Domestic active with large private equity role

Ronyld Wise,PLS Inc., Houston

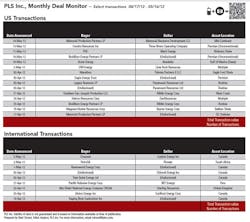

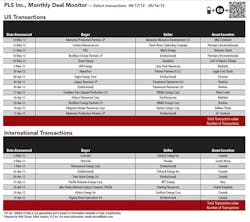

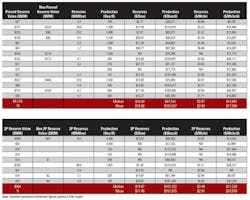

Domestically, PLS Inc. reports deal activity surging, mostly oil driven, with mean values of $105,000 per flowing boe and $16.00 per proved boe. Buyers are dominated by publicly traded E&Ps that enjoy market support in developing resource plays, including Marathon Oil (Eagle Ford), Concho Resources (Permian unconventional) and Magnum Hunter (Bakken). Internationally, PLS tallies indicate mean production multiples tracking closely to US values.

In the largest deal, Concho Resources bought private equity-backed Three Rivers Operating Company (3ROC) for $1 billion cash. PLS calculates metrics of $110,000 per flowing boe (59% oil), $13.39 per proved boe ($50% oil, 55% PD) and $3,200 per undeveloped acre (69,373 net acres). 3ROC, formed in 2009 and backed with a $200 million commitment by Riverstone Holdings, is led by Mike Wichterich, whose track record includes being CFO of Mariner Energy during Riverstone's investment in Mariner. 3ROC built the company with two Permian acquisitions financed with equity and debt – a $203 million buy from Chesapeake in April 2010 and a $344 million buy from Samson in January 2011. After acquiring the position and establishing a solid operating performance, 3ROC looked for a liquidity event and filed for an IPO in January 2012, reporting $287 million in debt. With the $1 billion cash sale to Concho, 3ROC successfully completed the PE build-grow-exit model in less than 3 years and provided a multiple of cash-on-cash returns for Riverstone.

The second PE story is Encap-sponsored Paloma Partners II's $750 million cash sale to Marathon Oil. Paloma Partners II, formed in 2009, had an initial Haynesville focus. However, Paloma sold the Haynesville position in 2010-2011 and re-focused in a "sweet spot" in the Eagle Ford, assembling 17,000 net acres in Karnes and Live Oak counties. Marathon's buy of Paloma is a "bolt-on" to its core position in the Eagle Ford's Sugarkane area established through its $3.5 billion, June 2011 purchase from Hilcorp and KKR. Once again, Paloma formed and exited within the traditional 3- to 5-year private equity model.

Private equity also plays a vital role in this month's second-largest deal, Halcón Resources' $987 million cash and stock buy of GeoResources. EnCap, Liberty Energy and Mansefeldt Investments joined with industry veteran Floyd Wilson in December 2011 to recapitalize publicly traded Ram Energy, re-name it Halcón Resources and initiate a growth strategy. As in all private-equity deals, management track record counts and in this case, the public can join with PE as Halcón executes its growth strategy. Wilson's admirable track record includes founding PetroHawk and Hugoton Energy and serving as chairman of 3TEC Energy. GeoResources' leader Frank Lodzinski also notches another success for his investors. Lodzinski's prior track record includes merging Southern Bay LLC into GeoResources in 2007 and building Texoil (sold in 2001) and Hampton Resources (sold in 1995).