OGFJ100P company update

Independent research firm IHS Herold Inc. has provided OGFJ with updated production data for our periodic ranking of US-based private E&P companies. The rankings provided by IHS are based on operated production only within the United States.

New to the list from the October issue are Pruet Production Co., Vantage Energy LLC, Cordillera Energy Partners III, Crawley Petroleum Corp., Nadel & Gussman LLC, Tanos Exploration LLC, JAMEX Inc., and Dan A. Hughes Co.

Top 10

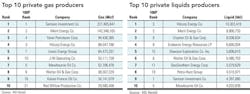

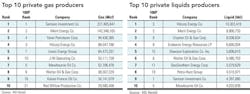

There were only minor changes at the top of the list of producers from our last installment in October 2011. Those moving downward this issue: Merit Energy Co. moved down one spot from No. 1 to No. 2, and Hilcorp dropped one place from No. 2 to No. 3. Moving upward were Mewbourne Oil Co. and Samson, who moved into the No. 5 and No 1 spots, respectively.

Acquisitions

The largest deal to take place in the private sector in a long time involves our current No. 1 company, Samson Investment Co. Samson accepted a $7.2 billion deal put forth by an investor group consisting of Kohlberg Kravis Roberts & Co. LP (KKR), Natural Gas Partners (NGP), Crestview Partners and Japanese trading house Itochu Corp. The group will acquire all of Samson's assets with the exception of its onshore Gulf Coast and offshore deep water Gulf of Mexico assets, which will continue to be owned by the Schusterman family.

"The assets are weighted 80% towards gas and will continue KKR's strategy of investing in shale gas plays during the US gas price slump, as it has done for the past two years," noted Evaluate Energy analyst Eoin Coyne in his M&A weekly update for OGFJ following the transaction's announcement.

The company's headquarters is expected to remain in Tulsa, Oklahoma. More information about the deal can be found in this issue's cover article starting on p. 18.

A Japanese company and North American shale were also components of another large deal in the private sector during the period. Marubeni Corp. recently became Japan's largest owner of American shale oil acreage when it announced it had acquired nearly 52,000 net acres in the Eagle Ford Shale from No. 13 Hunt Oil.

The Japanese trading company signed the deal with Dallas-based Hunt in which it will acquire a 35% working interest in oil and gas leases in South Texas' liquids-rich unconventional resource play.

Hunt Oil holds acreage throughout the play, but, as Global Hunter Securities (GHS) mentioned in a note to investors January 6, records indicate they've only drilled three Eagle Ford wells, located in LaSalle, Gonzales, and Wilson Counties.

A significant increase in drilling in the area is likely. The companies have put forth a plan to drill several hundred wells in the next five to ten years, and together, the companies will look to jointly acquire additional acreage in the play.

While the acquisition cost was not reported, Evaluate Energy estimates total development costs (including acquisition costs on Marubeni's share basis) of nearly US$1.3 billion.

GHS' estimates back up the possible transaction costs, noting Marubeni paid roughly $1.3 billion or approximately $25,000 per acre on an acreage-only basis from the private operator, an amount much higher than its estimated $5,000 per acre it paid to Marathon Oil Corp. for a portion of its Niobrara Shale-focused acreage back in April 2011.

Excitement surrounding the liquids-rich Eagle Ford has certainly been palatable. Evaluate Energy calls the Eagle Ford "2011's most expensive shale play (averaging at $10,000 per undeveloped acre)," and, according to GHS analysts, this most recent transaction "shows that demand to gain a stake in Eagle Ford isn't cooling."

Finally, just before the previous installment of the OGFJ100P went to press in October, Milagro Oil & Gas Inc. (currently sitting at No. 30) also looked to shore up its shale assets. Through its wholly-owned subsidiary, Milagro Producing LLC, the company agreed to purchase South Texas properties and increase its ownership in existing properties. The company completed the transaction which included 77 wells in Starr and Hidalgo Counties, Texas, 60 of which are currently operated by Milagro Exploration LLC, also a wholly-owned subsidiary of Milagro Oil & Gas Inc. The deal adds approximately 3 MMcfe per day net to Milagro, with proved reserves of nearly 15 bcfe.

2011 Year-to-date production ranked by BOE

2011 Year-to-date production - alphabetical listing

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com