A measured approach to managing oilfield services consolidation

Steven Bates and Peter G. Anderson, KPMG LLP, Houston

Companies pursuing consolidation strategies often suffer from broadly applied and often misunderstood market perceptions of the consolidation business model. Although the market seems to believe in industry consolidation, the investment community has been increasingly hesitant to commit to it due to slow results in achieving the value identified at the time of consolidation.

This is particularly true within the oilfield services (OFS) industry, which has struggled recently as the global economic slowdown has cut into demand for oil and gas. The OFS industry has historically been acquisition-oriented and largely built on the accumulation of assets, technology, and services. OFS companies are consistently challenged to expand and contract with cyclical market conditions. Larger companies have weathered the latest storm and recent transactions have led to speculation that stronger companies could acquire weaker rivals.

Market perception of OFS companies is often complicated by internal confusion as to whether their operations should be integrated or if they should be merely confederations of independent entities. Some consolidating companies are formed simply to capture a financial benefit related to the transaction itself. However, most OFS transactions rely on achieving operational synergies to capture the value of the business combination. This proposition is far more difficult to manage and carries with it a much greater degree of risk. For OFS companies that are focused on operations, purposeful steps should be taken to drive operational performance and improve market capitalization as rapidly as possible.

Companies most successful in achieving the value of consolidation share certain characteristics and pursue a key set of high-impact imperatives. These include:

- Establishing a governance model designed for the consolidation business strategy

- Deploying an efficient performance reporting framework

- Utilizing a results management approach to manage operational improvement

- Developing a strategic sourcing capability

- Centralizing or standardizing mid-office or back-office functions and implementing a cost effective and scalable technical architecture to support them.

Governance model

Successful consolidations address change as a fundamental component of the governance model, and they engage the field early and recognize that change is not sustained when it is imposed from the corporate office or by outsiders. The largest risk with the consolidation of companies is to meld the cultures of the companies and the corporate staff and still maintain focus on the ultimate objective of maximizing shareholder value.

Successful consolidators establish a governance model that rapidly integrates the capabilities of their acquisitions into the infrastructure required to manage the larger entity. In the oilfield, success is often dependent upon maintaining a level of entrepreneurial spirit within the acquired entities. Recognizing the synergies is critically important in achieving shareholder value, but these synergies cannot be achieved without the active support of the acquired companies.

Company management, many of whom were former owner-operators of private companies, should understand their new fiduciary and corporate responsibilities as directors of a new entity. This is particularly important in a publicly traded company. A key to understanding this is identifying roles, responsibilities, and accountabilities in a common manner and delineating where operational and financial authority lie. Care should also be exercised when determining board composition, particularly when granting board seats to executives of the acquired company. The consolidating company should actively work to diversify its board as it grows through acquisition.

Recent OFS organizational trends align services under geographical markets to capture service synergies and protect regional market share. When developing a new corporate governance model, functional alignment is essential for driving appropriate organizational and individual behaviors. Care should be taken to help ensure the vertical alignment of the goals of the business unit or acquired company with corporate strategies.

Equally important, however, is the horizontal alignment of goals across business units in support of corporate strategies. For many small and mid-market OFS companies, this concept will be unfamiliar, as their experience is that of an independent entity often in direct competition with what are now other acquired companies in the consolidated entity. Strategic alignment requires more than a due diligence review of potentially overlapping services and customers. Incentives for horizontal teaming are critical in achieving the operational value of consolidation, such as the development of national accounts.

Performance reporting framework

Central reporting and analysis of company performance is typically a highly visible and sensitive issue for consolidating companies, particularly early in the process of integrating an acquisition.

During this time, companies should design and deploy a performance reporting framework that establishes measures, identifies targets, and reports results on key financial and operational metrics. This can give the management team a tool for making the company's strategy operational and driving desired behaviors through the organization.

At the consolidated enterprise level, an effective reporting framework starts with a corporate dashboard comprised of a few leading indicators, usually containing a strong financial component. This handful of measures should be captured and tracked in such a way that comparative analysis, trends, and historical performance can easily be communicated. The corporate dashboard should serve as the foundation for the alignment of organizational goals and the performance-based incentive and rewards programs (see Figure 1).

A common mistake in the oilfield services industry is measuring too much. This is a particular problem for operational metrics. Corporate dashboards should provide enough actionable intelligence to enable management to pull the large levers and produce change across the organization. Operational measures should be linked to help ensure that lower-level metrics, and the behaviors they influence, are correlated to higher-level indicators. Widely communicating measures as well as their link to overall organizational success is a critical component in the acquired company's transition from an independent entity to a cohesive member of the consolidated organization.

Results management approach

Companies usually consolidate with the promise of capturing significant operational synergies. Consolidators should resist the temptation to launch immediately a host of improvement initiatives without first understanding where scarce improvement resources, such as capital and employees, can be deployed most effectively.

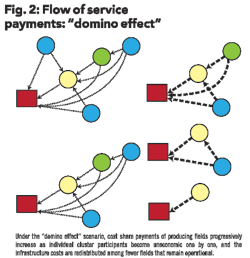

Even companies trying to integrate legacy acquisitions should develop a structured results management approach for targeting, prioritizing, and managing improvements focused on achieving the value of consolidation. For example, the chart in Figure 2 highlights a statistically based exception in operations that a company can target for improvement.

Companies should target areas for improvement that can yield high value and that are realistically achievable. Improvement programs should be centered on areas that are in alignment with overall company strategy, addressing operational and financial issues. Targeted initiatives should also address nonfinancial improvement expectations, such as quality of corporate governance. Companies should also screen improvement opportunities against corporate communications to the investment community to help ensure the improvement program is targeting those things that analysts tie closely to their valuations.

A small number of carefully chosen initiatives tied to the voice of the customer can usually yield a large amount of value. By utilizing statistically-based methodologies such as Six Sigma for identifying, evaluating, and prioritizing improvement initiatives, a company can manage its portfolio of improvement initiatives with the appropriate level of rigor.

Many OFS companies leverage Lean or Six Sigma methodologies to improve operational issues continuously; however, the majority does not apply the same level of rigor to help ensure business integration synergies. A phased approach should be deployed to help ensure the highest payback projects are pursued in the correct sequence, and to help ensure some degree of success early in the cycle. Well-designed improvement programs can often be self-funding.

For companies undergoing consolidation, achieving the value of operational improvements is paramount to success in the public markets. Major improvement programs, therefore, should be managed within the context of a results management methodology. Because improvement activity is so pervasive at many companies undergoing consolidation, competing resource demand for improvement projects should be managed at the aggregate level. Improvement progress, however, should be managed at the individual project level to help ensure that the project team maintains proper focus on scope, risk and issue management, work plan progress, and milestone and value achievement.

Strategic sourcing

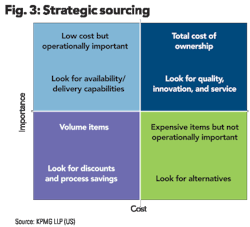

Employing strategic sourcing plays a large role in capturing the value of consolidation. As the name implies, strategic sourcing is about more than achieving volume price discounts alone. It is about putting an actionable and measurable strategy behind the sourcing of materials and services. As a company gains understanding of its consolidated purchasing patterns, its total procurement spend should be disaggregated into the major categories of goods, services, and labor. For significant areas of procurement spend, the quantification should be detailed to unique commodity groups. Once the procurement spend has been disaggregated, each commodity group can be evaluated based on operational importance and cost.

Specific product or service strategies should then be formulated for each commodity group to maximize its value to the company. Again, different commodity groups will likely utilize very different sourcing strategies. Low-cost, operationally important commodities will most often have sourcing contracts based on availability and delivery capabilities in addition to price. Other commodity groups are likely to be sourced based on service, innovation, or other provider characteristics.

Only after sourcing strategies have been developed should a company implement the technology, processes, structure, measurements, and methodology to support the strategies. Commodity groups, once prioritized, should be sourced in waves, based upon achievable value as compared to implementation effort. If implemented in a modular fashion using a company-standard implementation methodology, a company can help ensure a consistent process that is easily replicable when new acquisitions are made. (See Figure 3.)

Once appropriate commodity group strategies have been developed and confirmed, contracts can be negotiated at the local, regional, national, or global level. Strategic sourcing, if implemented correctly, can be an enormous source of value for the consolidating company. In addition to negotiated discounts, companies realize value in areas such as inventory management, capital asset management, and distribution. Increases in the use of preferred procurement channels, product quality, and processing efficiency can also add significant value.

Back-office functions and technical architecture

Consolidating companies are faced with an arduous task when it comes to selecting and implementing a back-office operating model and technical infrastructure. Common processes and systems enable higher-efficiency transaction processing and support. Establishing a "shared services" organization within a consolidated enterprise can lead to large productivity and efficiency gains based on a core group of back-office personnel who process a larger, more continuous base of transactions for the company.

Large cost reductions and efficiency gains can result when a company chooses to implement common financial, human resources, purchasing, and administrative support processes. In the oilfield, further gains can often be realized by consolidating district or field offices into regional centers.

Nonetheless, implementing centralized, common systems and processes throughout a consolidated enterprise can be a long, disruptive, and expensive proposition. For example, purchasing and contracting processes, especially over commodity categories, are good candidates for centralization. However, these processes can be a sensitive topic for both newly and historically acquired companies. Successful OFS companies account for the personal nature of these functions and include acquired companies in the decision process.

The goal of companies pursuing consolidation strategies should be to implement cost-effective and scalable technical architectures to support those processes required of public companies while achieving the performance reporting and analytics necessary to manage the day-to-day business. The consolidation business model implies bringing together once-independent entities. Financial and reporting technologies should, therefore, be adaptive enough to extract data from a variety of technology platforms while providing the flexibility to manipulate data into standard formats.

An often overlooked component of the integration rests upon rationalizing data around the newly combined business requirements. Integration teams should seek to align and challenge the demand for data against the strategic objectives of the company. Once data is aligned against purpose and value, only then should appropriate technologies, interfaces, and migration plans be selected.

Technologies should provide the scalability to handle the cyclical nature of the oil and gas industry. Chosen technologies need to be flexible enough to handle increasing complexity as the company grows as well as the ability to enable contraction through divestment cycles. Specifically, these technologies need to be able to provide key operational information quickly for new acquisitions or divestitures to increase the speed-to-value ratio. Additionally, expediting the conversion of newly acquired companies to automated financial close and consolidation processes greatly reduces the risks associated with manual consolidation of information and statutory reporting.

For OFS companies, implementing the appropriate common systems can help speed the integration of acquired companies while maintaining a sense of their operational independence. This operational independence is often lost when an Enterprise Resource Planning (ERP) implementation is rolled out to all companies without first understanding the most appropriate overall technical architecture.

Member companies often perceive that they will lose their entrepreneurial "license" when the consolidating entity migrates them to an integrated ERP system. A frequently acknowledged mistake within the oil and gas industry is to apply one of two extremes: the immediate and total migration of mid-office and back-office functions onto an ERP platform or the intentional decision to let an acquired company run on existing platforms. The implications from process, technology, and cultural dimensions of either direction are well documented.

Summary

Although the market believes in the promise of consolidation, most companies pursuing consolidation strategies have been slow in achieving the expected value. Oilfield companies pursuing acquisitions frequently devalue the cost and quality benefits of a purposeful integration program. Companies that have taken the steps necessary to drive operational performance are continuing to see improvements on their investment. By charting a course based on these principles and focusing on the key leverage areas with replicable processes, companies in consolidating industries can capture the value and share in the rewards. OGFJ

About the authors

Steven Bates is a managing director in KPMG's IT strategy and performance group, and Peter Anderson is a senior manager in KPMG's shared services and outsourcing group.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com