Net income for OGJ150 plummets, down 85% YoY, 92% from 3Q14

Don Stowers, Editor - OGFJ

Laura Bell, Statistics Editor - Oil & Gas Journal

This is it, folks - the first big quarterly financial stumble of the current downturn as the petroleum markets plummeted in the fourth quarter of last year along with falling oil prices.

Total revenues for the group of publicly-traded US-based companies tracked by Oil & Gas Journal and Oil & Gas Financial Journal declined by 14% in 4Q14 compared with the same period in 2013 and by 17% over the prior quarter. However, net income went through the floor. Income dropped by 85% from the same quarter in 2013 and by 92% compared to the previous quarter. Low commodity prices clearly have had a profound impact on earnings, although fourth-quarter financial reports show that some companies have been affected more than others.

Total revenue for the group fell by $31.4 billion to $198.1 billion year over year (YoY) in the fourth quarter. Revenue was down $39.8 billion compared to the 3Q14.

Net income for the group declined by $14.2 billion to just $2.5 billion in the fourth quarter compared to the same quarter in 2013. Income fell by $25.8 billion from the 3Q14 to 4Q14, an epic dropoff.

The number of reporting companies decreased from 131 to 122 in the fourth quarter, and 15 companies covered in the OGJ150 failed to report their earnings to the US Securities Exchange Commission by press time for this issue.

Year-to-date capital spending in the 4Q14 stood at approximately $221.1 billion compared to $204.4 billion in the fourth quarter of 2013, about a 9% increase.

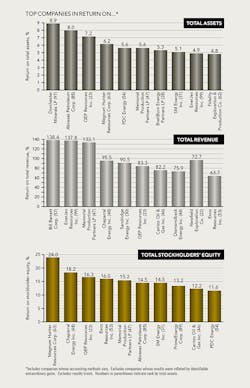

Total asset value for the OGJ150 group of reporting companies fell by $11.3 billion (about 1%) to $1.48 trillion in the fourth quarter from the preceding quarter. However, total assets grew by $61.3 billion (about 5%) compared to the same quarter in 2013.

Stockholders' equity for the group declined by $19 billion (about 3%) in 4Q14 compared to the third quarter. It increased by $18.1 billion (also about 3%) compared to the 4Q13. Total stockholders' equity for the 122 reporting companies stood at nearly $710.1 billion in the fourth quarter.

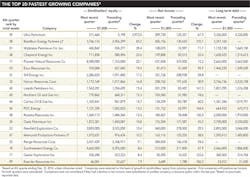

LARGEST IN NET INCOME

The top 20 companies ranked according to net income had a bad quarter - not as bad as the entire group of 122 reporting companies, but not good. The largest 20 companies saw collective net income decline by nearly $9.7 billion to $17.2 billion in the fourth quarter - a 36% drop - compared to the third quarter of 2014. Net income fell by nearly $5.2 billion compared to the fourth quarter of 2013 - a 24% decline.

Half (10) of the top 20 companies in net income for the third quarter of 2014 fell off the list for the fourth quarter. These include ConocoPhillips (net loss: $24 million); Occidental Petroleum (net loss: $2.5 billion); Anadarko Petroleum (net loss: $350 million); Devon Energy (net loss: $408 million); Hess Corp. (net loss: $7 million); Continental Resources (net income: $114 million); Energen Corp. (net income: $65 million); Kinder Morgan CO2 Co. LP (net income: $157 million); Concho Resources (net income: $130 million); and Eagle Rock Energy Partners LP (net loss: $345 million).

These companies remain on the top 20 list in net income from the prior quarter: No. 1 ExxonMobil Corp. (net income: $6.6 billion); No. 2 Chevron Corp. (net income: $3.5 billion); No. 3 Marathon Oil Corp. (net income: $926 million); No. 5 Chesapeake Energy (net income: $639 million); No. 6 EOG Resources (net income: $445 million); No. 7 Pioneer Natural Resources (net income: $431 million); No. 9 Noble Energy (net income: $402 million); No 10 Murphy Oil (net income: $375 million); No. 11 Denbury Resources (net income: $364 million); and No. 12 Newfield Exploration (net income: $360 million).

New companies joining the top 20 list in net income this quarter are: No. 4 QEP Resources (net income: $666 million); No 8 BreitBurn Energy Partners LP (net income: $405 million); No. 13 SM Energy (net income: $332 million) No. 14 SandRidge Energy (net income: $314 million); No. 15 Southwestern Energy (net income: $312 million); No. 16 Range Resources (net income: $284 million); No. 17 Halcon Resources (net income: $259 million); No. 18 WPX Energy (net income: $219 million); No. 19 Ultra Petroleum (net income: $210 million); and No. 20 Laredo Petroleum (net income: $201 million).

Most of the "new" companies to the top 20 list in net income have been there before, but this is a first for several of them.

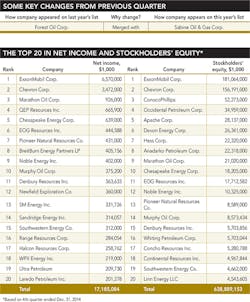

LARGEST IN TOTAL REVENUE

The top 20 companies in total revenue had $182.7 billion collectively in total revenue for the fourth quarter compared to $217 billion for the same quarter in 2013 and $222.7 billion for the prior quarter. The former represents a 16% decline, and the latter an 18% drop.

There was less of a shakeup among the top 20 in revenue than there was among the top 20 in net income. Two companies, Linn Energy and Whiting Petroleum, dropped off the list. Linn saw a 47% revenue decline from the 3Q14 and a 22% drop from the 4Q13, while Whiting had an 18% decline from 3Q14 and a 5% drop from 4Q13. WPX Energy joined the group at the No. 16 position, and Range Resources joined at No. 19. WPX reported $1.1 billion in total revenue, and Range Resources had $872 million in total revenue.

TOP SPENDERS

Collective spending by the top 20 companies in the fourth quarter of 2014 grew to $176.2 billion (year-to-date), about a 4% increase over the same quarter in 2013.

Top spenders were, in order, Chevron ($35.4 billion); ExxonMobil ($34.6 billion); ConocoPhillips ($17.1 billion); Apache Corp. ($10.9 billion); Anadarko ($9.5 billion); Occidental Petroleum ($8.9 billion; EOG Resources ($8.2 billion); Devon Energy ($7.0 billion); Hess Corp. ($5.3 billion); and Marathon Oil ($5.2 billion).

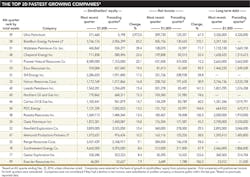

FASTEST-GROWING COMPANIES

The three fastest-growing companies, ranked by stockholders' equity, for 4Q14 were, in order, Ultra Petroleum (No. 1); BreitBurn Energy Partners (No.2); and Midstates Petroleum Co. Inc. (No. 3). Ultra and Midstates are headquartered in Houston, and BreitBurn is based in Los Angeles.

Click here to download the pdf of the OGJ150 Quarterly "4th Quarter ending Dec. 31, 2013"