The UKCS Collective Clout

This sponsored supplement was produced by Focus Reports.

Publisher: Ines Nandin

Project Director: Chiraz Bensemmane & Martijn Jimmink

Project Coordinator: Alina Manac

Editorial: Fraser Wallace

For exclusive interviews and more info, plus log onto energyboardroom.com or write to [email protected]

Photo courtesy of Ines Nandin

Churning and tumultuous, or cold and calm; the North Sea has many moods. It can still surprise an experienced sailor hugging the coast between Aberdeen and Anstruther; it has always tested those that gain their livelihoods moving over it, fishing through it and more recently the oil pioneers searching underneath it. Whilst in recent years the industry has experienced surprising squalls of regulatory turmoil, the publication of the Wood Review on February 24th 2014, epitomizes the current quest for stability amongst policy makers and the renewed focus on collaboration. Both stability and collaboration are key to capitalizing on the UK's remaining reserves and solidifying a sustainable oil and gas sector focused on knowledge and expertise with the potential to weather any storms the United Kingdom Continental Shelf (UKCS) has yet to face.

Alex Salmond, first minister of the Scottish Government, started his career as an oil economist. He continues to acknowledge the worth of the resource, stating: "oil and gas wealth is extremely valuable; with investment at current levels it is clear that operators have continued confidence in the future." Fergus Ewing, the Scottish Government's minister for energy, enterprise and tourism, sets out the Edinburgh government's vision of Scotland as a center of innovation. He emphasizes the desire to build on relationships between Scottish universities and the industry: "The UKCS can become a test-bed for perfecting operations and technologies that can be realized all over world, whether in offshore Mexico, West Africa, the basins south of China or to the west of Australia."

Scotland's devolved government in Edinburgh will hold an independence referendum in September 2014: if the nation votes in favor of independence, the Scottish parliament would gain control over many issues today controlled from London. In spite of this referendum, both the Scottish and UK governments are united in emphasizing the necessity for regulatory stability to boost the UK oil and gas industry, which has been beset recently by escalating costs. Both governments are aware of their responsibility to ensure the UKCS continues to build value beyond volume of output and the role that collaboration amongst key industry stakeholders will play in this.

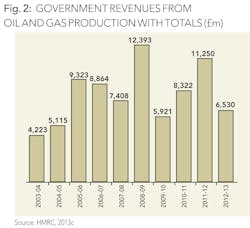

According to PwC, the total tax contribution (TTC) of the oil and gas industry in the UK in 2011 was over USD 46 billion representing 5.5 percent of total UK government tax revenues and underlining the industry's importance to the country. This figure does not include taxes paid by companies in the supply chain. Clearly, finding a way to maximize the value of this sector, and ensure its long-term sustainability, is key for whoever holds the keys to the North Sea's hydrocarbon assets. "Making the most of Britain's home grown energy is crucial to retain job and business opportunities and the government is committed to help maximize recovery of North Sea oil and gas," comments Michael Fallon, the UK Government's minister of state for energy.

Malcolm Webb, chief executive of Oil & Gas UK, the industry body furthering the interests of oil and gas companies in the UK, gives an indication of where the UK government should be seeking to encourage and stimulate the industry: "Many fields on the UKCS are still being decommissioned with more oil left in situ than that which has been extracted - recovery factors can be under 50 percent - the industry should aspire to increase this figure through the application of further technology."

There is a wide acceptance in the industry that improving production efficiency is one key step to reinvigorating the North Sea industry. "Although there is a decline in production in the UKCS, based on our current technologies we can expect a further 40-50 years of production," says Neil Gordon, chief executive of Subsea UK, the UK subsea industry body. "So many different technologies will to come into play, such as improved seismic understanding of reservoirs. Currently, we are only at a total average recovery rate of between 30 and 35 percent on the UKCS: we have only squeezed the sponge so far and we need to look at how to squeeze it further."

Professor Ferdinand Von Prondzynski, principal and vice-chancellor of Robert Gordon University, believes that the industry in the UK needs to look beyond the lifespan of the country's oil and gas reserves in order to ensure that it continues to add value to the economy after the oil is gone. "The industry is still very much at the investment rather than innovation stage of economic development; and it needs a much higher level of investment in R&D," he says. "Operators in the North Sea are introducing technological innovation to ensure enhanced oil recovery and to minimize the costs of decommissioning fields,but almost all of the innovation driving that is imported. If this industry is to have any life beyond the point at which the UKCS oilfields become too hard to manage, it needs to have a much higher value proposition than it does at the moment." Robert Gordon University is central to the formation of a new oil and gas institute, which aims to bring much higher levels of global and industry-focused expertise into Aberdeen.

"We need to anchor the supply chain here, which we can do by having very innovative companies- and there are many such companies in Scotland," says David Rennie, international sector head, oil and gas, with Scottish Enterprise, Scotland's main economic, enterprise, innovation and investment agency. "However, encouraging more innovative companies is essential."

"We are seeing a whole range of showpiece offices in Aberdeen," says councilor Jenny Laing, leader of Aberdeen City Council. "GDF Suez and EnQuest for example are currently building state-of-the-art complexes in the city. In addition Prime Four Business Park at Kingswells comprises 350,000 ft2 of state-of-the-art office complexes and global training facilities for oil and gas operators. This multi-million pound business park on the outskirts of the city will accommodate energy majors such as Nexen, Apache and Transocean." This move certainly represents a ‘vote with the feet'- suppliers and service providers acknowledging the value of Aberdeen as a hub by physically locating themselves in the granite city.

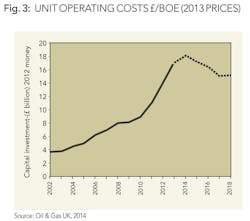

Companies moving to Aberdeen were part of record capital investment last year 2013 and significant capital investment this year 2014- expected to be around GBP 13 billion, or USD 22.06 billion, according to figures from Oil & Gas UK. The diversity of companies arriving in Aberdeen means that any investor finds a network of companies that have the skills and abilities to safely deliver profits from the increasingly challenging circumstances found in the mature UKCS basin.

Regulatory rollercoaster: the direction of travel for UKCS governance

Andy Brogan, global oil and gas transactions leader at EY, describes the aspects that make the UKCS attractive to investors and companies: "The North Sea is under the governance of an OECD country; one of few basins where this is the case. The UK ticks boxes for having low political risk, ease of supply and provision and a safety record to be applauded."

It is true that the UKCS has historically been under the remit of very politically stable governments, but these governments have been fickle in their implementation of tax policy. Clare Munro, partner and head of oil and gas for Brodies, differentiates between stability of government and the relative stability of the tax regime: "People speak about political and fiscal instability together despite the fact that they are different things. Whilst historically the UKCS has been politically stable, the fiscal regime in the UKCS has had serious and far-reaching changes every year for the past 15-20 years."

In 2011, the UK Government suddenly and radically changed the fiscal regime in the UKCS, raising taxes. Since then, it has sought to row back from this by introducing successive tax allowances, for brown field sites and initiatives to the West of Shetland for example. This effort to regain the trust of the industry resulted in the publication of the Wood Review. Commissioned by the Department of Energy and Climate Change (DECC) and authored by Sir Ian Wood, the report advocated the creation of the Maximising Economic Return (MER) strategy to deliver the greatest possible level of extraction of oil and gas from the UKCS. It also advocated creation of a regulator to connect the realms of commerce and governance and improved collaboration across the industry by facilitating the wider use of hubs and shared infrastructure to lower costs and improve reclamation rates of oil.

The 2014 budget from the British Government tracked the recommendations of the Wood Review in detail. Danny Alexander, chief secretary to the Treasury, elaborates: "Reviewing the overall fiscal regime for the North Sea is something the industry has been asking the government to do for a long time. This is a big opportunity to put in place a fiscal regime that allows every last drop of oil and gas to be obtained from the North Sea."

Sir Ian Wood himself welcomed the budget, stating it "has a different tone to any previous budget with regard to oil and gas. It embraces consultation and collaboration and includes a major review of the fiscal environment of the North Sea… In terms of the review itself, it says all we would wish." Moves towards the establishment of the new regulator and towards reviewing the fiscal regime of the North Sea continue.

"A strong regulator will fast track field development and give more guidance in terms of resolving field disputes since partnership alignment can be a major issue in the UKCS" states Ewan Neilson, partner at Stronachs, a legal firm based in Aberdeen, specializing in oil and gas.

One of the key questions still to be decided with regard to the regulator is the exact remit it will have to enforce desired outcomes – like that of greater collaboration in the North Sea. The Wood Review's goals have merit, but it is still unclear how effective a regulator will be in creating change in the sector.

The 2014 budget also introduced a measure known as the High Pressure High Temperature (HPHT) allowance, Professor Alexander Kemp, of petroleum economics and director of the Aberdeen Center for Research in Energy Economics and Finance at the University of Aberdeen elucidates how the scheme will differ from previous ones: "The new ultra HPHT allowance incorporates the idea that associated exploration could be eligible for the allowance. The new allowance conceptually is a great improvement over the previous field allowances. Basing tax policy on investment costs rather than on physical attributes, such as field size, depth of water and distance from infrastructure is prudent." He continues: "Secondly, the new allowance will include related exploration expenditure, which is a new idea with much merit and should help to enhance our exploration activity."

Maersk Oil and BG Group announced shortly after the budget was released that the HPHT allowance will facilitate the development of two new projects seeing potentially GBP 6 billion (USD 10.18 billion) invested across new fields such as the Culzean and Jackdaw fields in the central North Sea, owned and operated by these two companies.

The budget was a rose with thorns however, introducing a tariff for bareboat chartering. Sir Ian Wood comments: "the most negative impact of bareboat chartering is that it will dampen exploration; it is essential that this is revitalized in the North Sea. Exploration is a seed-cone for the future."

Malcolm Webb of OGUK comments on the bareboat chartering situation, stating unequivocally: "This is a mistake and we hope to see this amended following the fiscal review." The tax could represent a 10 percent increase on day rates for newly contracted drilling rigs and accommodation vessels.

Overall, the direction of travel with regard to regulation has been positive: for example, there is now clarification on decommissioning tax relief for companies. The government guaranteed businesses a certain level of tax relief even if tax rates should change in future. Ewan Neilson comments: "Over the past few years the UK government, DECC and the industry have worked together to obtain more certainty on decommissioning tax relief for companies. Stronachs' clients have already voiced a lot of interest in decommissioning, asking what their legal obligations are."

Decommissioning means old plant and fields have to be mothballed or that other parties must take up opportunities to revisit decommissioned fields using new technology and innovation to exploit the remaining potential there.

Value beyond volume- how collaboration is moving the UKCS forward

The supply chain in the UK is indeed flourishing, as Bob Keiler, CEO of Wood Group, international energy services company with over USD 7 billion in sales, attests: "The North Sea is still a location where good business can be done and will continue to contain opportunities for a long time."

Denis Jul Pedersen, COO of GMS, the largest global provider of self-propeled, self-elevating accommodation jack-up barges, describes how Aberdeen has allowed GMS access to the UKCS market: "every service you can dream of, you can find in Aberdeen: if you are working on improving safety, for example, you can find the relevant analysts, consultants and experts here."

Pedersen explains the crucial link between decommissioning and maintenance for the supply chain, stating, "Decommissioning doesn't operate on a fixed schedule and comes largely down to costs. Frequently, it costs less money in the short-term for an operator to maintain a mothballed asset than to decommission it." Either way, it is the engineering and equipment companies in the North Sea that will deal with the decommissioning or ongoing maintenance of the assets.

This interconnected supply chain really delivers value in the North Sea, be it toward the end of a project's life or starting a new one: the skills and abilities inherent to this area present opportunities to reduce high operating costs and diminish risk. Without the technological capabilities of companies in this area, many of the smaller volumes of oil in this aged basin would go ignored.

The glut of companies attracted here from all over the globe adds further to the complexity and abilities of the supply chain in the UKCS. The supply chain here is globally connected; of its full GBP 35 billion (USD 59.38 billion) value in 2012, according to OGUK and EY, 42 percent of this value was derived from exports.

Rory Deans, CEO of Sentinel Marine a company running ERRVs (emergency rescue and response vessels) details the international appetite for North Sea Skills: "the prevalence of North Sea skills globally is incredible. There is frequently someone from Aberdeen working for a logistics or drilling company regardless of where that company is operating globally. They are used to the high standards in the North Sea and they are often eager to bring these quality operating practices around the world." He comments on the implications for Sentinel Marine itself: "ERRVs tend to be unique to the North Sea but Sentinel is confident that this manner of working could have a wider role out of the North Sea."

Companies in the North Sea often drive forward excellence by specializing. CRC Offshore handles offshore welding, inspections and coating. "CRC Evans is an incredibly innovative company," says Adam Wynne Hughes, president of CRC Evans Offshore, a company providing equipment for offshore pipeline construction. He expands: "The automatic welding systems the business has developed are leading technologies."

"A desire for our offshore equipment is to see it smaller and more nimble- more like a formula one car, compared to our onshore equipment which is often much more substantial. Onshore pipelines are often built as the equipment moves and the pipe remains fixed in place, whilst offshore the pipeline will be fed out from a fixed spool base or vessel."

Hughes explains that companies can then pair these specialisms with expertise from other businesses, emphasizing how CRC Evan's partnership with Subsea 7 has furthered their mutual interests: "Technical teams have reciprocal visits to support each other's operations. Our business has also invested significantly to both improve customer experiences and to add to our abilities with regard to pipeline coating- we believe this will better support a broad spread of our customers."

The supply chain in Aberdeen is differentiated; diverse and dynamic, demonstrated by the responsiveness of companies to client needs. Gary Farquhar, director of Vector, a company providing ‘single-source' quality assured oilfield equipment, spare parts and consumables internationally, comments on recent movement of the market: "the new levels of investment are bound to translate into new opportunities. Much of the expenditure is being targeted towards hardware for the field after completion of the exploration work."

Farquhar continues, describing the implications of this for Vector: "The rentals part of the business has experienced a big upturn because of high levels of demand. That is probably as a direct result of the increase in investment." He reasons why the rental business is so strong in the UK: "Our rentals business is of course local whereas our other work tends to be much more global. Rentals must be local. It makes no sense to ship a small test unit to South Africa when the same unit can be acquired in regional markets."

TAQA, Abu Dhabi's government-controlled energy holding company, exemplifies a company actively seeking benefits from the responsive supply chain in the North Sea. Pete Jones, managing director of TAQA, expresses why working within the UK's supply chain is so important for his company: "We are keen to be operators. There is no better place to prove your capability as an operator than offshore UKCS. It really is a badge of honor to have that capability. We are very proud of that."

TAQA is one example of a company entering Aberdeen from abroad that are here in the UK learning to deal with a plethora of suppliers, costs driven by the market and about the need to work alongside the many other operators inhabiting the waters offshore. They are here because the diverse range of North Sea actors begets cooperation; this is useful both in the UKCS and wherever competencies developed in the North Sea are deployed.

Alasdair Buchanan, the COO/MD of Senergy, a company providing expertise and technology to assist the development and management of oil and gas fields, describes how his company is able to reach out globally from the UKCS: "our Aberdeen offices support many global operations and offer much technical support. We also have offices in Abu Dhabi, Houston, Jakarta, Melbourne, and Kuala Lumpur."

He comments on the value that businesses established in the UK have abroad: "we can come as an independent provider of services to give NOCs and companies entering the UKCS all the skill sets they need to explore and develop an asset outside sovereign borders. They would have all the abilities within their country, but not overseas."

One company seeking to be the embodiment of North Sea capability is Fisher Offshore. Jack Davidson, managing director of the company, a specialist supplier of engineering services to the marine industry internationally, explains: "Fisher Offshore's strength lies in subsea excavation, subsea lifting, cranes, winches and back-deck equipment. At the moment our business is customizing subsea tools for Subsea 7 to perform a fairly critical path spool-piece removal for the Cruden Bay transfer line from the Beryls and Forties fields. It is not so much about innovation but about realistic engineering. This is about giving the client a fit for purpose engineering solution."

"To achieve excellence in our winch and crane products, the important factor is to get close to the client and fully understand what they need, like what restrictions exist on deck space," Davidson continues, alluding to the need for communication in the UKCS. He details the implications this customer-oriented focus has for Fisher Offshore products. "We seek to minimize our products without reducing performance. We provide solutions that are appropriate for the purpose required, within budget, easily maintained with a simple spares package. At the end of the day it is a simple product- it should not be over complicated."

WE CAN'T PREDICT THE FUTURE, BUT IT'S IMPORTANT TO PREPARE FOR IT

Policy makers aim to build on relationships between Scotland's universities and the industry to encourage the take-up of innovation. However, for Robert Gordon University, the intention is to go beyond this well-established relationship of being a partner to the industry, and lead the sector in innovation.

"If you have an economy that needs to reposition itself urgently, you need to do that with high value university initiatives," says Professor Ferdinand von Prondzynski, principal of Aberdeen's Robert Gordon University (RGU). "The model of university that I have worked with is to ensure that we are not service providers but an institution that takes initiative." One example of this is the creation of an International Institute for Oil and Gas at RGU, solidifying the university's reputation as a global leader in oil and gas-related training and research. This GBP 8 million (USD 12.8 million) oil and gas investment will secure high-value expertise for the northeast of Scotland, which will support the industry in exploiting the oil reserves in the UKCS and in building up innovation and enterprise in the supply chain.

Von Prondzynski is seen by some as one of the new breed of so-called ‘reforming' university presidents. With ten years' experience at the helm of Ireland's leading business university, Dublin City University, he led a number of strategic developments including notable growth in research income (bringing in more than GBP 100 million (USD 160 million) in a decade) and initiated multiple partnership projects with the industry.

"We need to increase the value of what we do," Von Prondzynski admits. "Whereas our previous role has principally been in training we need to move beyond that to supporting innovation." He continues, stating that almost all of the innovation is coming from outside Scotland, but it is crucial that Aberdeen is seen globally as a source of innovation. "If this industry is to have any life beyond the point at which the UKCS' oilfields become unprofitable, it needs to have a much higher value proposition than it does at the moment," he concludes. The creation of the institute will attract and develop expertise in key areas such as exploration, infrastructure, regional hub development, production efficiency, improved and enhanced oil recovery and decommissioning at a critical time in the development of the UKCS.

Professor Ferdinand Von Prondzynski, principal and vice-chancellor of Robert Gordon University.

Davidson concludes, commenting on the essential nature of cooperation to guarantee successful operations in the North Sea: "It is a collaboration - Fisher Offshore's engineers are sorely conscious of this. It is beyond a client-vendor relationship, it is a team. When a boat casts off with both Fisher Offshore and the client's staff on it, there ceases to be a ‘them' and ‘us.' If there is a GBP 4 million [USD 6.79 million] ROV depending on a Fisher Offshore winch on that vessel, the winch simply has to work."

As Davidson illustrates, the experience of North Sea companies is underpinned by their human resources- a resource notoriously high in quality but short in numbers in Aberdeen and across the wider UKCS. Senergy's COO/MD Buchanan explains that in 2013 his company, along with the University of Aberdeen, developed an MSc petrophysics and Formation Evaluation program in direct response to the demand for petrophysicists. Some companies are responding by pairing with universities; others through creating their own training programs. Either way, they are seeking to invest in North Sea capabilities into the future.

An old dog can learn new tricks – INNOVATION AS MEANS TO MAXIMIZE RECOVERY

Many of the smaller companies emerging to operate smaller or partially depleted fields are using in-house specialisms. Wayne Kirk, technical director of Atlantic Petroleum, an exploration and production company, explains the importance of staff to smaller businesses: "many of the exploration wells drilled in the UK are being sunk by smaller companies. Some of the ideas developed in large companies have drifted into smaller businesses as the human resources, the creative forces behind these ideas, have moved themselves."

In the North Sea, approximately 42 billion barrels of oil equivalent (boe) have been produced and a further estimated 12 to 24 billion boe are potentially available, according to DECC. Whilst this means there are still significant resources to be acquired, they are ever more difficult to obtain: as stated in the Wood Review, production has fallen by 38 percent between 2010 and 2013.

Kirk explains how smaller companies can gain access to the stranded oil in the North Sea by "envisaging a means to access that oil cost-effectively." Innovation, driven by the creative forces that Kirk describes, is driving the UKCS's abilities to capture this remaining oil and both small and large companies need to remain proactive in driving forward new solutions to succeed. Aberdeen in particular is a strong-point for this innovation, as illustrated by Scott Campbell, UK business strategy manager for Technip, a business delivering engineering, project management and construction which has its UK headquarters for subsea operations in Aberdeen. "The company is still assisting the wider industry push boundaries- by going deeper or providing more sophisticated solutions," he explains. "Total Islay utilized the first electrically trace heated pipe in the world. This solution delivered by Technip had never been previously tried."

ENDURING PERFORMANCE

Dennis Jul Pedersen, Chief Operating Officer of Gulf Marine Services (GMS) highlights the opportunity that exists for his business supporting maintenance operations in the North Sea, commenting that "spending on operations at mature oil fields reliably increases year on year."

"The present asset life extension project we are supporting with the GMS Endurance in the North Sea is exactly what we came here to do. This is a project we are very proud of and is precisely what we built our self-propelled jack-up barges for; the project demonstrates well that our concept works.".

The GMS Endurance contract, originally signed in 2012 with a duration of two years, was GMS' first oil and gas contract in the North Sea and saw GMS' E-Class jack-up barge provide accommodation services to ConocoPhillips' operations in the Southern part of the North Sea.

These E-Class barges can accommodate 150 persons, have dynamic positioning capabilities and are capable of moving faster than conventional barges. They have a large deck space, crane capacity and accommodation facilities that can be adapted to the requirements of the group's clients. These vessels support GMS' clients in a broad range of offshore oil and gas platform refurbishment and maintenance activities, well intervention work and offshore wind turbine maintenance work (which are opex-led activities) and offshore oil and gas platform installation (as a capex-led activity).

Pedersen comments on the company's presence currently: ‘We hope to have one more jackup barge arriving in the North Sea in the third quarter of 2014. It will be a higher specification than the two we have currently working here, with higher crane capacity and longer legs.'

The platforms GMS has been working on in the North Sea have mostly been located at depths of 40-50 meters, to the south or in shallower waters. Whilst our existing jack-up barges are capable of covering most of the platforms on the UKCS, but in the future, we will need larger vessels for use in deeper water.'

Lastly, he sums up future plans for the business: ‘we are building a further four smaller jack-up barges, two of which we plan to bring to the UK in 2015 as there is considerable demand in the UKCS. We have a substantial backlog of contracts - a good position to be in.'

There is a clear reason for this high capability: at the moment, the North Sea is reaching into ever more difficult to access resources and expertise is needed to bring oil and gas to the surface from ever more complex reservoirs at a reasonable price. Many of these reservoirs' complexities mean better information about the assets is required to guarantee and maximize economic recovery.

"Statoil recognizes that informed risk is key to success in exploration," says Tom Dreyer, vice president exploration of Statoil in the North Atlantic. Dreyer emphasizes what drives the Norwegian state oil company's success, stating it "has been very focused on the best possible seismic data, using our expertise and obtaining the best possible subsurface image. This is then utilized to inform our drilling programs."

Martin Bett, senior vice president, reservoir solutions at TGS, a company delivering the full spectrum of exploration and reservoir monitoring technologies, describes what permanent monitoring systems (PRM) can do to inform operators about the reservoir they are dealing with: "PRM systems look to observe the dynamic elements of the reservoir, such as water pressure or movement of fluids within the reservoir. One desires the highest resolution imaging; placing a PRM system on the seabed offers access to this information in full azimuth – this is an image from multiple perspectives."

He concludes, summarizing what this data means to the industry: "These remote sensing efforts allow improved decisions to be taken by the oil and gas industry. This increased information has improved exploration and now can be turned to production and improving decisions in that aspect of work as well. Measuring, not just modeling, is key to this forward step. Oil companies pursue a number of scenarios when they are drilling wells. These wells are so expensive that having the knowledge to maximize the return from any well is vital; that, or actually deciding if a profitable scenario is likely."

Philippe Guys, managing director of Total E&P UK, emphasizes that this data is so valuable, it entirely influences the business' operations: "If our geoscientists provide geological data, which demonstrates prospect of discovering commercially viable and exploitable reserves we will go for it." This is corroborated by Martin Pedersen, vice president and managing director of Maersk Oil North Sea, who states: "First and foremost it is about technical knowledge and being able to identify and de-risk the prospects."

The whole picture; Xcite's de-risked asset

Xcite Energy holds and operates 100 percent of the Bentley field located in Block 9/3b (License P1078) one of the largest undeveloped fields in the North Sea which contains heavy oil.

Xcite's latest drilling program saw two pre-production wells, 9/3b-7 and 7Z, drilled. This effort delivered oil for 68 days and was wrapped up in September 2012. Key objectives were attained and the well notably produced around 149,000 barrels of Bentley crude.

The well test resulted in the discovery that less water was produced than expected and that a large active aquifer is present providing additional long-term pressure support over the field's span of production.

Early in the well test, Xcite gathered important data with regard to the reservoir, fluid characteristics and the movements of the contents of the reservoir. This will allow a tailored approach to be taken during production delivering greater efficiency and yield from the field.

This data also enabled Xcite to update the Reserves Assessment Report (RAR), underscoring the fact that many thousands of barrels of oil more than originally thought are recoverable. Expectations are now that 257 million barrels of oil will be recoverable from this field.

The knowledge derived from the extended well test (EWT) has given Xcite confidence that the business can proceed to develop this asset effectively and profitably. Subject to the successful completion of the final part of pre-FEED/assurance engineering towards the end of 2014, Xcite Energy and its development partners intend to sign binding contracts for the supply of an FSO, ACE self-installing platform, jack-up drilling rig and drilling services, subject to FDP approval.

Identifying and de-risking new and alternative prospects is seeing companies devise innovative new means of accessing resources. Robert Trice, CEO of Hurricane, an exploration and production company, is searching for fractured basement reservoirs- effectively where natural geological movements have fractured the rock, creating spaces in which hydrocarbons may pool. "Finding the fractured basement areas is the easy part of the process; one is looking for large structures that have the normal components of a trap: reservoir, seal and source. The principal challenge is evaluating the reservoir from a modeling point of view, calculating porosity, fracture density, fracture orientation and water saturation- these are the key aspects which must be investigated. Hurricane has its own bespoke technique for this in-house."

Hurricane identified areas of basement around the UK where reservoir, seal and source were consistently present, and cross-referenced this with sites where existing drilling had taken place and oil has been located in the basement or sediment. As a result, this approach taken by Hurricane has significantly de-risked the fractured basement prospects being explored by Hurricane.

To date, Hurricane has been admirably successful, finding commercial volumes of oil in basement in each of its drilling efforts. The company is now drilling to the west of Shetland to ascertain if the resource there offers a commercial flow. Trice describes the huge resources potentially available from basement reservoirs: "there is the potential for billions of barrels in the basement around the UK."

Financial risk

The innovation that is allowing access to such new and more difficult to reach resources is one further reason for the record investment currently flowing into the North Sea. Ibukun Adebayo, co-head of emerging markets & equity primary markets for the London Stock Exchange Group, describes the international interest in North Sea companies flowing through London's stock exchange: "London Stock Exchange very much tends to be a home for global businesses. For that reason more than half of the top 15 integrated oil and gas producers are listed in London." The financial muscle of London backs up the engineering capabilities of Aberdeen. It is of note however, that as the North Sea matures, the constituent companies working in the North Sea and in need of finance are changing.

The larger operators perceive the North Sea to be less material to their interests; Shell has recently moved to sell the Anasuria FPSO, and the Nelson and Sean platforms, though the company has reiterated its commitment to the North Sea. Andy Brogan, global oil and gas transaction leader for EY states: "The companies coming into the UKCS have been local independents - there are NOCs looking to acquire skills and capabilities here and trading houses acquiring assets." Brogan concludes by summing up the interconnected nature of the UKCS' industries across Britain, stating, "London is really the center of all oil and gas financing outside the USA. The hub here gives the business great access to key decision makers."

Production and the securing of income from cost-effective assets beget investment. "The acquisition of BP assets and their integration was extremely successful, which gave us a core area in the central North Sea, an operating platform in Harding, a growth project, and a very significant gas cap," says Pete Jones of TAQA. "We hit record production of 85,000 barrels a day for a number of days at the end of last year, which was a major milestone and certainly solidified us in the top 10 operators in the North Sea."

Jones describes TAQA as "one of the best companies in the North Sea in terms of ongoing production, development opportunities and for its willingness to continue to invest. The company invests not only in acquisitions but also continues to invest on the order of USD 700 million as a kind of base level, which is very significant."

There are many smaller companies seeking to gain the security of income from a producing asset. One of these is Xcite Energy. The company's CEO, Rupert Cole, speaks of the strategy behind securing this asset: "Xcite is still continuing to pursue a de-risked action at Bentley- the whole industry places a far greater emphasis on this now."

Part of this de-risking strategy saw Xcite undertake a highly successful extended well test on its Bentley field. "For investors, the key is that Xcite has a development ready, major strategic North Sea asset and is ahead of any other project of this type because of the company's understanding of the asset," Cole adds. "Xcite has financing options with regard to the field and the assets we will bring onto the field. The business is ready to move forward and this is why this company should excite investors."

Finance is a major challenge for smaller companies and one that requires an innovative approach to overcome. "At the moment there is probably less available equity and debt capital for small and medium sized businesses," says Ewan Neilson of Stronachs. "These businesses are thus trying to find new ways of accessing capital." Innovation can help deliver production; by demonstrating that a company has the means to access the resource, investors become more willing to back a company up.

There are other ways to de-risk access to capital too, however: both through spreading financial risk through diversified debts, or by sharing the risk with another party. Nigel Hares, co-founder and advisor to the CEO of EnQuest, an exploration and production company, describes his business' efforts to spread risk from borrowing: "Companies with strong existing cash flows are finding it easier to demonstrate their viability and access finance in this respect," he explains. "Often, smaller companies do not have diversified financing and EnQuest's bank debt was originally on a limited term. Since establishment, EnQuest has taken two actions to address this, firstly through launching the retail bond to increase the tenor of our debt and more recently adding some high yield debt. That gives the company debt with an eight-year term. Now EnQuest has diversified, strong financing with debt at the end of last year amounting to GBP 380 million [USD 644.69 million]. This includes bank debt, retail bonds with a higher tenor and high yield debt."

SENTINEL: ON FLEET REQUIREMENtS FOR THE NORTH SEA

"The basic requirements for an ERRV in the North Sea are actually quite high. The UKCS has the highest requirements and standards of all the North Sea sectors. A standard vessel must be able to rescue and accommodate up to 300 people."

"Sentinel's vessels will be built to accommodate more than 300 persons and house advanced medical facilities, a dormitory for twenty beds, seated areas, toilets and showers. The ships also carry fast rescue craft and daughter craft. Sentinel has worked closely with Palfinger to create our own designs of this type. These vessels will be unveiled June 10th in Southampton."

"Our vessels have further capacities as well; they can perform emergency towing and have dynamic positioning systems. This latter innovation is highly original."

Cygnus aft port sea - credit to Sentinel Marine

"Fuel consumption and emissions are lower on our vessels putting Sentinel at an advantage over its competitors. The new design of our vessels is responsible for our vessels having a greater degree of reliability too. Reliability is of particular importance because if an ERRV breaks down, its associated platform may have to cease.

Jacob S. Ulrich, chairman and interim CEO of Sterling Resources, an exploration and production company, expands on his company's efforts to secure income from an asset: "For companies our size to attract investors, you need to have a portfolio of cash-producing assets. At Sterling Resources, we are very much reliant on one asset, Breagh, thus it is critical to expand into other cash-producing assets. We need to be able to raise money going forward for various exploration and development activities."

In order to capitalize on its Breagh asset, Sterling sought and was awarded further licenses in the immediate area in the 27th offshore licensing round. Ulrich continues: "Sterling Resources will be the operator of the license with a 100 percent working interest."

Ulrich illustrates the steps that Sterling Resources took to de-risk this move, highlighting collaboration as key. "Naturally, it will be far too large for us to do on our own and thus we will be looking for the right partners," he explains. Cooperation, he believes, is vital: "When the bigger players get out, they do not want to sell asset by asset. They want to sell packages. When you are a USD 300-600 million company, you cannot really afford those packages. We need to bulk up and find the right partners, synergies and value drivers in common. These are the ingredients to build up a company to something substantial."