Alberta’s Industrial Heartland to grow as Canada’s predominant NGL hub

Key Highlights

- Canadian gas production is predicted to increase to 22 bcfd by 2030, almost 18% more than 2024, while NGL production is forecast to increase about 200,000 b/d to 1.75 million b/d over this period.

- Alberta’s Industrial Heartland is emerging as Canada’s primary NGL fractionation hub, with projects by Pembina and Keyera expanding capacity and infrastructure to meet domestic and international demand.

- Canadian LPG exports to Asia are increasing due to shorter shipping times and better netbacks, with new projects on the BC coast expected to more than double capacity.

- LNG Canada’s startup in 2025 and additional pending projects are expected to significantly boost Canadian gas production, supporting robust growth in NGL and LPG output.

Strong growth in liquids-rich natural gas production in Western Canada, largely due to LNG export projects coming online in British Columbia over the next several years, is likely to solidify Alberta’s Industrial Heartland (AIH) as Canada’s predominant NGL fractionation hub, especially as additional LPG export capacity is being added at Prince Rupert, BC, the heartland’s primary conduit to the expanding Asian market.

AIH is a 582-sq km pre-zoned industrial region—the only one in Canada—in parts of three counties (Lamont, Strathcona, and Sturgeon) and two cities (Fort Saskatchewan and Edmonton, the province’s capital) and is the country’s largest hydrocarbon processing cluster.

LNG exports to drive production

Earlier this century, Canadian gas production was negatively impacted by a combination of the US shale gas evolution (which backed Western Canadian gas out of markets south of the border and in eastern Canada), an inability to advance LNG export projects on the BC coast, and a lack of economic conventional gas resource.

After peaking at 17.5 bcfd in 2002, Canadian dry gas production slipped to 14.5 bcfd early last decade, before rebounding to a new annual high of 18.7 bcfd in 2024, with the shale revolution opening massive, low-cost unconventional resource in Alberta and British Columbia and the prospect of new demand from LNG exports finally on the horizon.

Canada has the fifth largest technically recoverable shale gas resource in the world. Canadian unconventional plays also have some of the lowest supply costs in North America, with the Montney having the lowest costs of all, according to Calgary-based energy investment bank Peters & Co. (Fig. 1).

The Montney and Deep Basin formations, on either side of the Alberta-BC border, have an estimated 449 tcf and 197 tcf of marketable natural gas potential, respectively, while Alberta’s Duvernay formation has 77 tcf of marketable potential.

“The anticipated start-up of LNG Canada in 2025 has bolstered Wood Mackenzie’s gas production outlook, both in the short term and the long term,” Swetha Sivaswamy, principal analyst oil and gas at Edinburgh-based consultancy, Wood Mackenzie, told Oil & Gas Journal.

WoodMac is predicting Canadian gas production will increase to 22 bcfd by 2030, almost 18% more than 2024, while NGL production is forecast to increase about 200,000 b/d to 1.75 million b/d over this period.

In addition, “Montney production is projected to nearly double from 2025 levels by the early 2040s,” Sivaswamy said. “Since NGL-LPG are a byproduct of oil and gas production, we see robust growth in them as well.”

Over the next several years, Canadian LPG production could increase by 238,000-264,000 b/d based on several BC LNG projects coming online alone, according to analysis by AltaGas Ltd., a Calgary-based midstream and utilities company with LPG export capacity on the BC coast.

As a result, “there will be a glut of propane and butane [in Western Canada],” Sivaswamy said. “Overland exports to the US help balance the market, but the economics of exporting to international destinations are better.”

LNG exports from Canada are gaining momentum. Shell PLC’s 14 million tonne/year (tpy) LNG Canada project came online in June, and two additional projects with a combined capacity of 5.4 million tpy are under construction. Three more projects with a combined capacity of 28.5 million tpy are in advanced stages of planning and awaiting FID, two of which are on the federal government’s new fast-track projects list (Fig. 2).

The Heartland NGL hub

“Alberta’s Industrial Heartland in Canada can be considered an analogue to Mont Belvieu in the US, where the majority of the fractionation capacity is built. We expect AIH to continue to serve the needs of Canadian NGL processing and fractionation in the future,” WoodMac’s Sivaswamy said.

All planned fractionation projects by the two largest NGL fractionators in Canada, Pembina Pipeline Corp. and Keyera Corp.—once its C$5.15 billion acquisition of Plains All American’s Canadian NGL assets is finalized in first-quarter 2026—are to be in the AIH, despite a significant share of each company’s fractionation capacity presently being outside the region (Figs. 3a, 3b, and 4).

Over half of Pembina’s 430,000 b/d of fractionation capacity is outside the AIH, as is about 40% of Keyera’s soon-to-be 284,000 b/d total capacity.

“At the center of Alberta’s Industrial Heartland is Pembina’s Redwater complex, a premier NGL fractionation facility. Redwater currently has about 200,000 b/d of fractionation capacity, and with our RFS [Redwater Fort Saskatchewan] IV expansion underway, that will grow to roughly 256,000 b/d. The project is expected to be in service, on time, in the first half of 2026,” Chris Scherman, senior vice-president, marketing, and strategy officer at Pembina, told Oil & Gas Journal.

“When the market signals are right, Redwater is well positioned to grow again. The complex has room for potential expansion, which would be capitally efficient given the economies of scale within the facility. In addition, the site’s extensive rail loading and storage infrastructure make future expansions highly efficient, while our connection to global markets continues to strengthen,” he said.

During Pembina’s second-quarter earnings call on Aug. 8, 2025, Jaret Sprott, the company’s chief operating officer, provided rationale for investing in fractionation projects in AIH rather than elsewhere, besides possibly on a small-scale niche basis.

The key reasons are: its location near liquids-rich gas resources in the Montney, Deep basin, and Duvernay formations; the AIH’s incumbency and redundancy advantages, with large-scale inlet capacity, storage caverns, petrochemicals plants, and rail connectivity to export to the south, east, and west; optionality for Western Canadian LPG producers to redirect shipments to take advantage of changing price dynamics between North America and Asia.

A key component of Keyera’s growth strategy—the company is one of two fully integrated well-head to end-product marketing NGL service providers in Canada, along with Pembina—has been the expansion of its C3+ fractionation capacity. The company plans to increase its post-Plains acquisition capacity of 284,000 b/d by more than half over the next several years via three projects in AIH.

On July 23, 2025, Keyera filed an initial project description with the Impact Assessment Agency of Canada (IAAC) outlining the company’s plans for the proposed Josephburg Project, a 100,000 b/d fractionator to separate NGL from its KAPS pipeline. Keyera is targeting the project to be online by third-quarter 2030. A cost estimate is yet to be released.

On May 15, 2025, Keyera said it had sanctioned the Keyera Fort Saskatchewan (KFS) Frac III project, a 47,000 b/d expansion to the company’s 66,000 b/d KFS plant. The project is expected to cost C$500 million, including investments to enhance egress at the plant. Detailed design is under way and early-works construction activities have started, with the expansion targeted to enter service mid-2028.

On Feb. 13, Keyera said it had sanctioned the KFS Frac II Debottleneck project to add about 8,000 b/d of capacity at a cost of C$85 million. Fabrication of major equipment and on-site construction began this summer, with the additional capacity expected to come online mid-2026.

West coast LPG exports, projects

Until 2017, all Canadian propane exports were shipped to the US by pipeline, railcar, or truck. Starting that year, 5,300 b/d, or 3.8% of annual exports of 138,000 b/d, were shipped outside the US. These exports were apparently to Asia to achieve higher netbacks via the 58,000 b/d propane and butane Ferndale export terminal in Washington state. Canada Energy Regulator (CER) data does not identify final markets for Canadian LPG exports (Fig. 5).

Poor prices caused this market shift by Western Canadian LPG producers, with a supply glut due to a lack of continental demand causing LPG prices at Edmonton to briefly drop into negative territory in 2015.

The market shift led AltaGas to move into the LPG terminal space by partnering with Dutch infrastructure provider Royal Vopak on the Ridley Island Propane Export Terminal (RIPET) in the Prince Rupert, BC region—commissioned in 2019 and now with an expanded capacity of 92,000 b/d—and by assuming ownership of the Ferndale export terminal through its acquisition of former Canadian midstream company Petrogas Energy in 2020.

In April 2021, Pembina brought into service the only other propane export plant on the Canadian west coast to date, the 25,000 b/d Prince Rupert Terminal on Watson Island.

These terminals allowed Canada’s propane exports to non-US destinations to increase to more than 92,000 b/d in 2024, 42% of the 218,000 b/d total, based on CER data. According to a recent US Energy Information Administration (EIA) report, Japan, and South Korea are the major Asian customers for Canadian propane.

Canadian LPG has an inherent transportation cost advantage to East Asian markets because the shipping time from the BC coast is shorter than the competition’s, said WoodMac’s Sivaswamy.

For example, “the travel time from Canada’s west coast to countries in Far East Asia is only 10-12 days, while it can be greater than 22 days from the US Gulf Coast. Any issues in the Panama Canal exacerbate the transit time, such as the drought situation in 2023, when VLGCs had to wait for 8-10 days to cross the canal,” she said.

At the same time, Canadian propane producers are continuing to benefit financially from exporting to Asian markets such as Japan and South Korea, according to AltaGas, opening the door for additional exports in the future. The company estimates the netback for shipping propane to Asia via RIPET was C$6/bbl, or 14.3 cents per US gallon, higher than if it had been shipped to the propane hub in Conway, Kan., for the past 2 years.

“Also, only propane is currently exported from Canada [to Asia]. We see potential for butane export terminals to be added in the future,” Sivaswamy added.

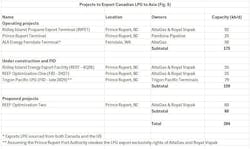

Four additional LPG export projects are moving forward on the BC coast. The projects have the potential to more than double Canada’s LPG export capacity to Asia to 394,000 b/d, including capacity from the Ferndale terminal in Washington state.

The Ridley Island Energy Export Facility (REEF), another joint venture between AltaGas and Royal Vopak, involves three projects at various stages of development. The C$1.35 billion initial project, with design capacity of 55,000 b/d of propane and butane, is under construction and expected to come online near end-2026.

During its third-quarter earnings call on Oct. 29, AltaGas noted the joint venture had sanctioned the REEF Optimization One project. At an estimated capital cost of C$110 million, the project aims to increase REEF’s original capacity by about 25,000 b/d, with an in-service date slated for second-half 2027.

AltaGas and Royal Vopak are also advancing engineering, permitting, and stakeholder relations work for the REEF Optimization Two project, which would add 60,000 b/d to the first two projects.

On June 11, Trigon Pacific Terminals took positive FID for its 2.5 million tpy (79,000 b/d) Trigon Pacific LPG project. The C$750 million project is to repurpose a thermal-coal export terminal on Ridley Island to export LPG by late 2029. The fate of the project is uncertain, as the Prince Rupert Port Authority previously provided AltaGas and Royal Vopak exclusive rights to export LPG from the port. Trigon sued the port authority in November 2023, but the matter remains before the courts.

Pembina has no plans to expand LPG export capacity at its Prince Rupert Terminal at the present time. However, during the company’s second-quarter 2025 earnings call, Scott Burrows, the company’s president and chief executive officer, did not rule out future expansion.

“As we secure more barrels, we will look to where the optimal markets are and that could be further barrels off the west coast or it could be to other markets depending on the time and where the markets are open at that time,” he said.

About the Author

Vincent Lauerman

Vincent Lauerman is a freelance writer based in Calgary, Alberta. Over his nearly 4-decade career he has worked as an analyst and journalist focusing on global and North American energy markets and issues, including a stint as New York Bureau Chief for Energy Intelligence.