Earnings for 45 indies up 106% in 3Q2005

Crude oil prices rise for 13th consecutive quarter, relative to year-earlier levels

The financial performance of energy companies continues to spiral upward. A snapshot of the industry taken after the third quarter results from last year shows that earnings of 45 independent energy companies grew 106% in the third quarter of 2005, compared with results at the end of the same quarter in 2004 (see Table 1).

In its quarterly review of financial trends of oil and gas companies, the Energy Information Administration (EIA) analyzed results from a sampling of independent oil and gas producers, oil field service companies, and refiner/marketers. All three types of companies showed improved performance over the year-ago quarter, as crude oil prices, natural gas prices, and gross refining margins all increased (see Table 2).

Only three companies listed in the EIA report - all producers - reported negative earnings. These losses were attributed to declines in the market value of their derivative holdings (financial contracts tied to the prices of natural gas or crude oil) and production declines due to Hurricanes Katrina and Rita in the Gulf of Mexico.

The information in the report is compiled from companies’ quarterly reports and press releases.

Prices up nearly 50%

Crude oil and natural gas prices both increased by almost one-half relative to the prices of a year ago. The US refiner average acquisition cost of imported crude oil increased 47% relative to the previous year, from $38.64/bbl in 3Q04 to $56.69/bbl in 3Q05 (see Table 2).

Reduced Gulf of Mexico production due to Hurricanes Katrina and Rita added to the effects of worldwide factors that had already elevated the price of crude oil. Other factors include continued and forecast growth in world oil demand, low worldwide spare production capacity, and geopolitical risks that have increased the level of uncertainty in world markets.

Higher US crude oil stocks in 3Q05, which were 11% higher than a year earlier and 7% higher than the third-quarter average level from 1999 through 2003, have provided scant relief. This was the 13th consecutive quarter in which crude oil prices increased relative to their year-earlier levels, after 6 consecutive quarters of falling or unchanged crude oil prices prior to that (relative to a year earlier).

The average US natural gas wellhead price increased 50% between 3Q04 and 3Q05, from $5.28/mcf to $7.90/mcf (Table 2). The EIA attributes higher natural gas prices to high world oil prices, a 4% growth in the US economy, the anticipation of reduced hydroelectric generation in the Pacific Northwest, and declining domestic production - in addition to lost production due to Katrina and Rita.

A 2% increase in demand and a 10% decline in net imports of natural gas (chiefly due to liquefied natural gas) put additional upward pressure on domestic natural gas prices, overshadowing a 9% increase in the opening level of working gas in storage in 3Q05 relative to 3Q04.

Prices boost producer earnings

Increases in both natural gas and crude oil prices have helped increase the earnings of independent producers. Net income of the producers included in this report rose 43% between 3Q04 and 3Q05, from $441 million to $630 million, as revenues rose 40% (Table 1). Independent oil and gas producer earnings were boosted by a 47% increase in the price of crude oil and a 50% increase in the price of natural gas over year-ago prices (Table 2).

Rig count impacts service companies

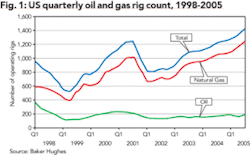

Higher drilling rig counts have helped fuel an increase in revenues and earnings for oil field service companies. Net income of US oil field service companies included in this report jumped 119% - from $1.2 billion in 3Q04 to $2.5 billion in 3Q05 - as revenues rose 26% (Table 1). These earnings were strengthened by an increase in the worldwide rig count of 18% from 2,401 in 3Q04 to 2,836 in 3Q05, according to Baker Hughes data.

Higher rig counts and the resulting higher demand for rig services directly increased the demand for the equipment and services supplied by oil field service and supply firms. This increase in demand raised day rates on equipment and margins on overall operations, thereby increasing companies’ profits. The ODS-Petrodata Day Rate Indices were sharply higher in 3Q05, compared to 3Q04.

The rig count growth rate over the year-ago quarter for the US of 16% was just short of the worldwide growth rate of 18% (Fig. 1). Breaking down the total US rig count into its natural gas and oil components shows that this overall growth was evenly distributed between natural gas (16% growth) and oil (15% growth). The natural gas rig count has now increased for 11 consecutive quarters relative to its year-earlier level.

Breaking down overall (oil plus natural gas) rig counts on a regional basis shows that rig counts grew 16% in the US from 3Q04 to 3Q05, jumped 53% in Canada, and grew 8% in the rest of the world.

Refiner earnings up sharply

Earnings of the independent refiners included in this report increased from $60 million in 3Q04 to $250 million in 3Q05 (Table 1). Driving this earnings growth was an increase in average refining margins of 58% from 3Q04 to 3Q05 (Table 2).

NOTE: The average refining margin is the difference between the composite wholesale refined petroleum product price and the composite refiner acquisition cost of crude oil.

Refining margins increased because the increase in refined product prices (calculated from Table 2 by adding the price of crude oil and the gross refining margin) of $25.89 more than offset the $18.05 increase in the price of crude oil. $