Asia-Pacific leads 2020 pipeline construction growth

Planned worldwide pipeline construction to be completed in 2020 surged from the previous year, with multiple large projects in the Asia-Pacific region scheduled to finish construction and enter service. US projects shrank as a portion of total planned build, except products pipelines, with multiple NGL-focused projects expected to be completed in the year ahead. Plans for US construction in 2020 made up just 25% of the global total, compared with 44% in 2019.

Global future planned mileage slipped for the third straight year, with a sharp, US-driven uptick in post-2020 crude projects not making up for smaller worldwide natural gas and products plans.

Operators plan to install 19,075 miles in 2020 alone (Table 1), with natural gas plans (10,345 miles) making up 78.5% of the total, based on data collected by Oil & Gas Journal. By contrast, gas pipelines made up more than 72% of total planned construction a year earlier.

As 2020 began, operators had announced plans to build nearly 31,000 miles of crude oil, product, and natural gas pipelines extending into the middle of the decade, a roughly 4% decrease from data reported the prior year (OGJ, Feb. 4, 2019, p. 48). Combining both current-year and forward estimates (Fig. 1), increases in planned construction in the US and Africa were again outweighed by decreases elsewhere.

Outlook

EIA forecast world liquid fuels consumption to increase by more than 20% through 2050 (using a 2018 baseline), a period that encompasses the long-term pipeline construction projections stated here. This rate of growth was up slightly from EIA’s year-earlier forecast, which called for an 18.9% increase from a 2015 baseline.

Demand growth will be strongest, according to its September 2019 International Energy Outlook (IEO), among non-OECD countries, growing 45% during the projection period compared with a decrease in the OECD over the same period. Increased demand will be led by Asia, with its non-OECD countries making up about 75% of expected worldwide economic growth as India experiences rapid industrial expansion and increased transportation demand.

OECD demand declines slowly through 2050, efficiency improvements outstripping sluggish general expansion. Liquid fuels demand in OECD Americas and Asia will be relatively unchanged, but will decline 15% in OECD Europe. Transportation is responsible for more than half of liquid fuels demand by 2050, with industrial use accounting for roughly one-third.

Economic growth in China, other Asia, and Africa will average nearly 4%/year, according to the IEO. Projected growth in China is down considerably from 2000-10’s average of about 10%/year.

Faster economic growth in India (nearly 5.5%), however, will increase its energy use. India’s share of global energy-intensive manufacturing grows to 25% in 2050 from 11% in 2018, while China’s share decreases to 35% from 41%. EIA expects India’s industrial energy consumption to nearly triple, growing to 47 quadrillion btu (quads) from 16 quads, an annual rate of 3.4%. This 31-quad increase makes up 40% of expected growth in global industrial demand through 2050.

The EIA Annual Energy Outlook (AEO) 2019 forecast the US becoming a net energy exporter in 2020 and remaining so through 2050 due to large production increases and slow growth in its own consumption. Near the end of the projection period, however, the US returns to being a net importer of petroleum and other liquids on an energy basis due to increased domestic gasoline consumption and falling domestic crude oil production.

US liquids fuels use reaches a peak of 20.64 million b/d in 2019 (from a 2017 base of 19.91), dropping to 19.08 million b/d in 2036 before rising to 19.24 in 2040 and a new peak of 20.18 million b/d in 2050.

EIA projects US crude oil production to set annual records through 2027 and remain greater than 14 million b/d through 2040. Lower 48 onshore tight oil development continues to be the main source of production growth, accounting for about 68% of cumulative domestic production through 2050. Most tight oil production growth will occur in the Permian basin, according to EIA.

The agency projects US dry natural gas production to grow 3.7%/year through 2028, reaching 38.26 tcf, before slowing to <1%/year for the remainder of the projection (from 27.17 tcf in 2017). Demand from large chemical projects and new LNG liquefaction plants supports the near-term production growth. EIA predicts 2050 production of 43.41 tcf.

OGJ tracks applications for gas pipeline construction to the US Federal Energy Regulatory Commission (FERC). Applications filed in the 12 months ending June 30, 2019 (the most recent 1-year period surveyed) fell sharply from the previous year.

- 246 miles of gas pipeline were proposed for land construction. For the earlier 12-month period ending June 30, 2018, more than 544 miles had been proposed.

- FERC applications for new or additional compression horsepower at the end of June 2019 were flat, totaling roughly 290,000 hp each year.

Bases, costs

For 2020 only (Table 1), operators plan to complete roughly 19,000 miles of oil and gas pipelines worldwide at a cost of about $100 billion. For 2019 only, companies had planned 14,400 miles at a cost of nearly $150 billion.

For projects completed after 2020 (Table 2), companies plan to lay nearly 31,000 miles of line and spend roughly $167 billion. When these companies looked beyond 2019 last year, they anticipated spending roughly $332 billion to lay nearly 32,000 miles of line. Land construction costs fell in the meantime to $4.6 million/mile from $9.95 million/mile.

- Projections for 2020 pipeline mileage reflect only projects likely to be completed by yearend 2020, including construction in progress at the start of the year or set to begin during it.

- Projections for mileage after 2020 include construction that might begin in 2020 but be completed later. Also included are some long-term projects judged as probable, even if they will not break ground until after 2020.

Based on historical analysis, and a few exceptions and variations notwithstanding, these projections assume 90% of all construction will be onshore and 10% offshore and that pipelines 32 in. OD or larger are onshore projects.

Following is a breakdown of projected costs, using these assumptions and OGJ pipeline-cost data:

• Total onshore construction (18,360 miles) for 2020 only will cost $84.6 billion:

—$385 million for 4-10 in.

—$8.3 billion for 12-20 in.

—$21 billion for 22-30 in.

—$55 billion for 32 in. and larger.

• Total offshore construction (715 miles) for 2020 only will cost nearly $16 billion:

—$206 million for 4-10 in.

—$4.4 billion for 12-20 in.

—$11.2 billion for 22-30 in.

• Total onshore construction (29,282 miles) for beyond 2020 will cost nearly $135 billion:

—$55 million for 4-10 in.

—$18.9 billion for 12-20 in.

—$40.3 billion for 22-30 in.

—$75.6 billion for 32 in. and larger.

• Total offshore construction (1,430 miles) for beyond 2019 will cost nearly $32 billion:

—$10.1 billion for 12-20 in.

—$21.6 billion for 22-30 in.

Action

What follows is a quick rundown of some of the major projects in each of the world’s regions.

Pipeline construction projects mirror end users’ energy demands, and though much of that demand continues to center on natural gas, both crude and NGL are a large part of pipeline construction plans. The following sections look at both natural gas and liquids pipelines.

US, Canada activity

Gas, NGL

Alaska LNG plans to build an 800-mile, 42-in OD pipeline with a capacity of 3.3 bcfd to carry natural gas from the Alaska North Slope (ANS) to southcentral Alaska for liquefaction and export. Multiple interconnection points along the pipeline will provide for in-state gas distribution. The pipeline will have a 2,075-psig (143-bar) operating pressure.

Alaska Gasline Development Corp. (AGDC) is leading the project, but Alaska Gov. Mike Dunleavy has indicated his preference for removing the state from the financial risk involved. The budget he put forward for next fiscal year (starting July 1, 2020) cut AGDC spending to $3.4 million from $9.7 million.

FERC is scheduled to release its final environmental impact statement (EIS) on the project Mar. 6, 2020, which would allow commissioners to vote on the project during their June meeting.

The US Army Corps of Engineers Alaska District in June 2018 released the final supplemental EIS for the proposed 733-mile Alaska Stand Alone Pipeline (ASAP) project from the ANS to southcentral Alaska. The two projects share a common mainline alignment for more than 80% of their route. ASAP lacks an LNG component. AGDC is advancing both projects but views ASAP as the backup.

Large gas pipeline projects in Canada continued to focus on potential exports.

Shell Canada Energy in October 2018 took FID on its 14-million tonne/year (tpy) liquefaction joint venture, LNG Canada, in Kitimat, BC, allowing work to begin immediately. TC Energy will build, own, and operate the 2.1-bcfd Coastal GasLink pipeline that will deliver gas to the plant. Coastal GasLink is a 420-mile project extending from Montney shale production near Dawson Creek, BC, to the LNG Canada plant. It will be expandable to 5 bcfd.

Indigenous peoples’ groups have objected to construction of the pipeline. But the British Columbia government says it will proceed, citing both favorable court rulings and approval of 20 First Nations.

The first segments of pipe arrived in Kitimat and Chetwynd, BC, in December 2019, with 24% of the pipeline’s route cleared. A 2020 start to construction would allow the system to enter service in 2024.

GNL Quebec has been developing its Energie Saguenay project since 2014, involving construction of an 11-million tpy LNG plant at Port Saguenay to begin operations in 2025. Natural gas would be supplied via a 465-mile, 42-in. OD pipeline from northeastern Ontario to Port Saguenay to be built by Gazoduq Inc., connecting the plant to western Canadian production. Gazoduq plans to file an impact statement in early 2020 to allow construction to begin early-2022 and system operations by early 2025.

Projects to move NGL to market made up a large part of US pipeline development plans.

MPLX and WhiteWater are planning to build the Belvieu Alternative NGL (BANGL) pipeline between Orla and Sweeny, Tex. The 24-in. OD, 500,000-b/d line would enter service early 2021. MPLX also plans to build an export hub in Texas City for deliveries from both BANGL and its Wink-to-Webster (W2W) crude oil pipeline.

Permico Energia LLC plans to build its 510-mile, 24-in. OD Companero NGL pipeline to ship West Texas Permian basin production to a newbuild 300,000-b/d fractionator near Corpus Christi, Tex. The project also includes construction of a 350-mile system of downstream product pipelines accessing both an 8 million-bbl storage site and Gulf Coast industrial users, including the Mont Belvieu, Tex., market.

Oneok Inc. is building its Arbuckle II pipeline to move unfractionated NGL from Oklahoma to the company’s storage and fractionation at Mont Belvieu. The roughly 530-mile 24- and 30-in. OD pipeline will have an initial capacity of 400,000 b/d (to be expanded to 500,000 b/d) and is expected to be complete in 2020.

Energy Transfer Partners is expanding its Lone Star Express pipeline by adding 352 miles of 24-in. OD pipe from its existing system near Wink, Tex., to its 30-in. pipeline south of Fort Worth. The new line is expected to be in service by early fourth-quarter 2020, transporting Permian and Delaware basin NGL production.

Energy Transfer’s 275,000 b/d, 306-mile Mariner East 2 pipeline, designed to move Marcellus shale NGL to the US Atlantic coast for shipment to Gulf Coast chemical producers and European markets, entered service at the end of 2018. The line uses new 20-in. and 16-in. OD pipelines in the same right of way as the existing Mariner East line. Mariner East 2 (20-in.) carries propane, ethane, and butane; 2X (16-in.) will carry all three of these as well as C3+, natural gasoline, and condensate, or any combination of these products, when it enters service in 2020. Energy Transfer in January 2020 reached agreement with the Pennsylvania Department of Environmental Protection to complete Mariner 2X.

Natural gas pipeline projects in the northeast US continued to be delayed by strident opposition.

EQM Midstream Partners’ Mountain Valley Pipeline (303 miles, 42-in. OD, northwestern West Virginia to southern Virginia) was scheduled for fourth-quarter 2018 startup but instead is navigating a variety of vacated or suspended permits and lawsuits. The company and its partners suspended work on the project in 2019.

FERC in August 2019 asked the US Fish and Wildlife Service (FWS) to restart its permitting process and a few months later granted an extension of FWS reviews to Feb. 10, 2020. In January 2020, however, a group of landowners filed a new lawsuit with the US District Court in Washington, DC, challenging both the project’s use of eminent domain and the constitutionality of its approval process.

The project is 90% complete and EQT maintains startup will now happen late-2020.

Dominion Energy in December 2018 suspended work on its Atlantic Coast pipeline (600 miles, 42-in. OD, West Virginia to North Carolina) due to the stay of a previous environmental ruling. The company had already asked that three water crossing permits be voluntarily suspended until any outstanding issues could be resolved.

The US Pipeline and Hazardous Material Safety Administration (PHMSA) cited the project for unsafe construction practices in August 2019. Later that year the US Supreme Court agreed to hear a case involving the US Forest Service’s authority to grant permission for the pipeline to cross the Appalachian Trail, which was struck down by the Fourth US Circuit Court of Appeals. Eighteen states, led by West Virginia, filed a friend of the court brief supporting the project.

Dominion anticipated construction would resume by end-2020 given a June ruling by the court. In January 2020, however, the Fourth Circuit revoked the permit for one of the project’s compressor stations.

National Fuel Gas Supply Corp.’s Northern Access Project (96.49 miles, 24-in. OD, McKean County, Pa., to Erie County, NY), announced more than 3 years ago, remains in limbo. The state denied the project’s water quality permit. But in February 2019 a US appeals court vacated the denial, saying that the state had exceeded the 12 months allowed to make its decision. FERC granted a 3-year extension to complete the project, allowing work to continue into late 2022 if needed.

The Permian basin once again experienced the US’s most rapid annual growth in hydrocarbons production, accompanied by a continued scramble to build new pipelines to both consuming centers and export destinations.

Kinder Morgan Texas Pipeline (KMTP), ExxonMobil Corp., and EagleClaw Midstream Ventures LLC, a portfolio company of Blackstone Energy Partners, are building the Permian Highway Pipeline (PHP). The $2-billion pipeline is expected to be in service first-quarter 2021, with 99% of its rights-of-way acquired and its western segment under construction. US Army Corps of Engineers and FWS permits, however, are still outstanding for certain segments.

PHP is designed to transport as much as 2 bcfd of gas through 430 miles of 42-in. pipeline from the Waha, Tex., area to the US Gulf Coast and Mexico. Committed shippers include EagleClaw, Apache Corp., and XTO Energy Inc., a subsidiary of ExxonMobil, among others. KMTP will build and operate the pipeline.

Tellurian Inc. plans to develop a natural gas pipeline network including the Driftwood Pipeline (DWPL), Permian Global Access Pipeline (PGAP), Haynesville Global Access Pipeline (HGAP), and Delhi Connector Pipeline (DCPL).

DWPL, a 96-mile, 48-in. OD pipeline, is expected to be in-service mid-2023, delivering 4 bcfd from Gillis, La., to Driftwood LNG. The other three pipelines are expected to enter service by end-2024.

PGAP would be a 625-mile, 42-in. OD pipeline transporting 2 bcfd from the Waha Hub in Pecos County, Tex., and Permian and associated shale plays around Midland, Tex. to interconnects near Gillis, La. Proposed interconnects include the Creole Trail Pipeline, Cameron Interstate Pipeline, Trunkline Gas Co., Texas Eastern, Transco, Tennessee Gas Pipeline, Florida Gas Transmission, and DWPL, among others. Tellurian expects to complete its FERC application process for PGAP in October 2020.

HGAP would cross 200 miles with 42-in. OD pipeline, transporting an additional 2 bcfd to the same interstate pipelines near Gillis. DCPL will be a 42-in. OD, 180-mile pipeline connecting the Perryville-Delhi hub in Richland Parish, La., to Gillis, La.

NAmerico Partners LP’s proposed Pecos Trail pipeline would ship more than 1.85 bcfd through 468 miles of 42-in. OD pipe from the Permian basin to Corpus Christi by 2021. Work on the project was delayed in April 2019 to further gauge shipper interest.

MPLX LP, Whitewater Midstream, Stonepeak Infrastructure Partners, and West Texas Gas plan to jointly develop the Whistler Pipeline project from the Permian basin to markets along the Texas Gulf Coast.

The project is designed to transport 2 bcfd of gas through 450 miles of 42-in. pipeline from Waha, Tex., to NextEra’s Agua Dulce market hub, with an additional 170 miles of 30-in. pipe continuing from Agua Dulce to Wharton County, Tex. Supply will come from the Midland and Delaware basins, including direct connections to Targa plants through a 27-mile, 30-in. pipeline lateral, as well as a direct connection to the 1.4-bcfd Agua Blanca Pipeline—a joint venture of WhiteWater, WPX Energy, MPLX, and Targa—which crosses through the Delaware basin, including portions of Culberson, Loving, Pecos, Reeves, Winkler, and Ward counties. The project would have access to the Nueces Header and markets at Agua Dulce, as well as along a northern extension through Corpus Christi to the Houston Ship Channel.

Whistler would begin operation in third-quarter 2021, subject to necessary agreements and approvals.

Crude

Permian basin growth continued to push crude pipeline development.

As previously mentioned, Epic is building a Permian-to-Corpus Christi crude pipeline, largely paralleling the path of its Y-grade project. The 700-mile line will carry as much as 600,000 b/d of crude from Orla, Tex., and include terminals in Pecos, Saragosa, Crane, Wink, Midland, Helena, and Gardendale servicing the Delaware, Midland, and Eagle Ford basins. The line is expected to be completed first-quarter 2020 and is expandable to 900,000 b/d.

Magellan Midstream in December 2017 proposed a 750-mile, 24-in. OD pipeline from Crane, Tex., to Three Rivers, to Corpus Christi, moving both Permian and Eagle Ford crude to the coast. The 400,000 b/d Voyager line would include a 200-mile branch from Three Rivers to Houston and is planned to enter service in 2021.

JupiterMLP has proposed a 650-mile, 36-in. OD crude pipeline from the Permian to Brownsville, Tex., with connections in the Three Rivers area to existing pipelines bound for Houston and Corpus Christi. The company also plans a terminal in Brownsville with 10 million bbl of storage, three docks, an offshore very large crude carrier loading site, and crude processing for up to 170,000 b/d. Financing and dedicated shippers are still being secured.

ExxonMobil, Plains, and Lotus Midstream LLC are pursuing a 1-million b/d crude pipeline (W2W) from Wink and Midland to Webster, Tex., near Houston-Beaumont. The 36-in. OD, 650-mile line is expected to enter service in 2021 and will be expandable to 1.5 million b/d.

Outside the Permian, Enbridge Inc.’s $7.5-billion Line 3 Replacement (L3R), which the company describes as its largest project ever, continues to face delays. L3R will replace the majority of Enbridge’s existing 34-in. OD Line 3 crude pipeline with new 36-in. OD line on both sides of the Canada-US border, a total of 1,031 miles, doubling its capacity to 760,000 b/d.

On the Canadian side of the border Enbridge will replace most of the existing Line 3 between its Hardisty Terminal in east-central Alberta and Gretna, Man. In the US, Enbridge will replace Line 3 between Neche, ND, and Superior, Wisc.

Canada’s federal government approved L3R construction in late 2016. Enbridge originally expected the new line to enter service second-half 2017, but the company in December 2017 described its start date as uncertain and perhaps as late as November 2019, given mounting resistance inside the US. Enbridge will decommission the existing Line 3 once the new line is complete.

Multiple lawsuits have been filed against the line, the most recent wave contesting the completeness of L3R’s environmental impact statement. Plaintiff’s against L3R also asked the Minnesota Court of Appeals to overturn the state public utilities commission’s decision to grant the project a certificate of need. Minnesota regulators restarted the project’s review process in October 2019.

Against this backdrop, however, Enbridge in November 2019 began deliveries on the Canadian portion of the line (with US shipments continuing through the old pipe) and the next month signed labor contracts to begin the pipeline’s construction.

The Trans Mountain Expansion project (TMEP) to move crude west from Alberta would use 36-in. OD pipe to twin 980 km of the existing Trans Mountain pipeline. TMEP would add 590,000 b/d to the Trans Mountain system, bringing total capacity to 890,000 b/d. The Westridge marine terminal at Trans Mountain’s end in Burnaby, BC, would be expanded with three new berths. Planned storage additions include 14 new tanks at an existing terminal in Burnaby and five new tanks at an existing terminal in Edmonton.

Kinder Morgan Inc. (KMI), the project’s original owners, planned to begin construction in September 2017 and place the expansion into service in late 2019. In January 2018, however, the company said the project could be as much as a year behind schedule due to permitting delays, moving its projected in-service date to as late as December 2020.

Later in 2018 KMI sold Trans Mountain to the Canadian government for $4.5 billion (OGJ Online, May 29, 2018). Canada’s Federal Court of Appeal in August of that year declared TMEP’s regulatory review impermissibly flawed, effectively halting work. The court based its decision on a failure to include project-related tanker traffic as part of its evaluation. It also cited KMI’s failure to consult with indigenous peoples.

Regulators reapproved TMEP in June 2019. TMEP began mobilizing its contractors in January 2020 and now has a mid-2022 expected in-service date.

TransCanada concluded on open season for its long-sought (originally planned to enter operations in 2012) 830,000-b/d Keystone XL pipeline in January 2018, securing about 500,000 b/d of firm, 20-year commitments and describing the results as sufficient for the project to proceed. It planned to begin primary construction in 2019, pending a final investment decision.

In November 2018, however, US District Judge Brian Morris vacated the March 2017 US Department of State record of decision authorizing the project and ordered further reviews in response to a lawsuit by environmental organizations. Congressional Republicans finished 2018 by asking President Donald J. Trump to “take appropriate action necessary to move construction forward.”

TransCanada in January 2019 filed documents indicating it hoped to start construction by June to complete the build by late 2020 and put the line in service in early 2021. Construction did not resume in 2019, but in January 2020 the company told the court it would begin mobilizing equipment in February to resume construction, starting with the project’s border crossing but gradually ramping up activity in Nebraska, South Dakota, and Montana as well.

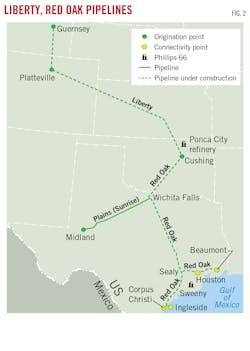

Phillips 66 formed two separate 50-50 joint ventures to build pipelines that will transport crude from the Rockies and Bakken production areas to Cushing and from Cushing and the Permian basin to the Gulf Coast.

The company and Bridger Pipeline LLC formed Liberty Pipeline LLC to build the 24-in. OD Liberty Pipeline from the Rockies and Bakken production areas to Cushing. Phillips 66 will lead project construction and operate the pipeline. The project is expected to cost $1.6 billion.

With Plains All American Pipeline, Phillips 66 formed Red Oak Pipeline LLC to construct the Red Oak Pipeline from Cushing and the Permian basin to Corpus Christi, Ingleside, Houston, and Beaumont.

The Red Oak JV will lease capacity in Plains’ Sunrise Pipeline system, which extends from Midland to Wichita Falls, Tex. The JV plans to construct a 30-in. pipeline from Cushing to Wichita Falls and Sealy, Tex. From Sealy, the JV will construct a 30-in. pipeline segment to Corpus Christi and Ingleside and a 20-in. pipeline segment to Houston and Beaumont (Fig. 2). Plains will lead project construction and Phillips 66 will operate the pipeline. The project is expected to cost $2.5 billion.

On both the Liberty and the Red Oak systems, where feasible, the companies will use existing pipeline and utility corridors to limit environmental and community impact. Initial service on both pipelines is targeted to begin as early as first-quarter 2021, subject to applicable approvals. Both pipelines are underpinned by long-term shipper commitments with plans for supplemental binding open seasons expected later.

Latin America

Substantial growth of US gas exports to Mexico—which have more than doubled in the past 5 years to 5.5 bcfd—has prompted rapid construction of new transmission capacity both between the countries and inside Mexico. The new Sur de Texas-Tuxpan natural gas pipeline begins offshore in the Gulf of Mexico at a border point near Brownsville, Tex., and extends along the coast to Tuxpan, Veracruz, Mexico, connecting with Cenegas’s pipeline system in Altamira and TransCanada’s Tamazunchale pipeline, among other transporters in the region.

Mexico’s President Andres Manual Lopez Obrador in January 2020 said he intended to ask TC Energy to reroute its Tula pipeline project, planned to run 178 miles from Tuxpan to Tula. The 36-in. OD pipeline would carry 886 MMcfd. The associated Tula-Villa de Reyes pipeline would move 550 MMcfd 174 miles through 36-in. OD pipe. Work on the lines was already progressing more slowly than anticipated before the possibility of route changes was introduced, with state power company CFE approving force majeure events on construction of each and TC Energy at one point suspending construction. Both companies, however, anticipate the lines’ eventual placement into service, with TC Energy indicating the line to Villa de Reyes could begin phased-in operations as early as first-quarter 2020.

Argentina plans to build a 620-mile natural gas pipeline from the Vaca Muerta shale in southwestern Neuquen basin to Buenos Aires. The government started a tender process for the project in mid-2019. The 24-in. OD pipeline would eventually carry as much as 1.4 bcfd. Progress, however, has been delayed by Argentina’s financial crisis, and the deadline for bids was extended to Mar. 31, 2020.

Asia-Pacific

Negotiations are still underway between Russia and China regarding a potential western natural gas export route between the two countries, moving gas into the Xinjiang Uygur Autonomous Region on Power of Siberia 2 (formerly Altai pipeline). The 1,612-mile line would use 56-in. OD pipe to ship 30 bcmy. China in September 2019 expressed a preference for routing the line through Mongolia instead of Xinjiang.

China is also addressing its gas demand domestically. Sinopec is building a 5,563-mile, 40-in. OD pipeline to move coal-to-gas sourced production from Xinjiang east to Guangdong and Zhejiang. Planned capacity is 30 bcmy. Phase 1 construction began in 2018. Construction of the initial 4-bcmy synthetic natural gas plant began in May 2019.

Turkmengaz is leading the consortium of national governments planning to build, own, and operate the 1,800-km Turkmenistan-Afghanistan-Pakistan-India (TAPI) natural gas pipeline, planned to carry 33 bcmy by 2022. Persistent delays have raised TAPI’s projected cost to $10 billion.

TAPI would cross 200 km through Turkmenistan (starting from Galkynysh gas field in Turkmenistan’s eastern Mary province), 773 km through Herat and Kandahar provinces, Afghanistan, and 827 km through Multan and Quetta, Pakistan, to end at Fazilka in northern Punjab province, India.

Turkmengaz in December 2019 selected Genoa, Italy-based, RINA SPA as its technical consultant for supervision and project support services relating to its section of the project, including two compressor stations. RINA expects construction of the Turkmen section to be completed in 4 years.

Line pipe began arriving in Turkmenistan in November 2018. Construction has yet to begin in Afghanistan.

The pipeline would carry 90 million standard cu m/day (MMscmd) of natural gas from the 16-tcf Galkynysh field (formerly South Yolotan-Osman) under 30-year commitments, with India, Pakistan, and Afghanistan originally set to have received 38, 38, and 14 MMscmd, respectively. Afghanistan, however, reduced its requirement to just 1.5-4 MMscmd, opening the possibility of India and Pakistan’s share growing to as much as 44.25 MMscmd each.

TAPI is financed by Saudi Arabia-based Islamic Development Bank.

GSPL India Gasnet Ltd. is building a 2,052-km natural gas pipeline between Mehsana and Bhatinda. The project received its environmental permits from the Indian government in May 2013. GSPL expects the 42-in. OD pipeline to enter service in 2020 with a capacity of 30 MMscmd. The pipeline will carry production and imports from India’s east coast to consumers in central and northern parts of the country.

Construction began in July 2015 on the first phase of GAIL (India) Ltd.’s Jagdishpur-Dhamra natural gas pipeline. The 2,810-mile pipeline—2,111 miles of 36-in. OD trunkline and 699 miles of 12-30 in spur and feeder lines—will connect eastern India to the national grid. The initial phase will ship 7.4 MMscmd, with total capacity reaching 16 MMscmd.

The pipeline will cross Bihar, Jharkhand, West Bengal, and Uttar Pradesh states, supplying a refinery in Barauni. It will also supply local gas networks in Barauni, Gaya, and Patna. The line is expected to be complete in 2020.

GSPL India Transco Ltd., Indian Oil Corp. (IOC), HPCL, and Bharat Petroleum Corp. are building a 992-mile, 24-in. OD pipeline from Mallavaram to Bhilwara, with completion expected in 2020. The pipeline is designed to move 30 MMscmd from India’s east coast to consumers in central and northern parts of the country.

IOC is also building a 729-mile, 28-in. OD pipeline from Ennore to Tuticorin to move regasified LNG. Completion is expected in 2020.

In Pakistan, a 700-km, 42-in. OD pipeline would run from Gwadar LNG east to Nawabshah and access to the Sui Southern Gas Co. (SSGC) network by as early as 2020. An 81-km leg from Gwadar to the Iranian border could be added once the larger line has entered service. Pakistan has been slow to build the line due to lack of funding. A division of China National Petroleum Corp. (CNPC) will provide engineering, procurement, and construction (EPC) services.

Russia, meanwhile, has agreed to build the North-South Gas Pipeline Project in Pakistan, connecting an LNG terminal in Karachi with Lahore. The 42-in. OD, 683-mile pipeline would carry 1.2 bcfd north from the coast starting in 2023. Financing was approved in early 2018. The Pakistani government in July 2017 asked SSGC to build a section between Nawabshah and Karachi, connecting these systems.

Europe

Gazprom and Germany’s BASF SE in August 2015 signed a memorandum of intent stipulating cooperation on building the Nord Stream 2 gas pipeline. The companies agreed to build strings No. 3 and No. 4, connecting the Russian (Ust-Luga) and German (Greifswald) coasts under the Baltic Sea and doubling the line’s 55-bcmy capacity by 2019. E.On, Shell, and OMV AG each previously had agreed to participate in construction of the two strings.

The 759-mile line is uses 48-in. OD pipe. It is more than 85% laid with the center section near Denmark still pending completion. Denmark approved the project in October 2019 but US sanctions targeting industry participants prompted Allseas to halt pipelay in January 2020.

Gascade is building the European Gas Pipeline Link (EUGAL) from Nord Stream landfall at Lubmin near Greifswald southward to Deutschneudorf in Saxony and from there to the Czech Republic. The 300-mile, 56-in. OD line will parallel the Baltic Sea Pipeline Link (OPAL) for much of its route, running through the German federal states of Mecklenburg-Western Pomerania (102 km), Brandenburg (272 km) and the Free State of Saxony (106 km). Gascade expects to complete construction by end-2020.

Partners in the Shah Deniz consortium made a final investment decision (FID) in December 2013 on Stage 2 development of the Caspian Sea natural gas field offshore Azerbaijan, triggering plans to expand the South Caucasus Pipeline (SCP) through Azerbaijan and Georgia, build the Trans Anatolian Gas Pipeline (TANAP) across Turkey, and begin work on the previously selected Trans Adriatic Pipeline (TAP) for shipment into Europe.

SCP expansion twinned the existing Baku-Tbilisi-Ceyhan (BTC) pipelines through Azerbaijan and Georgia, as well as adding two compressor stations to boost capacity by 16 bcmy. Project plans called for 441 km of new 56-in. OD pipe; 385 km through Azerbaijan and another 56 into Georgia, at which point the expansion was connected to the existing SCP. The first additional compressor station is 3 km inside Georgia, collocated with an existing BTC station near Rustavi. The second new station is at a greenfield site on the existing line 139 km downstream, west of Tsalka Lake, Georgia. BP completed work and placed the 16-bcmy expansion in service first-half 2018, bringing capacity to 23 bcmy.

TANAP runs 1,800 km using 48- and 56-in. OD pipeline to move as much as 30 bcmy and also entered service first-half 2018.

The Shah Deniz II consortium in June 2013 selected the Trans Adriatic Pipeline (TAP) as the project’s European transport option. TAP will transport as much as 20 bcmy from Shah Deniz II through Greece and Albania to Italy, from where it can be shipped further into Western Europe.

The project will use 36- and 48-in. OD pipe, with service expected to begin in 2020. The 36-in. pipe will make up the line’s 115-km offshore section, with the 48-in. pipe used onshore. Total planned length is 878 km.

In November 2019 TAP introduced gas to the Greek part of the system, beginning its commissioning process. Commercial gas flows from Shah Deniz II to Europe are planned to start in October 2020.

Shah Deniz II adds 16 bcmy of gas production to the roughly 9 bcmy of Shah Deniz Stage 1. Field development, some 70 km offshore Baku in the Azerbaijan sector of the Caspian Sea, includes two new bridge-linked production platforms; 26 subsea wells; 500 km of subsea pipelines; the upgrade to SCP; and expansion of the Sangachal Terminal.

The Poland-Lithuania Gas Interconnector (GIPL), designed to connect the Polish and Lithuanian gas transmission systems, will enter service in 2021. The 28-in. OD pipeline would include 310-357 km between Holowczyce, Poland, and the Lithuanian border, and another 177 km from the border to Jauniunai, Lithuania. Line pipe began to arrive in Lithuania in January 2020. Lithuania’s system operator, Amber Grid, plans to lay 100 km this year and the balance in 2021.

Middle East

Iraq began technical work in 2014 on twin 1,043-mile pipelines—one crude oil, one associated gas—running from Basra to the Red Sea at Aqaba, Jordan. The oil pipeline would move 1-million b/d, crossing 422 miles inside Iraq with the balance in Jordan.

Jordan will keep 150,000 b/d for domestic refining. Iraq is pursuing the project to decrease its dependence on the Persian Gulf as an oil export route.

Iraq decided in August 2017 to cancel a parallel gas pipeline, citing high costs and associated delays. The pipeline was to have fueled the crude line’s pumps, with alternative sources now being sought.

Iraqi and Jordanian leadership met in January and July 2019 to finalize the oil pipeline. It is expected to begin operations in 2023.

The National Iranian Gas Co. (NIGC) continues construction of its 1,147-mile Iran Gas Trunkline IX (IGAT 9), running from Asalouyeh to West Azerbaijan province, Iran, providing for the potential shipment of South Pars gas to European customers. Completion is expected in 2022.

The National Iranian Gas Export Co. (NIGEC) in 2016 hired Iranian Offshore Engineering and Construction Co. (IOEC) and Pars Consultant Engineering Co. to perform survey and basic engineering work on a 380-km pipeline intended to carry 28 MMscmd of Iranian gas to Oman. IOEC will complete the offshore study and Pars the onshore.

The onshore section of the pipeline would use 200 km of 56-in. OD pipe in Iran, with the offshore section running 180 km of 36-in. OD pipe from Kuhe Mubarak, Iran, to Sohar Port, Oman. The onshore pipe would deliver gas from the IGAT VII pipeline to Kuhe Mubarak. The two countries reached agreement on the project in February 2017.

In addition to domestic consumption, Oman—which lies beyond the Straits of Hormuz—is considering liquefaction and export. Progress on this project has been curtailed by US sanctions against Iran.

Africa

CNPC is building an 1,181-mile, 20-in. OD crude oil pipeline from Agadem block in Niger to Benin’s Port Seme terminal. Construction of the 90,000-b/d pipeline began in September 2019 and is expected to conclude in 2021. It will include nine pump stations and load tankers via a single-point mooring system.

Uganda and Tanzania plan to build the 897-mile, 24-in. OD heated East Africa Crude Oil Pipeline (EACOP), bypassing Kenya en route from fields in Uganda to the Tanzanian port of Tanga. The pipeline, engineered by Gulf Interstate Engineering Co., would transport roughly 300,000 b/d to the Indian Ocean for export.

Total SA suggested this route as an alternative to mitigate security concerns regarding the Kenyan passage. China National Offshore Oil Corp. Ltd. and Tullow Oil are developing the project with Total. The line is expected to enter service in 2021.

The Tanzania Petroleum Development Corp. plans to build an 1,100-mile, 24-in. OD gas pipeline from Dar es Salaam to Uganda, with construction beginning in 2021 and completed in 2024. The line would pass through Tanga to Mwanza. A second possible route would follow EACOP’s corridor.

Ethiopia and Djibouti plan to build a 765-km, 40-in. OD natural gas pipeline to transport Ogaden basin gas to a floating LNG liquefaction plant offshore Djibouti. China’s Poly-GCL is developing the project with a 2023 startup date anticipated based on a 3-year construction timeline. The 3-mtpy plant, fed by the 2-billion cu m/year pipeline, would be sited at Damerjog port near the Djibouti-Somalia border and expandable to 10 mtpy. Gas would be sourced from Calub and Hilala fields, being developed by China Oil HBP Group. The countries agreed to build the pipeline in April 2019 and the Ethiopian parliament approved the project that December.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.