a steep decline in infrastructure activity in 2020, with pipeline projects slowed or cancelled as drilling activity dwindled.

Tellurian Inc.’s plans to develop a natural gas pipeline network including the Driftwood Pipeline (DWPL), Permian Global Access Pipeline (PGAP), Haynesville Global Access Pipeline (HGAP), and Delhi Connector Pipeline (DCPL), were among those that began to unwind. PGAP in December 2020 withdrew its National Environmental Policy Act (NEPA) prefiling request with FERC for the proposed 625-mile, 42-in. OD natural gas pipeline. PGAP’s planned route from Waha, Tex., to Gillis, La., crossed 24 counties and 4 parishes.

The pipeline would have provided as much as 2.3 bcfd of incremental firm transportation service to markets in Southwest Louisiana, including Tellurian’s planned 27.6-million tonne/year Driftwood LNG liquefaction plant. Tellurian is still seeking customers for Driftwood, which it hopes to start building in 2021. The company ascribed PGAP’s cancellation to the COVID-19 pandemic, ensuing collapse of domestic and global energy commodity prices, reduced consumption, and the addition of alternative transportation solutions out of the Permian basin

DWPL, a 96-mile, 48-in. OD pipeline, is still expected to be in-service mid-2023, delivering 4 bcfd from Gillis, La., to Driftwood LNG. DWPL has received FERC permitting.

Both HGAP and DCPL have been deferred. HGAP would cross 200 miles with 42-in. OD pipeline, transporting an additional 2 bcfd to interstate pipelines near Gillis. DCPL would be a 42-in. OD, 180-mile pipeline connecting the Perryville-Delhi hub in Richland Parish, La., to Gillis, transporting 2 bcfd.

NAmerico Partners LP’s proposed Pecos Trail pipeline was intended to ship more than 1.85 bcfd through 468 miles of 42-in. OD pipe from the Permian basin to Corpus Christi by 2021. The project, however, was put on hold in April 2020 due to concerns about its continued viability.

By contrast, MPLX LP, Whitewater Midstream, Stonepeak Infrastructure Partners, and West Texas Gas have continued development of their Whistler Pipeline project connecting the Permian basin with the Texas Gulf Coast.

The pipeline is designed to transport 2 bcfd of gas through 450 miles of 42-in. pipeline from Waha, Tex., to NextEra’s Agua Dulce market hub, with an additional 170 miles of 30-in. pipe continuing from Agua Dulce to Wharton County, Tex. Supply will come from upstream connections in Midland and Delaware basins, including direct access to Targa Resources Corp. plants through a 27-mile, 30-in. pipeline lateral, as well as a direct connection to the 1.4 bcfd Agua Blanca Pipeline—a joint venture of WhiteWater, WPX Energy, MPLX, and Targa—which crosses through Delaware basin.

The project will have delivery access to the Nueces Header and markets at Agua Dulce, as well as along a northern extension through Corpus Christi to the Houston Ship Channel. Whistler remains on track to begin operation in third-quarter 2021.

Crude

Magellan Midstream in December 2017 proposed a 750-mile, 24-in. OD pipeline from Crane, Tex., to Three Rivers to Corpus Christi, moving both Permian and Eagle Ford crude to the coast. The 400,000 b/d Voyager line would include a 200-mile branch from Three Rivers to Houston and had initially been planned to enter operation in 2021. As of September 2020, however, it was on hold and undergoing redesign.

JupiterMLP has proposed a 650-mile, 36-in. OD crude pipeline from the Permian to Brownsville, Tex., with connections in the Three Rivers area to existing pipelines bound for Houston and Corpus Christi. The company also planned a terminal in Brownsville with 10 million bbl of storage, three docks, an offshore very large crude carrier loading site, and crude processing for up to 170,000 b/d. As of December 2020, however, necessary regulatory applications still had not been filed, legal challenges were mounting, and official project updates were unavailable.

Outside the Permian, Enbridge Inc.’s $7.5-billion Line 3 Replacement (L3R) Program, which the company describes as its largest project ever, began to gain momentum. L3R will replace the majority of Enbridge’s existing 34-in. OD Line 3 crude pipeline with new 36-in. OD pipeline on both sides of the Canada-US border, a total of 1,031 miles, doubling its capacity to 760,000 b/d.

On the Canadian side of the border Enbridge replaced most of the existing Line 3 between its Hardisty Terminal in east-central Alberta and Gretna, Man. In the US, Enbridge will replace Line 3 between Neche, ND, and Superior, Wisc. Enbridge will decommission the existing Line 3 once the new line is complete.

Canada’s federal government approved L3R construction late-2016. Enbridge originally expected the line to enter service second-half 2017, but in December 2017 described its start date as uncertain and perhaps as late as November 2019, given mounting resistance inside the US.

Enbridge did begin deliveries along the Canadian portion of the line that November (with US shipments continuing through the old pipe) and the next month signed labor contracts to begin the pipeline’s US construction.

One year later, in November 2020, Enbridge received the final federal and state permits needed to begin construction and did so in December. Protests against the pipeline accelerated along its route and new lawsuits were filed by environmental and tribal groups seeking to halt construction. Barring another extended work interruption, however, L3R should be complete by September 2021.

The Canadian government’s Trans Mountain Expansion project (TMEP) to move crude west from Alberta will use 36-in. OD pipe to twin 980 km of its existing Trans Mountain pipeline. TMEP will add 300,000 b/d of capacity to the Trans Mountain pipeline system, bringing total capacity to 890,000 b/d.

Work on expansion of the Westridge marine terminal and Burnaby storage terminal at Trans Mountain’s end in Burnaby, BC, was underway in April 2020. Planned storage additions at Burnaby include 14 new tanks, with three wharfs being added at Westridge. Five new tanks will also be added at an existing terminal in Edmonton, near TMEP’s origin.

The Commission of the Canada Energy Regulator as of June 2020 had approved more than 86% of TMEP’s detailed route. At that point, the project route was fully approved in Segment 1 in Alberta, as well as in Segment 3 between Hargreaves and Blue River, BC. Segment 7 in Burnaby is also finalized.

Work on the pipeline paused for 2 weeks as of Dec. 18, 2020, following one death and one serious injury in two separate incidents. Two companies working to build TMEP had their contracts terminated in the wake of the incidents. TMEP was 20% complete at the time, with a 2022 in-service date expected.

Kinder Morgan Inc., TMEP’s previous owners, originally planned to begin construction in September 2017 and place the expansion into service in late 2019. In January 2018, however, the company said the project could be as much as a year behind schedule due to permitting delays, moving its projected in-service date to as late as December 2020.

TC Energy concluded on open season for its long-sought (originally planned to enter operations in 2012) 830,000-b/d Keystone XL pipeline between Hardisty, Alta., and Steele City, Neb., in January 2018, securing about 500,000 b/d of firm, 20-year commitments and describing the results as sufficient for the project to proceed. It planned to begin primary construction in 2019, pending a final investment decision.

In November 2018, however, the US District Court for the District of Montana vacated the March 2017 US Department of State record of decision authorizing the project and ordered further environmental reviews in response to a lawsuit by environmental organizations. Congressional Republicans finished 2018 by asking former President Donald J. Trump to “take appropriate action necessary to move construction forward.”

TC Energy in January 2019 filed documents indicating it hoped to start construction by June to complete the build by late 2020 and put the line in service in early 2021. Construction did not resume in 2019, but in January 2020 the company told the court it would begin mobilizing equipment in February to resume construction, starting with the project’s border crossing but gradually ramping up activity in Nebraska, South Dakota, and Montana as well.

Work on the 1,210-mile project began in April 2020 but stalled almost immediately when the US Supreme Court upheld the District Court’s invalidation of required US Army Corps of Engineers water-crossing permits. The same court, however, denied a request by Native American tribes to halt construction due to potential damage to cultural sites by future spills, clearing the way for work to resume once permitting was complete.

On this basis, in October 2020 TC Energy awarded work to six contractors to build 800 miles of pipe across three states. A seventh contract was awarded in January 2021 for work in Montana and South Dakota.

Pres. Joe Biden revoked Keystone XL’s permits Jan. 20, 2021, his first day in office.

Phillips 66 in 2019 formed two separate 50-50 joint ventures to build pipelines that will transport crude from the Rockies and Bakken production areas to Cushing and from Cushing and the Permian basin to the Gulf Coast.

The company and Bridger Pipeline LLC formed Liberty Pipeline LLC to build the 24-in. OD Liberty Pipeline from the Rockies and Bakken to Cushing. With Plains All American Pipeline, Phillips 66 formed Red Oak Pipeline LLC to construct the Red Oak Pipeline from Cushing and the Permian basin to Corpus Christi, Ingleside, Houston, and Beaumont, Tex.

The Red Oak JV will lease capacity in Plains’ Sunrise Pipeline system, which extends from Midland to Wichita Falls, Tex. The JV plans to construct a 30-in. pipeline from Cushing to Wichita Falls and Sealy, Tex. From Sealy, the JV will build a 30-in. pipeline segment to Corpus Christi and Ingleside and a 20-in. pipeline segment to Houston and Beaumont. Plains will lead project construction and Phillips 66 will operate the pipeline. The project is expected to cost $2.5 billion.

Initial service on both pipelines had been targeted for as early as first-quarter 2021. Both are underpinned by long-term shipper volume commitments. In March 2020, however, Phillips 66 deferred the projects as part of reducing 2020 consolidated capital spending by $700 million to $3.1 billion.

Latin America

Delays in building out Mexico’s gas pipeline infrastructure have led to bottlenecks and underutilization of already completed pipelines. Natural gas prices in Mexico have reached levels not experienced since early 2019 as a result.

Mexico’s President Andres Manual Lopez Obrador in January 2020 asked TC Energy to reroute its Tula pipeline project, planned to run 178 miles from Tuxpan to Tula. The 36-in. OD pipeline would carry 886 MMcfd but construction has been delayed indefinitely by ongoing consultation with indigenous peoples.

The associated Tula-Villa de Reyes pipeline would move 550 MMcfd 174 miles through 36-in. OD pipe. Work on the lines was already progressing more slowly than anticipated before the route changes were introduced, with state power company CFE approving force-majeure events on construction of each and TC Energy at one point suspending construction altogether. Both companies, however, anticipate the lines’ eventual placement into service.

Argentina plans to build a 645-mile natural gas pipeline from the Vaca Muerta shale in southwestern Neuquen basin to Buenos Aires via Bahia Blanca. The government started a tender process for the project in mid-2019. The 24-in. OD pipeline would eventually carry as much as 1.4 bcfd. The project, however, was shelved in December 2020 due to changed domestic and international gas market and economic circumstances. A larger project connecting Vaca Muerta to southern Brazil’s gas grid continues to seek financing.

Asia-Pacific

Design and survey work on the 50 billion cu m/year Power of Siberia 2 natural gas pipeline is continuing. Work on the line, which would deliver gas to western China via Mongolia (Fig. 2), began in March 2020. The 1,612-mile line will use 56-in. OD pipe

Preparations to develop the line’s Mongolian section have also begun, a special-purpose company having been established between the two countries to conduct a feasibility study for the pipeline’s route and choose the best option. The company expects results of the study to be available as early as first-quarter 2021. China in September 2019 had expressed a preference for routing the line through Mongolia instead of Xinjiang.

China is also addressing its gas demand domestically. Sinopec is building a 5,563-mile, 40-in. OD pipeline to move coal-to-gas sourced production from Xinjiang east to Guangdong and Zhejiang. Planned capacity is 30 bcmy. Phase 1 construction began in 2018. Construction of the initial 4-bcmy synthetic natural gas plant began in May 2019. Part of the line have already entered service and completion is expected in 2021.

Turkmengaz is leading the consortium of national governments planning to build, own, and operate the 1,800-km Turkmenistan-Afghanistan-Pakistan-India (TAPI) natural gas pipeline, planned to carry 33 bcmy by 2022. Persistent delays have raised TAPI’s projected cost to $10 billion.

TAPI would cross 200 km through Turkmenistan (starting from Galkynysh gas field in Turkmenistan’s eastern Mary province), 773 km through Herat and Kandahar provinces, Afghanistan, and 827 km through Multan and Quetta, Pakistan, to end at Fazilka in northern Punjab province, India.

Turkmengaz in December 2019 selected Genoa, Italy-based, RINA SPA as its technical consultant for supervision and project support services relating to its section of the project, including two compressor stations.

Afghanistan confirmed in December 2020 that construction will begin in 2021 on the portion of TAPI crossing its territory. Minister of Mines and Oil Industry Guran Chakhansuri said work would start in Herat. Turkmenistan’s foreign minister had earlier mentioned that his country would complete construction in its territory during 2020 and begin building in Afghanistan.

The pipeline would carry 90 million standard cu m/day (MMscmd) of natural gas from 16-tcf Galkynysh field (formerly South Yolotan-Osman) under 30-year commitments, with India, Pakistan, and Afghanistan originally set to have received 38, 38, and 14 MMscmd, respectively. Afghanistan, however, reduced its requirement to just 1.5-4 MMscmd, opening the possibility of India and Pakistan’s share growing to as much as 44.25 MMscmd each.

TAPI is financed by Jeddah, Saudi Arabia-based, Islamic Development Bank.

India’s Petroleum and Natural Gas Regulatory Board in 2016 received an expression of interest from Indian Oil Corp. Ltd. (IOCL) to lay, build, operate, and expand LPG pipeline from IOCL’s LPG import terminal at Kandla, Gujarat, to Gorakhpur, Uttar Pradesh, with branch pipelines to Ujjain, Madhya Pradesh, and Varanasi, Uttar Pradesh.

In 2019, IOCL (50%) formed a joint venture with Bharat Petroleum Corp. Ltd. (BPCL, 25%) and Hindustan Petroleum Corp. Ltd. (HPCL, 25%) to lay the 2,757-km pipeline (Fig. 3). The pipeline, estimated to cost $1.46 billion, will have capacity of 8.25 million tonnes/year of LPG, about 25% of India’s demand, according to Indian Oil. The companies expect to complete the project in 2022.

It will receive product from three terminals and two refineries in western India and supply three bottling plants in Gujarat, six in Madhya Pradesh, and 13 in Uttar Pradesh. With road links, the pipeline will supply 21 other bottling plants in Rajasthan, Gujarat, Madhya Pradesh, Maharashtra, and Uttar Pradesh.

GSPL India Gasnet Ltd. is building a 2,052-km natural gas pipeline between Mehsana and Bhatinda. The project received its environmental permits from the Indian government in May 2013. GSPL expects the 42-in. OD pipeline to enter service in 2021 with a capacity of 30-MMscmd). The pipeline will carry production and imports from India’s east coast to consumers in central and northern parts of the country.

Construction began in July 2015 on the first phase of GAIL’s Jagdishpur-Dhamra natural gas pipeline. The 2,810-mile pipeline—2,111 miles of 36-in. OD trunkline and 699 miles of 12-30 in. spur and feeder lines—will connect eastern India to the national grid. The initial phase will ship 7.4 MMscmd, with total capacity reaching 16 MMscmd.

The pipeline will cross Bihar, Jharkhand, West Bengal, and Uttar Pradesh states. It will pass through 13 districts in Bihar, supplying both a refinery in Barauni and other end users. It will also supply local gas networks in Barauni, Gaya, and Patna. The line is expected to be complete in 2021.

GSPL India Transco Ltd., IOCL, HPCL, and BPCL are building a 992-mile, 24-in. OD pipeline from Mallavaram to Bhilwara, with construction underway as of August 2020 and completion expected in 2021. The pipeline is designed to move 30 MMscmd from India’s east coast to consumers in central and northern parts of the country.

IOCL is also building a 729-mile, 28-in. OD pipeline from Ennore to Tuticorin to move regasified LNG. Completion is expected in 2021 but the project has been met with local opposition along its route.

In Pakistan, a 700-km, 42-in. OD pipeline would run from Gwadar LNG east to Nawabshah and access to the Sui Southern Gas Co. (SSGC) network by as early as 2021. An 81-km leg from Gwadar to the Iranian border could be added once the larger line has entered service. Pakistan has been slow to build the line due to lack of funding.

A division of China National Petroleum Corp. (CNPC) will provide engineering, procurement, and construction (EPC) services. The pipeline is part of a larger project between Pakistan and China to connect Gwadar with the Xinjiang Autonomous Region in western China.

Russia, meanwhile, has agreed to build the Pakistan Stream gas pipeline project, connecting an LNG terminal in Karachi with Lahore. The 42-in. OD, 683-mile pipeline would carry 1.2 bcfd north from the coast starting in 2023. Pakistan will own 74% of the pipeline and Russia the remaining 26%. Construction is expected to start in July 2021.

Europe

Gazprom and Germany’s BASF SE in August 2015 signed a memorandum of intent stipulating cooperation on building the Nord Stream 2 gas pipeline. The companies agreed to build strings No. 3 and No. 4, connecting the Russian (Ust-Luga) and German (Greifswald) coasts under the Baltic Sea and doubling the existing Nord Stream line’s 55-bcmy capacity by 2019. E.On, Shell, and OMV AG each previously had agreed to participate in construction of the two strings.

The 759-mile line uses 48-in. OD pipe. It is more than 94% laid with the center section in Denmark’s exclusive economic zone (EEZ) near the island of Bornholm still pending completion. Denmark approved the project in October 2019 but US sanctions targeting industry participants prompted Allseas to halt pipelay in January 2020.

Russian pipelaying vessel Fortuna in December 2020 resumed work at a construction site 70 km off the German coast, laying 2.6 km in Germany’s EEZ accompanied by two supply ships. Russia intends to complete work offshore Bornholm in 2021.

IGI Poseidon’s EastMed gas pipeline is designed to transport initially 10 bcmy from the offshore Leviathan and Aphrodite fields into Greece and, in conjunction with the Poseidon and IGB pipelines, into to Italy and other southast European countries. It would also supply Cyprus with 1 bcmy. IGI Poseidon is a joint venture of Public Gas Corp. of Greece (DEPA) and Edison International Holding.

EastMed will include 1.300 km of offshore pipeline and 600 km of onshore:

- 200 km, 24-in. OD offshore from the Eastern Mediterranean fields to Cyprus.

- 700 km, 26-in. offshore pipeline connecting Cyprus to Crete.

- 400 km, 26-in. offshore pipeline from Crete to Peloponnese, Greece.

- 600 km, 42-in. onshore pipeline to a western Greece interconnection with Poseidon.

The EU Commission has confirmed EastMed as a project of common interest among the Southern Gas Corridor developments. Turkey opposes the pipeline on a variety of political and resource-development bases.

IGI Poseidon expects to make a final investment decision on the pipeline in 2022 to hit a 2025 in-service target.

The Poland-Lithuania Gas Interconnector (GIPL), designed to connect the Polish and Lithuanian gas transmission systems, will enter service in 2021. The 28-in. OD pipeline will include 310-357 km between Holowczyce, Poland, and the Lithuanian border, and another 177 km from the border to Jauniunai, Lithuania. Line pipe began to arrive in Lithuania in January 2020.

Middle East

Iraq began technical work in 2014 on twin 1,043-mile pipelines—one crude oil, one associated fuel gas—running from Basra to the Red Sea at Aqaba, Jordan. The oil pipeline would use 56-in. OD pipe to move 1-million b/d, crossing 422 miles inside Iraq with the balance in Jordan.

Jordan would keep 150,000 b/d for processing at its Zarqa refinery near Amman. Iraq is pursuing the project to decrease its dependence on the Persian Gulf as an oil export route.

Iraq decided in August 2017 to cancel the parallel gas pipeline, citing high costs and associated delays. Iraqi and Jordanian leadership met in January and July 2019 to finalize the oil pipeline. In 2020 these talks were expanded to include Egypt. The pipeline is expected to begin operations in 2023.

The National Iranian Gas Co. continues construction of its 1,147-mile Iran Gas Trunkline IX (IGAT 9), running from Asalouyeh to West Azerbaijan province, Iran, providing for the potential shipment of South Pars gas to European customers. Completion is expected in 2022.

Iran expects during first-quarter 2021 to complete work on the 1-million b/d Goureh-Jask crude oil pipeline, shipping oil through 682 miles of 42-in. OD pipe to an export point beyond the Straits of Hormuz on the Gulf of Oman. The 300,000-b/d system will include five pump stations, two pig stations, and a single meter station at the end of the line. It was 80% complete as of December 2020.

Africa

CNPC is building an 1,181-mile, 20-in. OD crude oil pipeline from Agadem basin in Niger to Benin’s Port Seme terminal. Construction of the 90,000-b/d pipeline began in September 2019 and is expected to conclude in 2024. Work was put on hold in 2020 due to the COVID-19 pandemic. The pipeline will include nine pump stations and load tankers via a single-point mooring system.

Uganda and Tanzania plan to build the 897-mile, 24-in. OD heated East Africa Crude Oil Pipeline (EACOP), bypassing Kenya en route from fields in Uganda to the Tanzanian port of Tanga. The pipeline, engineered by Gulf Interstate Engineering Co., would transport roughly 300,000 b/d to the Indian Ocean for export, using six pumping stations (two in Uganda and four in Tanzania) and two pressure reduction stations, both in Tanzania.

Total SA suggested this route as an alternative to mitigate security concerns regarding a previously considered Kenyan passage. China National Offshore Oil Corp. Ltd. and Tullow Oil are developing the project with Total. The line is expected to enter service in 2024.

The Tanzania Petroleum Development Corp. plans to build an 1,100-mile, 24-in. OD gas pipeline from Dar es Salaam to Uganda, beginning in 2021 with work completed in 2024. The line would pass through Tanga to Mwanza. A second possible route would follow EACOP’s corridor.

Ethiopia and Djibouti plan to build a 765-km, 40-in. OD natural gas pipeline to transport Ogaden basin gas to a floating LNG liquefaction plant offshore Djibouti. About 65 km of pipe will be in Djibouti. China’s Poly-GCL is developing the project with a 2023 startup date anticipated based on a 3-year construction timeline.

The 3-mtpy plant, fed by the 2-bcmy pipeline, would be sited at Damerjog port near the Djibouti-Somalia border and expandable to 10 mtpy. Gas would be sourced from Calub and Hilala fields, being developed by China Oil HBP Group. The countries agreed to build the pipeline in April 2019 and the Ethiopian parliament approved the project that December.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.