Independent research firm IHS has provided OGFJ with updated production data for the OGFJ100P periodic ranking of US-based private E&P companies. The rankings are based on operated production only within the US.

Top 10

The biggest change in the April installment of the OGFJ100P from the list published in January is the omission of Citrus Energy Corp. The Castle Rock, CO-based company was previously listed in the ranking at No. 29, but has since sold its Marcellus assets (more on that to come), pushing the company out of the list of the largest privately-held companies ranked by BOE.

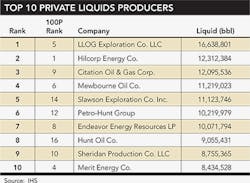

In another, move, albeit less dramatic, Houston, TX-based Citation Oil & Gas Corp. jumped from its previous spot at No. 15 in the January installment to its current seat at No. 9. The company also moved from the No. 6 spot on the Top 10 Private Liquids Producers list to the No. 3 spot. According to the company website, Citation is the second largest producer of crude oil in Oklahoma. The company lists southern Oklahoma as the majority source of its proved reserves, and operations in the Ardmore Basin play into the mix.

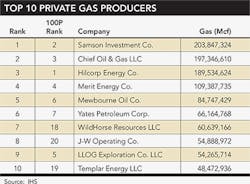

Chief Oil & Gas LLC moved from No. 6 to No. 3 in the BOE ranking, and jumped above Hilcorp Energy (still at No. 1 in overall production) in the Top 10 Private Liquids Producers list. Walter Oil & Gas Corp., No. 13 in the OGFJ100P ranking for this issue, lost its previous spot at No. 10 in the Top 10 Private Gas Producers list. Moving into the Top 10 Private Gas Producers list for this issue is J-W Operating Co. The company, which ranks No. 20 overall, comes in as the No. 8 private gas producer.

Citrus exits Marcellus

In October 2014, privately-held Citrus Energy Corp. closed on a deal with Warren Resources Inc. in which it sold essentially of its assets in the Marcellus shale play. The deal, announced earlier in the summer, was part of a deal Warren struck with Citrus and two additional working interest owners for $352.5 million.

The purchase price to Warren to enter the area—its previous core consisted of California oil and Wyoming natural gas—consisted of $40 million in Warren common stock priced at $6.00 per share, and approximately $312.5 million paid in cash.

In June, before the deal closed, the assets produced an estimated 82 million net cubic feet per day of natural gas. Estimated net proved reserves, as of the July 1 economic effective date, totaled approximately 208.3 billion cubic feet, 55% proved developed, as estimated by Netherland, Sewell & Associates Inc. President and co-founder of Citrus, Lance Peterson, joined Warren's board of directors. Key technical, operating, and land personnel are transitioning from Citrus to Warren as employees, including Zachary Waite, who will assume the role of vice president of business development and Marcellus operations, and Daniel Collins, who will assume the role of vice president of Marcellus land.

BMO Capital Markets served as financial advisor, and Thompson & Knight LLP served as legal advisor to Warren. Jefferies LLC served as financial advisor, and Vinson & Elkins LLP served as legal advisor to Citrus.

Great Western acquisition

Denver, CO-based Great Western Oil & Gas Co., an affiliate of The Broe Group with active operations in the Denver-Julesburg Basin in Colorado, has purchased 14 producing wells and 816 net leasehold acres in the Wattenberg Field from an undisclosed seller. The private company closed on the deal January 16. The price was not disclosed.

The acquired assets are adjacent to existing Great Western Oil & Gas land in Weld County. While Great Western Oil & Gas Co. doesn't appear in the OGFJ100P, the company website notes the deal helps "bolster the company's position among the top 10 oil & gas producers in Colorado, where the company continues to look for additional acquisitions of wells, acreage and non-consenting working interests."

Rich Frommer, president and CEO of Great Western Oil & Gas, said the aquisition "is a great example of our strategy to expand our holdings in the Wattenberg Field, particularly during the current period of variability in the industry, and achieve economies of scale throughout our operations in Northern Colorado. We continue to search for additional suitable wells and leasehold acreage located near our current operating locations."

Bankruptcy

Houston, TX-based Royalty Partners LLC, a privately held company with holdings in the Eagle Ford shale play, filed for Chapter 11 bankruptcy reorganization in the US Bankruptcy Court Southern District of Texas in Victoria in late January.

Court filings show that, as of Jan. 27, the company's total assets were $845,218, while its debts were more than $1.5 million. A court date has not yet been set for these proceedings.

Click here to download pdf of the "2014 Year-to-date production - alphabetical listing"

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.