Devon CEO: We’re looking at building ‘essentially our own utilities’ to help solve Delaware electricity supply issues

Key Highlights

- Devon Energy is exploring an expansion of its electricity infrastructure in the Delaware Basin due to supply constraints.

- The company is exploring the idea of co-ops to develop its own utility solutions amid political and logistical challenges.

- Other firms, including Diamondback and Chevron, have invested in renewable and alternative power sources for some of their operations.

Devon Energy Corp., Oklahoma City, Okla., may significantly scale up its investment in electricity infrastructure in parts of the Delaware basin, president and chief executive officer Clay Gaspar said recently.

Speaking earlier this month at the Barclays 39th Annual CEO Energy-Power Conference 2025 in New York, Gaspar said Devon’s operations in New Mexico have run into electricity supply constraints in recent years that have spurred his team to build more than 800 miles of distribution lines and its own microgrids in addition to using generators on location.

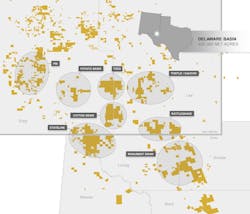

Devon is one of the largest oil and gas producers in the Delaware and the basin accounts for about 60% of the company’s output. About two-thirds of the company’s holdings across roughly 400,000 acres in the basin are in New Mexico.

With additional electricity not forthcoming from utilities in New Mexico—a situation Gaspar attributed to “self-induced issues” and “a whole political thing”—Devon is examining possible next steps that include teaming up with other notable names.

“We’ll be looking and trying to understand our capabilities of building co-ops with peers to build our […] essentially our own utilities,” Gaspar told Barclays attendees. “That’s a whole political challenge and a whole another step. But that’s kind of the future that we’re having to explore in a defensive mechanism.”

Devon officials declined to elaborate on Gaspar’s remarks about what Devon’s future development of electrical infrastructure might entail.

Investing in power infrastructure

Other exploration and development firms have invested in power infrastructure for their operations as they’ve outpaced the electrical grid’s capacity. Diamondback Energy Inc. partnered with VoltaGrid to build a microgrid northeast of Midland, Tex. that uses associated natural gas to provide power to a nearby field as well as to drilling and completion equipment.

Other energy sources are available, too, for power-hungry companies in the Permian basin and other natural resource zones. In California, for instance, a set of Chevron Corp. facilities has since 2020 been powered by the Lost Hills Solar Project, which Chevron developed with SunPower.

“New solar generation in the heart of oil and gas territory is not only wanted but desperately needed,” analysts at Enverus Intelligence Research wrote last year when discussing opportunities for cooperation between oil-and-gas-companies and renewable-energy developers seeking large footprints.

A possible longer-term wild card for Devon? Gaspar and his team last year invested $117 million in Houston-based Fervo Energy, which is developing geothermal wells. The Fervo team has secured hundreds of millions of dollars in other funding as well as contracts with Shell Energy and Southern California Edison and plans to start delivering electricity to the grid in 2026 from its maiden project in Utah.

About the Author

Geert De Lombaerde

Senior Editor

A native of Belgium, Geert De Lombaerde has more than two decades of business journalism experience and writes about markets and economic trends for Endeavor Business Media publications Healthcare Innovation, IndustryWeek, FleetOwner, Oil & Gas Journal and T&D World. With a degree in journalism from the University of Missouri, he began his reporting career at the Business Courier in Cincinnati and later was managing editor and editor of the Nashville Business Journal. Most recently, he oversaw the online and print products of the Nashville Post and reported primarily on Middle Tennessee’s finance sector as well as many of its publicly traded companies.