1Q2011 revenues rise 21%, net income increases by 13%

Don Stowers, Editor, OGFJ

Laura Bell, Statistics Editor, Oil & Gas Journal

Revenues in the first quarter of 2011 surged by 21% over the first quarter of last year and were up 13% over the prior quarter for the group of companies tracked by Oil & Gas Journal and Oil & Gas Financial Journal. Net income for this same group of companies rose 13% compared to the first quarter of 2010 and increased by 26% over the previous quarter.

For the 124 companies reporting first-quarter revenues, total revenue was $304.5 billion, up $52.9 billion over the $251.6 billion reported in the 1Q2010. Revenues grew by $33.9 billion over the previous quarter.

Net income for the group increased by $2.9 billion from the 1Q2010 to 1Q2011. It was up nearly $5.3 billion compared to the prior quarter.

Year-to-date capital spending jumped by $7.6 billion to nearly $37.7 billion, a 26% increase, compared to the same quarter last year. This is the largest quarterly increase in capital expenditures since 2008.

Total asset value for the combined OGJ150 group of companies grew to $1.243 trillion from $1.109 trillion – about a 12% increase – from 1Q10 to 1Q11. Assets were up by $49 billion over the previous quarter, a more modest 5% increase.

Stockholder equity continued to show strong gains. Equity for the group rose by $79.6 billion (16%) over the first quarter of 2010 and by $22.2 billion (4%) over the prior quarter.

Largest in net income

The 20 largest companies ranked according to net income had almost $27 billion in collective net income for the quarter. This compares with $20.8 billion for the 1Q10 and $21.8 billion for the previous quarter. This represents more than 100% of the net income for the entire OGJ150 group ($26,962,327,000 for the top 20 compared to $26,237,008,000 for the whole group), so the 104 companies after the top 20 collectively had a net loss of $725.2 million. This seems to be the norm for these companies as a group. Individually, many of them show nice earnings however.The top three companies in net income – ExxonMobil, Chevron, and ConocoPhillips – had just under $20 billion in net income ($19.9 billion), up from $16.6 billion in the previous quarter. This represents approximately 76% of the net profits of all 124 companies reporting in this group.

The top five companies by net income for the quarter are ExxonMobil ($10.7 billion), Chevron ($6.2 billion), ConocoPhillips ($3.0 billion), Occidental Petroleum ($1.5 billion), and Apache Corp. ($1.1 billion). They are followed by Marathon Oil ($999 million), Hess Corp. ($974 million), Devon Energy ($416 million), Pioneer Natural Resources ($344 million), and Murphy Oil ($269 million). Three of those top 10 companies – ConocoPhillips, Marathon, and Murphy – have either spun off their upstream business units from the rest of the company or announced plans to sell non-E&P assets. It remains to be seen how this will impact their future revenue streams and net income.

Leaders in stockholder equity

Combined stockholder equity for the top 20 companies continued to climb as well. It was up $76.6 billion (16%) over the first quarter of 2010 and $18.5 billion (4%) over the fourth quarter of 2010. The 10 largest companies in this category are ExxonMobil, Chevron, ConocoPhillips, Occidental, Apache, Marathon, Anadarko, Devon, Hess, and Chesapeake Energy.

Largest in total revenue

Nearly all of the top 20 companies ranked by total revenue held their positions. Exceptions are No. 11 EOG Resources, which switched places with No. 12 Chesapeake, and No. 19 Pioneer Natural Resources, which moved ahead of No. 20 Denbury Resources.

Total revenue for the top 20 companies increased 23% from the same quarter in 2010 and grew 13% from the prior quarter.

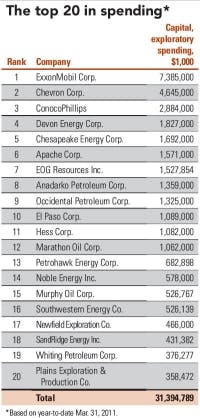

Top spenders

For the third consecutive quarter, the top 20 companies in spending showed a significant rise in spending over the same quarter in the previous year. Spending for the group grew from $25.7 billion in the first quarter of 2010 to about $31.4 billion in the first quarter of 2011 – a 22% increase.

Top spenders were, in order, ExxonMobil, Chevron, ConocoPhillips, Devon, Chesapeake, Apache, EOG Resources, Anadarko, Occidental, and El Paso Corp.

Key changes from previous quarter

Doral Energy Corp. changed its name to Cross Border Resources Inc., and NGAS Resources Inc. dropped off the list because it was acquired by Magnum Hunter Resources Corp.

Fastest-growing companies

Natchez, Miss.-based Callon Petroleum Co. takes top honors as the fastest-growing company based on growth of stockholders' equity in this quarter compared to the preceding quarter. Callon had a whopping 484.6% increase in stockholder equity as well as a 469.6% increase in net income over the previous quarter.

Founded in 1950, Callon Petroleum (NYSE: CPE) has principal operations in the Permian Basin of West Texas and in the Haynesville Shale in northern Louisiana. The company also has producing assets in the Gulf of Mexico, which provides sufficient cash flow to fund its onshore development operations. Fred L. Callon serves as chairman and CEO of the company.

Click here to download the pdf of the "OGJ150 Quarterly"

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com