Upstream capital cost review

A FRESH APPROACH TO ENGINEERING AND PROJECT DELIVERY COULD HAVE LONG-LASTING IMPLICATIONS FOR PROJECT COSTS

MARK ADEOSUN, DOUGLAS-WESTWOOD, HAVERSHAM, UK

PRIOR TO THE OIL PRICE DOWNTURN, cost reductions for offshore projects were a major issue in the industry, as both CAPEX (capital expenditure) and OPEX (operational expenditure) were escalating at an unsustainable level while oil prices reached a plateau. As a result, a number of projects were already stalled even before the downturn, with Shell's Bonga South West and Chevron's Rosebank being high-profile examples.

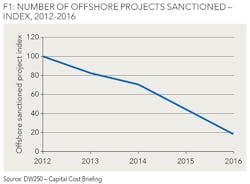

The decline in commodity prices since 2014 has greatly exacerbated this trend, resulting in a large reduction in project sanctioning, with the number of FIDs (final investment decisions) taken in 2016 expected to be 81% lower than the number of offshore projects sanctioned in 2012.

Sustained low oil prices have placed more pressure on exploration and production companies, which has resulted in operators taking a more conservative approach to field development. Most projects have undergone a review of the development concept, and many have been completely re-engineered to be profitable at a lower oil price. Subsequently, only the most cost-efficient projects are being sanctioned, with the focus for many companies being cost management so that dividends can be maintained through the downturn.

The immediate impact of the downturn was a squeeze on the supply chain by E&P companies, which have pushed for continued price reductions for services and equipment, usually with success. Reduced activity levels have led to a continued over-supply of some asset classes. Rig and vessel utilization are among those that have fallen most dramatically, with some day rates plummeting by more than 60%.

A large part of re-engineering has been a drive to simplify project development, with the often touted industry-wide standardization a key method of achieving this. Early in 2016, US supermajor Chevron Corp. cancelled plans to develop its Buckskin and Moccasin projects in the ultra-deepwater Gulf of Mexico, citing challenging market conditions. However, Repsol later acquired Chevron's stake in the Buckskin project, looking to revive the economic viability of the field with the aim of developing it as a tieback to Anadarko's nearby Lucius facility.

Anadarko has stated that using standardized equipment will further reduce costs. This highlights how industry-wide standardization can lead to cost savings while also simplifying field development.

Another example of an independent reworking the development concept of a stalled field and steering it back on track is Anadarko, having assumed the operatorship of the Constellation field, also in the Gulf of Mexico. The field (previously called Hopkins) was operated by BP, which envisioned a semi-sub development that proved uneconomic at current oil prices. As a result, Anadarko took over as operator and announced recently that it intends to develop the field as a tieback to its Constitution spar.

It is important to note that operators are sometimes faced with regulatory and political limitations in the selection of the cheapest development option possible. An example of such a project is the Abadi gas field, where the Indonesian government favored an onshore liquefaction development as opposed to Inpex's preference for a 2.5-mmpta floating liquefaction unit for the initial development phase. A development plan is expected to be submitted later this year which will utilize an onshore plant.

One of the key reasons for the oil price collapse was the dramatic change in output from the US, which went from being a major importer to being self-sufficient due to the revolution in shale production. However, US unconventional production is typically more expensive than conventional onshore production, with higher drilling and completion costs compared to that for conventional. As a result, this sector has been particularly hit hard by the oil price crash, with a large number of companies going bankrupt and others cutting back on drilling activity. The US land drilling market is particularly susceptible to fluctuations in commodity prices, with drilling activity having been significantly reduced as a result of the downturn.

Despite this, output remains relatively high from the most productive basins, and a focus on efficiency and innovation has led to better returns. This is due to the fact that drilling and completion (D&C) and estimated ultimate recovery (EUR) costs have come down substantially, with a number of factors responsible for this.

A reflection of how the US rig market has been affected is indicative in the Baker Hughes rotary rig count reported in May 2016, with active rig numbers at the lowest point on record at 374 active rigs. This has driven equipment and land rig costs down dramatically. However, there are signs the market is improving, with the latest active rig numbers on an upward trend to 513 active rigs reported in mid-October, a 37% increase.

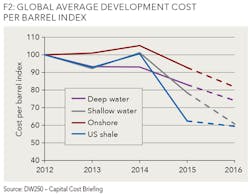

In the current oil price environment, DW250 Capital Cost Briefing analysis shows that development CAPEX per barrel for deepwater projects declined substantially by 41% over the 2012-2016 period, while the US shale D&C cost per barrel also declined by 36% over the same period.

As the market begins to recover, some of these cost savings will inevitably unwind. However, the opportunity to develop a fresh approach to offshore engineering and project delivery could have long-lasting implications for project costs and predictability.

ABOUT THE AUTHOR

Mark Adeosun is the author of "The World LNG Market Forecast 2017-2021," which examines trends in the LNG market by region and facility type, supported by analysis, insight, and industry consultation. He has authored various industry reports and has conducted high-level research into various oil and gas projects. Adeosun has a BSc degree in geology and a master's degree from the University of South Wales in geographic information systems (GIS).