France: Giant Without A Field

THIS SPONSORED SUPPLEMENT WAS PRODUCED BY FOCUS REPORTS.

Report Publisher: Diana Viola

Project Director: Crystelle Coury

Editorial Coordinator: Alexis Chemblette

For exclusive interviews and more info, please log onto www.energyboardroom.com or contact us at [email protected]

In recent decades, French oil and gas companies have grown used to market fluctuations, but the current downturn in the oil price has challenged the very fundamentals of the industry, triggered unprecedented structural changes and brought need for reform in the French oil and gas industry front and center. The French hydrocarbons sector, which traces its roots back to the turn of the 20th century, has proven to be resilient, technologically adept and resourceful in finding innovative ways to cope with the current crisis.

Patrick Pouyanné, CEO of Total, places the blame for the current slowdown on price fluctuations, the unexpected emergence of unconventional hydrocarbons and competition between various forms of energy. France's flagship oil and gas company is today actively seeking spending cuts, but as Pouyanné explains, this was not a priority just a few years ago. "While cost-cutting might seem obvious today, it was not the case a few years back. Things had escalated to the point that many in the industry had forgotten that when working with commodities, it's essential to carefully manage your expenses and your cash break even." Even France's IOC has been shaken by the current situation. "Our size may prevent us from collapsing in the short term but we must remain extremely cautious and acknowledge what economic signals are telling us."

CEO, Total

chairman and CEO, Technip

"What clearly distinguishes the current crisis from previous ones is that some of the oil majors have almost immediately initiated a staff reduction," explains Thierry Pilenko, Chairman and CEO of Technip. "What also differentiates the current situation with the 2009 crisis is the immediate reaction from both IOCs and NOCs."

"No one had introduced the topic of shale gas before I left Total in 2002," admits René Bauquis, a prominent geologist and economist. "It had barely started to emerge in the US. When I realized that this new industry was growing, and growing very quickly, it was very unexpected. Of course, shale hydrocarbons were known but we were convinced that these hydrocarbons would forever remain economically unviable to produce."

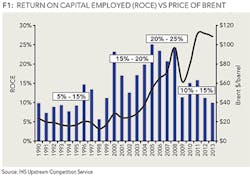

While the current slowdown is compelling major French companies to introduce cost-effective solutions, many regret that these measures weren't adopted sooner. Philippe Crouzet, Chairman of Vallourec, explains that prior to this crisis, the oil and gas sector's performance data had sent a clear signal indicating a need for reform, which companies initially ignored. Indeed, returns on capital expenditure had drastically diminished long before oil prices started to crumble.

chairman, Vallourec

CEO, CGG

Some French companies were more attentive to market signals. "We were among the first companies to sound the alarm," says Jean-Georges Malcor, CEO of CGG. "In December 2013, we outlined the details of our transformation plan, which consisted of reducing our footprint in acquisitions and reducing our cost base to become more agile." When market conditions worsened in 2014, CGG furthered its efforts by reducing its fleet size and cutting its global headcount by 12 percent, drastic measures that Malcor presents as a necessary evil. "The situation paradoxically helped us complete this transformation faster than expected. There has fortunately been positive feedback from the market."

While all companies, irrespective of size and position in the value chain, endorse cost-cutting measures, they fail to agree on who exactly should bear the burden." The dramatic changes occurring in our business environment and their implications to our clients' cash flows compelled them to enact drastic measures. Their reaction is only natural but they need to seek further cooperation with their contractors to foster a resilient cost-environment." asserts Thierry Pilenko, Chairman and CEO of France's leading engineering, construction and project management company Technip.

Some companies have managed to mitigate the effects of the crisis through good portfolio management. "In spite of strong challenges generated by the slowdown, we are entering this difficult period having achieved a record of order intakes in 2014," reveals Pilenko, "The steps we have taken to broaden our portfolio of solutions have contributed significantly to our solid performance. We won many projects in the subsea world thanks to our complete set of solutions."

Reactivity and proximity are the new watchwords of Dominique Henri, Chairman and CEO of Heurtey Petrochem, an engineering and project management company specialized in two market segments; process furnaces for refining, petrochemicals & hydrogen production, and natural-gas treatment, through its subsidiary Prosernat. "We capitalize on our new fabrication facilities, project management and engineering offices in India to deliver our services more effectively in Asia and the Middle East," he explains.

president, SeaOwl

The ability of E&P and EPC companies to drastically reduce costs and introduce internal flexibility has created an unprecedented window of opportunity for ambitious niche players that can assist them in fulfilling this objective: "Our business model consists of enabling oil and gas companies to provide quality at a global level without enduring unbearable costs," explains Arnoult Gauthier, president of SeaOwl, an asset management and technical assistance company. Gauthier firmly believes that the oil and gas industry cannot afford to be conservative and complacent, and must outsource wherever possible to reduce costs. "For instance, in asset management, we provide integrated services that cover the marine side of FPSOs," Gauthier explains. "Our role is to assess from a global perspective, which people will be needed in which positions, and where the risks lie in terms of safety."

GENERATIONS OF UNLOCKING TECHNOLOGICAL BARRIERS

Although France doesn't have any significant hydrocarbon production of its own, it has nevertheless managed to create an oil and gas industry composed of market leaders in virtually every segment of the value chain. "Very few people know that France is the world's second largest oil services industry in terms of exports," says Jean Ropers, the former chairman of the French Association of Companies and Professionals in the oil, gas and related industries, or GEP-AFTP.

chairman 2009-2015, GEP-AFTP

France's involvement in oil and gas dates back to the end of the First World War. Successive governments recognized the significance of oil and gas as a pivotal resource to win major wars. "In 1924, the French government created an ad hoc company called Compagnie Française Des Pétroles," explains Daniel Valot, Technip's Chairman & CEO from 1999 to 2007. "Later on, wishing to monitor its oil supplies more closely, the French authorities enacted a law in March 1928 that gave the French state a monopoly on importing and refining crude oil, but would delegate this monopoly to various French companies."

The credibility and quality of this French expertise arguably stems from the scientific excellence of engineering schools such as Ecole Polytechnique, and various research institutes and associations have successfully translated this engineering excellence into oil and gas expertise. Olivier Appert, chairman and CEO of IFPEN from 2003 to 2015, the institute that has over the last 70 years accompanied oil and gas companies during phases of radical technological transformation, explains how within the French oil and gas community, IFPEN symbolizes the epitome of innovation and successful R&D. "We are an innovative center, developing products and processes to match the demands of both the industry and society at large. We always have one foot in pure science but keep an eye on commercialization," Appert explains. IFPEN contributed to the creation of companies like Technip and Coflexip, but also niche market leaders such as Eurecat, a renowned supplier of catalyst processes, and Axens, an engineering company that still conducts research programs in cooperation with IFPEN and develops state-of-the-art technologies, services, catalysts and adsorbents with optimum performances for the refining, petrochemical, gas and alternative fuels industries.

chairman & CEO 2003-2015, IFPEN

In spite of its rigid labor market and high labor costs, France is home to the research, execution and project centers of several international companies. "Saipem France has become a leading project execution center for Saipem globally," declares Fabio Pallavicini, CEO of the French affiliate. "Technological development is undeniably critical to our success and explains the importance of our Paris office as a project execution center. We have established lasting relationships with French universities and research centers to develop new technologies."

Many leading French companies have come to terms with the fact that they can no longer compete with emerging economies on costs, and must focus now on added value: "To remain competitive in the long run, we must remain at the vanguard of innovation in relation to project management and engineering," declares Antoine Bresolin, CEO of Eiffage Metal. "We are perpetually committed to engineering in steel construction. We seek the brightest engineers. I have one goal for the coming years: excellence."

CEO, Saipem SA

France has fostered a dense network of small but competitive SMEs dedicated to oil and gas, many of which capitalize on the fact that their technologies and engineering capabilities can allow them to become market leaders in small niches. Doris Engineering is an example of a French company that built on that niche position to great effect, eventually being presented with the OTC award in 2006, perfectly illustrating France's position as an engineering powerhouse. Nicolas Parsloe, Doris' CEO, attributes his company's success to its way of relentlessly seeking to unlock technological barriers. "Our philosophy has always consisted in pushing the limits forward," he explains, "One of Doris' fundamental characteristics is that people who work here are passionate and so we are able to take on new challenges when we believe we can address an issue that remains unsolved. Our competent staff that masters the technology to develop projects anywhere in the world remains our greatest asset." Parsloe insists that the pool of talented engineers available in France has contributed to the company's success. "R&D has always been at the heart of our philosophy. France is always innovative as French people are very keen on mathematics and physics and take pride in developing cutting edge-solutions. Doris boasts very bright and competent young professionals."

CEO, Doris Engineering

NO DOMESTIC SAFETY NET

The lack of significant domestic oil and gas production means that many French companies must seek international growth without proving their concept domestically first. French companies operating in the oil and gas industry are therefore experienced in competing in foreign markets where they are not favored as natural partners of choice. Since French oil and gas players cannot rely on a domestic safety net, most of them achieve a substantial portion of their turnover internationally. Prior to earning a global reputation, French companies must build networks and overcome fierce international and local competition without boasting longstanding credentials. Several SMEs have even admitted that risk wasn't enshrined in their culture and that they sometimes dithered too long before finally entering a market.

"We have already established subsidiaries across the globe but our main objective in years to come is to have foreign companies use our French concepts and technologies," explains Guy Bardot, founder and CEO of Bardot Group, a mid-sized French company specialized in strategic polymer parts and subsea umbilicals, risers and flowlines (SURF). By 2020, the company aims to grow to USD 100 million based on this model. "We want to duplicate our model to every region of the world, notably the United States and the United Arab Emirates. We decided to seek industrial partnerships with companies in demand of engineering processes and recipe for polymers. We now boast partnerships in the US, Brazil, Europe and Malaysia."

"In our business, we always arrive before or after a revolution. We need to be aware of that without putting ourselves in danger," says Jean-Claude Bourdon, executive vice president of Dietswell, who recently signed two major contracts in Iraq for its particular niche service of integrated drilling and engineering services. "Even though the country was chaotic and unsafe, I found it had potential," he says, discussing the challenges of the project. "We ran the operations from our Abu Dhabi office. The best way for us to enter the country was through inspection and technical assistance services." Bourdon sincerely believes that these bold decisions characterize the oil and gas industry. "We now have constant activity in Abu Dhabi in the commissioning of land rigs coming either from the USA or China or their numerous launching of offshore platforms. From there, we have spread to neighboring countries like Yemen, Oman, Qatar and Iraq."

chairman, Bardot Group

executive vice president, Dietswell

Ludovic Villatte, CEO of ITP Interpipe, a global leader in the design, provision and fabrication of highly insulated pipes, is convinced that preserving his plant in France contributes to his company's success in the long run. Several French exporting SMEs subscribe to this vision and have received positive feedback from their international clients. According to them, many players in emerging markets consider that the Made in France label constitutes a "pledge of quality," which serves to explain the commitment of French SMEs to preserve a production facility in France. "We are committed to preserving our manufacturing facility in France because it serves as a center of progress and excellence. Our plant enables us to dispatch qualified equipment and trained engineers across the world."

France's historical, linguistic and cultural links to a number of African countries have provided a wealth of opportunities for French oil and gas companies. "We are also convinced that the African continent will constitute our main market of interest according to its forecasted growth levels," reveal's SeaOwl's Gauthier. "A few majors used to dominate Africa. Nowadays, the advent of ambitious national players, with insatiable demands for technical assistance, has opened a considerable window of opportunity for suppliers of expertise and manpower like SeaOwl."

Small and mid-sized French service providers rejoice every time Patrick Pouyanné expresses Total's continued commitment to Africa, as partnering with the IOC on projects in African countries allows them to grow and build lasting partnerships with local players. Companies like Krohne, Sofregaz, Eras and SDV Logistics have long admitted that the development of their activities in Africa was the basis of their international expansion elsewhere. Several companies have built on success in Francophone Africa to gradually expand toward Anglophone and Portuguese Africa and seize opportunities in key markets like Nigeria, Angola and Mozambique. Indeed, Doris Engineering recently won an important contract in Angola, while Eiffage Metal has contributed to the OFON project in Nigeria.

SAFETY: BELIEF OR COMPLIANCE?

Cost reduction strategies have not dampened the enthusiasm for continuing to embrace safety as a core value and priority for French companies: the oil and gas industry has witnessed tragic incidents in the recent past, which French oil and gas players have sworn never to repeat, committing to a stringent set of HSE norms and standards, irrespective of size and turnover.

Pouyanné expresses the importance of safety by including it in a list of five words for the future of Total, which urges all its professionals dispatched around the world to respect its safety guidelines and recommendations. "Safety will systematically constitute a permanent key concern for Total," he observes. "We are aware that nowadays, safety may put the future of a company at stake as we have observed after the tragic Deep Horizon accident in the Gulf of Mexico." Total recently encountered and addressed serious safety threats in Yemen and Libya. "In Yemen, as rebel forces approached our LNG facilities, we not only cautiously evacuated our expatriates but also our local staff after having safely and orderly shutdown our operations." Technip's Pilenko is also keen to explain that safety is no longer compromised or dismissed at the expense of other investments and cost saving. "Safety is a critical component of our success and will never be disregarded or compromised in any economic context."

CEO, Bureau Veritas

Oil and gas companies no longer seek to implement safety measures for the sake of compliance but rather because they are fully aware of the risks implied: "Customers in the past focused on safety to satisfy growing government requirements," says Thibault Fourlegnie, general manager and EMEA operations director of Oldham, a provider of gas detection systems. "They are now pursuing the highest standards of safety to protect their staff and ensure tranquility during the course of their missions." Fourlegnie also emphasizes the growing role of support services and maintenance in his business: "On the maintenance side, we have 45 field technicians in France and a trusted network of distributors dispatched across the world. We deliver process control and need to ensure adequate maintenance, operation, inspection and prevention around the products we deliver."

As safety prevails as a core concern in the oil and gas industry, certification and inspection companies play a growing role in accompanying their clients' HSE development and compliance. "QHSE is the core activity of our company," explains Didier Michaud-Daniel, Bureau Veritas' CEO. "Operators have unanimously expressed their commitment to continue their efforts in this field. The impact of QHSE within the deployment of these projects is undeniable and has encouraged Bureau Veritas to accompany and adapt these new trends and developments in mentalities and business philosophies."

Half a century of drilling expertise

Entrepose Drilling was founded in 1958 as COFOR and has drilled thousands of wells worldwide. The company which belongs to the Entrepose Group, itself part of Vinci, relies on its conventional and automated modern hydraulic rigs to offer its clients a wide spread of solutions for drilling and workover applications. "We invested in the most recent generation of drilling rigs," reveals David Richard, CEO of Entrepose Drilling. "We therefore improve safety levels via highly automated rigs. Environmentally, they have a smaller footprint and limited noise levels. We foster innovation through the type of rig we select, which in turn address environmental concerns. It is through the rig itself that Entrepose Drilling can really make a difference," he explains.

CEO, Entrepose Drilling

Recently, the company has decided to leverage its oil and gas drilling experience to specialized niche segments including deep aquifer systems, deep geothermal wells and coal bed methane. "We have built extensive experience in geothermal drilling in France, and have become a leader in that aspect. We are even able to address turnkey wells," says Richard, before admitting that like most players in the French oil and gas community, Entrepose Drilling had to seek international expansion to sustain its activity. "The market slowdown in Europe encouraged us to seek opportunities both geographically and technologically. Geographically, we are involved in West Africa, India and the Middle East."

Bridging the gap between global solutions and local proximity

As the oil and gas industry increasingly embraces safety as a core value, certification companies have worked to get as close as possible to their clients. In this respect, DNV GL has built a subsidiary in Paris to work with French clients during the design phase of both domestic and international projects. This strategy is starting to bear fruit: "Until a few years ago, DNV GL didn't participate in calls for tender issued by Total for classification, but three years ago, we broke this trend by winning an important classification contract on behalf of Total in Congo," explains Anje Deschoolmeester DNV GL's manager for oil and gas in Southern Europe, "Since then, DNV GL is regularly asked to present its services and solutions to major French operators and EPCs."

manager Southern Europe Oil & Gas, DNV GL

The need for coordinated solutions between subsidiaries is growing increasingly important, according to Deschoolmeester. "We are handling a project for Technip and Total in the North Sea: project management for verification is conducted from Paris, while execution falls under the umbrella of our Danish and Korean offices; risk and reliability management is coordinated between here and Oslo. Our teams must adapt and adopt the culture of every country where we operate. It is critical for us to understand and recognize the specific regulations, customs and requirements in each country." According to Deschoolmeester, DNV GL's French entity revolves around safety and risk management systems and reliability studies, while the global group's competitive advantage resides in its unparalleled investments in innovation.