Financing new E&P technology

A PRUDENT CASH FLOW MANAGEMENT SYSTEM IS ESSENTIAL FOR ENTREPRENEURIAL SUCCESS

SIDDHARTH MISRA, UNIVERSITY OF TEXAS, AUSTIN

EDITOR'S NOTE: This is the first in a two-part series about financing new E&P technology ventures. Part 2, which will focus on private equity and private placements, will run in the July issue of OGFJ.

FOR OIL AND GAS ENTREPRENEURS, raising capital in a highly volatile and risk susceptible industry is a challenge. Understanding the broad sources of available capital is the fuel for making an entrepreneur's vision a reality.

Most entrepreneurs bootstrap the business for the first few years, aiming at positive cash flow. Business cash flow is referred as EBITDA. Debt servicing, tax payment, asset building, and profit distribution to shareholders after payment of operating expenses is done with cash available in form of EBITDA. Depreciation and Amortization lowers taxable profits and increases a company's cash flow.

An entrepreneur should maximize day-to-day cash flow of the business and avoid a "paper-rich, cash-poor" situation. For a service company, expenses are mostly in terms of labor costs, and profits are diminished with any delay in cash reimbursement. For a producer, materials, production, and inventory are the sources of expenses and face long lag times between cash outflows and the receipt of money from customers (cash inflows).

A prudent cash flow management system is essential for entrepreneurial success. The oil and gas business is cyclical and money is needed to make money. In a stronger economy with a fast-growing company, cash flow controls can be overlooked without immediate negative consequences, but an economic downturn accelerates the negative influences of poor cash flow management. An accurate cash flow forecast determines a business's financing needs. Cash flow depends on cash receipts and payables. An increase in demand, long-term sales growth, and asset building are essential parameters for a cash flow forecast.

For an entrepreneur, the amount of capital to be raised depends on these factors:

- The monthly cash flow projection, which is the sum of Free Cash Flow (FCF) and debt obligations (i.e. interest + principal payments, also called net cash flow) for three to five years.

- The largest cumulative negative cash flow (cumulative projected NCF) denotes the capital needed.

- EBIDTA - that is the sum of net earnings, interest, taxes, depreciation, and amortization - is required to be maintained at the proper level.

When it comes to raising capital, there are two schools of thought: series funding and one-time funding.

SERIES FUNDING VS ONE-TIME FUNDING

Pros: Series funding keeps the entrepreneur disciplined and minimizes wasting. Also, in series funding, less equity is lost as the next series of capital comes at higher valuation.

Cons: Availability of future capital is uncertain and resources have to be allocated for securing additional funding.

During the start-up phase of Google, Sergey Brin and Larry Page maxed out their credit cards to buy storage and later they raised $100,000 from a friend and $900,000 from family friends and acquaintances. In its rapid-growth stage, 3.5 years after its founding, Google raised $24 million from two venture capital firms. Eight years after its founding, Google raised $1.67 billion from its IPO.

It is difficult to raise capital for entrepreneurial ventures because capital providers are taking major risks in financing them. Statistics clearly show that 60% of new ventures fail within four years, and nine out of 10 fail in 10 years. Most of the failure can be attributed to lack of adequate capital obtained at the best terms from the right investors.

SEQUENCE OF NEW VENTURE FINANCING

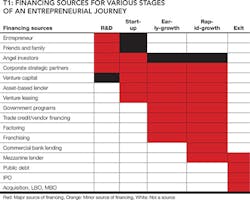

Each stage of the entrepreneurial journey has its own financing needs, and every financing mechanism has its own risk and reward profile. Financing a new venture is done in the following stages (See Figure 1):

SOURCES OF NEW VENTURE FINANCING

The method of financing is critical in determining how fast and the degree of success with which the idea or product reaches the market (See Table 1). Financing is the fulcrum that magnifies the value of an entrepreneur's efforts. It is important to remember that a limited history and an uncertain future prohibit raising required capital.

Self, friends, and family

This is the primary source for bootstrap financing, which doesn't depend on an investor's assessment of the merits of opportunity or assets of the venture. These sources should be well aware of the entrepreneur's reliability, trustworthiness, and ability to handle adversity.

Angel investors

This source is made up of high net worth individual, who are like freelancers interested in investing $25,000 to $500,000 in early-stage projects. They provide seed capital to develop an idea and increase the valuation of the venture to the point where formal outside financing becomes feasible. The time horizon for such an investment ranges from five to 10 years.

In the United States in 2010, $10 billion to $26 billion in seed financing came from angel capital. Angels can work alone or as affiliates to an angel network. The advantage of an angel network is its ability to raise greater capital, share in due diligence, and sharing experiences. An angel investor's reason for investing is to share in the potential growth of the company's valuation.

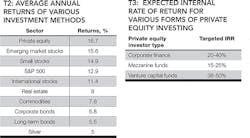

During the seed and start-up stages of an entrepreneurship, there is a lack of capital. Angels and venture capitalists want high returns on the order of 38% IRR, and with the a lower amount of funding they are able to get a large ownership position in the ventures as they come in when valuation of the venture is low.

In 1977, A.C. Markkula invested $91,000 in Apple Computer as an angel and personally guaranteed another $250,000 in credit lines. When apple went public in 1980, his stock in the company was worth more than $150 million. Angel investing has seen a dramatic growth due to the large number of millionaires and a change in federal tax laws whereby the capital gains tax was reduced from 28% to 20%.

Pros of angel investment: It provides seed capital and angels can be value-added investors with their business experiences. Angels generally have a longer time horizon for the investment. Cons of angel investment: They provide limited capital, and such a capital is expensive.

Venture capital

This source is active in early-growth companies. Backing from VC firms ensures that the company has little collateral and provides a basis for secured lending. VC funding was at its peak in 2000 at $100 billion but plunged to just $19 billion in 2003. Since then, there has been a dramatic fall off in VC activity.

VC firms have a unique organizational structure and focus on a specific market niche of high-risk ventures with potential for rapid and significant growth. An entrepreneur's venture should be well suited for VC financing.

American Research and Development (ARD) was the first modern VC Fund in the US and was organized in 1946. It established the practice of searching for high-risk deals with the potential for big wins. In the US, mutual funds and other investment companies are regulated under provisions of the Investment Company Act of 1940 (ICA), enforced by the Securities Exchange Commission. During early times, the SEC required that the fair value of a fund's investments be determined in "good faith by a fund's board of directors." Reliance on consultants for valuations was inconsistent with fair value, and the SEC also equated value with liquidation value, and prohibited a reliance on formulaic approaches for determining fair value.

VCs are able to avoid being subjected to SEC interpretations of the ICA by taking advantage of safe harbor provisions in the SEC acts. The safe harbor provisions has driven firms interested in raising capital to invest in non-public companies, to organize limited partnerships, and to only raise capital from investors who are deemed by the SEC to be sophisticated investors not requiring protections of the SEC acts.

In early years VC funds were committed to seed, start-up, and early-stage ventures. From 1980 to 2000, venture capital firms increased their involvement in later-stage investment. As can be seen in Figure 2, during 2000 to 2008, seed and start-up stage investment were a small fraction of later-stage investment. It is worth noting that in 2008, VC funds invested $1.5 billion compared to angel investment in seed/start-up stage ventures.

PRIVATE EQUITY FIRMS

Private equity refers to any investment in equity that is not traded on an organized exchange. Investments in private equity can take the form of leveraged buyouts, VC, distressed equity investments, mezzanine capital, and so forth. Venture capital is one aspect of private equity industry. These are private deals between the companies where money is exchanged for equity in the company. IPOs are examples of public equity financing. An explosion in private equity funds happened in the 1990s, and number of PE firms rose from 151 in 1990 to 807 in 2000. But, after 2003, the number dropped to 263.

Owners of private equity companies are entrepreneurs operating in the business of providing capital. They put their capital at risk in pursuit of exploiting new venture opportunities. Most of them are organized as limited partnerships or limited liability companies. This legal structure indemnifies the external investors and the principals. They also have an advantage over C-corporations because they limit the life of the firm to a specific amount of time (usually 10 years), and with such a structure, double taxation is avoided.

Professional investors who manage the firm are the general partners. GPs typically invest only about 1% to 5% of their personal capital in the fund and make all the decisions. External investors are called limited partners. LPs pledge a specified amount of capital for the new venture funding. GPs rely on their proprietary network of entrepreneurs, attorneys, limited partners, and industry contacts to introduce to them new companies.

Private equity investors make their real money when the portfolio company undergoes liquidation event - i.e., the company goes public, merges, recapitalizes, or gets acquired. Depending upon equity and investment life cycle, the private equity fund's investor typically plan to exit between three to 10 years after the initial investment.

PART TWO WILL APPEAR IN THE JULY ISSUE.

ABOUT THE AUTHOR

Siddharth Misra is a final year doctoral candidate in the Petroleum Engineering Department at the University of Texas at Austin. He has worked on formation evaluation projects in Egypt, Saudi Arabia, Germany, India, Italy, and the United States. He can be reached on LinkedIn at sidmisra29.