Third-quarter results improved on higher crude oil prices

Conglin Xu

Senior Editor-Economics

Laura Bell

Statistics Editor

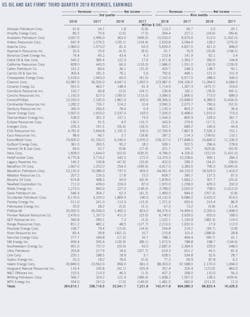

A group of 59 US-based oil and gas producers and refiners reported a total net income of $23.54 billion in this year’s third quarter compared with earnings of $7.23 billion in the previous year’s third quarter. Collective revenues totaled $264.61 billion compared with $206.72 billion a year ago.

Brent crude oil prices averaged $75.25/bbl in this year’s third quarter compared with $52.09/bbl in third-quarter 2017 and $74.53/bbl in the second quarter of this year.

West Texas Intermediate at Cushing, Okla., averaged $70/bbl in this year’s third quarter compared with $48.16/bbl in third-quarter 2017 and $68/bbl in this year’s second quarter.

The US rig count was flat from late June through September at nearly 1,050 active rigs, reflecting pipeline limitations and correspondingly lower local prices for oil and natural gas. WTI in Mainland, Tex., dropped to an average of $52/bbl in August.

However, the number of wells drilled each month increased, suggesting ongoing gains in drilling efficiency over that time. This also led to a rise in inventory of uncompleted wells, especially in the Permian basin. The Permian accounted for 40% of the wells drilled over the summer, but only for a third of the wells completed.

For the third quarter, US crude oil production averaged 11.25 million b/d compared with 9.32 million b/d for third-quarter 2017 and 10.53 million b/d for this year’s second quarter, reported the US Energy Information Administration.

US dry gas production climbed to 91.44 tcf in this year’s third quarter from 83.92 tcf in the same quarter in 2017.

Natural gas prices at Henry Hub averaged $2.93/MMbtu for this year’s third quarter compared with $2.95/MMbtu for third-quarter 2017. Natural gas at the Waha hub in West Texas, constrained by pipeline capacity, slipped further to an average of $1.56/MMbtu in September from $1.88/MMbtu in August.

Refineries are processing record volumes of crude thanks to low feedstock costs and healthy demand for US products. Refinery outages in Latin America have helped keep demand for US products strong.

During this year’s third quarter, US refinery utilization rates were 95% compared with 91% in third-quarter 2017. Operating rates on the Gulf Coast reached as high as 99% in August.

However, during the quarter, refining margins were undesirable in most regions due to the rise in crude oil prices and low gasoline refining margins. Gasoline refining margins—the difference between the spot price of gasoline and the Brent crude oil spot price—have been on a downward trend since August, reaching some of their lowest October and November levels in the past 5 years. At the same time, strong growth in distillate demand has driven increased distillate prices and refining margins.

Disconnected from the seaborne hubs, the US Midcontinent refiners enjoyed higher margins again, thanks to the discounted US inland and Canadian grades. These refineries enjoy some of the lowest feedstock costs, while product prices tend to be at a premium to other regions, too.

According to Muse, Stancil & Co., refining cash margins in this year’s third quarter averaged $28.59/bbl for the Midwest, $13.37/bbl for the West Coast, $9.09/bbl for the Gulf Coast, and $3.92/bbl for the East Coast. In the same quarter in 2017, these refining margins were $15.88/bbl, $19.08/bbl, $11.84/bbl, and $7.81/bbl, respectively.

Meantime, surging petrochemical processing is putting downward pressure on the price of key chemical products.

Separately, a sample of 12 companies based in Canada, including oil and gas producers and pipeline operators, reported combined earnings of $5.61 billion (Can.) in this year’s third quarter. In third-quarter 2017, this group’s combined earnings were $4.34 billion.

Prices for Western Canadian Select (WCS) increased to $47.35/bbl in this year’s third quarter vs. $38.25/bbl in the same quarter last year, which was less than the increase in WTI because of the continued impact of wider western Canadian heavy crude differentials due to takeaway constraints in the Alberta crude market. During the quarter, the Canadian dollar relative to the US dollar strengthened as the average exchange rate moved to 0.77 from 0.8.

US oil and gas producers

ExxonMobil Corp. announced a net profit of $6.24 billion for this year’s third quarter compared with net earnings of $3.97 billion for the same 2017 quarter. Cash flow from operations and asset sales was $12.6 billion during the past quarter, including proceeds associated with asset sales of $1.5 billion.

Excluding entitlement effects and divestments, liquids production of ExxonMobil increased 6% as growth in North America more than offset decline and higher downtime.

Chevron Corp. recorded net earnings of $4.05 billion for this year’s third quarter compared with a net income of $1.95 billion for third-quarter 2017.

US upstream operations earned $828 million in the third quarter compared with a loss of $26 million in the same quarter a year ago. The improvement reflected higher crude oil realizations and production, partially offset by higher depreciation and exploration expenses, primarily reflecting a $550-million write-off of the Tigris project in the Gulf of Mexico.

International upstream operations earned $2.55 billion in this year’s third quarter compared with $515 million in the same quarter in 2017. The increase in earnings was mainly due to higher crude oil and gas realizations and higher gas sales volumes.

Chevron’s US downstream operations earned $748 million in this year’s third quarter, up from earnings of $640 million a year earlier, primarily due to higher equity earnings from the 50%-owned Chevron Phillips Chemical Co. LLC and lower tax expense, partially offset by higher operating expenses.

The company’s international downstream operations earned $625 million in this year’s third quarter compared with $1.17 billion earned in third-quarter 2017. The decrease in earnings was largely due to lower gains on asset sales.

Anadarko Petroleum Corp. posted net profit of $363 million for this year’s third quarter compared with a net loss of $699 million for the same 2017 quarter.

ConocoPhillips reported net profit of $1.86 billion for this year’s third quarter compared with net earnings of $420 million for the same 2017 quarter. Excluding the impact from closed dispositions, the company’s underlying production increased 6%, as growth from the Big 3 unconventionals, development programs in Europe and Alaska, and ramp-up of major projects in the Asia-Pacific region more than offset normal field decline.

Devon Energy Corp. reported net earnings of $2.54 billion for this year’s third quarter, up from net earnings of $193 million in the same 2017 quarter.

Devon’s total companywide production averaged 522,000 boe/d in the third quarter. With the company’s capital programs focused on expanding higher-margin production, oil, and NGL volumes increased to 67% of the product mix. In addition to the strong US production performance, Devon maintained discipline with its capital program.

Occidental Petroleum Corp. reported a net income of $1.87 billion in this year’s third quarter compared with net earnings of $190 million for the same 2017 quarter, reflecting higher sales volumes across all products. Meantime, the recent third-quarter results included an aftertax gain on the sale of domestic midstream assets of $700 million.

Oxy also recorded an impairment charge of $196 million for the quarter because of Qatar Petroleum’s decision to take over operatorship and ownership of the Idd El-Shargi North Dome offshore field in Qatar upon the upcoming contract expiration in October 2019.

EOG Resources Inc. posted a net income of $1.19 billion for this year’s third quarter compared with a net income of $100.5 million for third-quarter 2017.

EOG produced 415,000 b/d of oil, an increase of 27% compared with the same period a year ago. NGL production increased 46% while gas volumes rose 13%, contributing to total company production growth of 25%.

The company’s per-unit operating expenses declined during the third quarter compared with the same period in 2017. On a per-unit basis, general and administrative expenses fell 20%, transportation costs declined 15%, and depreciation, depletion, and amortization expenses fell 13%.

Anadarko achieved record US onshore oil sales volume of 175,000 b/d representing a 37% increase over third-quarter 2017 on a divestiture-adjusted basis. The company expanded Delaware basin oil processing capacity by 120,000 b/d in 2018, including the startup of the Loving Regional Oil Treating Facility in the third quarter.

Hess Corp. reported net earnings of $53 million for this year’s third quarter compared with a net loss of $635 million for third-quarter 2017. Higher realized crude oil selling prices combined with lower operating costs and depreciation, depletion, and amortization expenses in the third quarter more than offset lower production volumes due to asset sales, compared with the prior-year quarter.

Refiners

Phillips 66 posted third-quarter net income of $1.49 billion. Phillips 66’s worldwide crude utilization rate was 93% during the quarter, down from 100% in the prior quarter. Refining adjusted net income was $959 million in this year’s third quarter compared with $911 million in this year’s second quarter.

The increase was largely driven by higher realized refining margins in the Central Corridor, partially offset by declines in realized margins in the Gulf Coast and West Coast regions.

Central Corridor refineries benefited from a wider WTI-WCS crude differential and ran at 108% utilization during the third quarter. The Gulf Coast region was impacted by narrowing heavy crude differentials and unplanned downtime. In the West Coast, results were impacted by declining gasoline crack spreads.

Valero Energy Corp. posted net profit of $856 million for this year’s third quarter compared with net income of $841 million for the same 2017 quarter. The company’s refining business reported $1.3 billion of operating income for the third quarter compared with $1.4 billion for the same quarter in 2017. The $90-million decrease was mainly due to lower gasoline and secondary products margins.

The company’s refinery throughput capacity utilization was 99%, with throughput volumes averaging 3.1 million b/d in this year’s third quarter. This compares with 2.9 million b/d in the same quarter in 2017, during which five refineries were impacted by Hurricane Harvey.

The company’s biofuel blending costs were $94 million in the most recent quarter, which is $136 million less than in third-quarter 2017, mainly due to lower Renewable Identification Number prices.

Marathon Petroleum Corp. posted a third-quarter net profit of $737 million compared with net earnings of $903 million in the same quarter in 2017. Its refining and marketing business income from operations was $666 million, driven by 97% utilization and completed successful turnarounds at Canton and Detroit. Speedway segment income from operations was $161 million, as gasoline and distillate margins were adversely impacted by the overall rise in crude oil prices.

HollyFrontier Corp. announced a third-quarter net profit of $342.5 million compared with net earnings of $272 million in the same quarter a year ago. Its refining and marketing business reported adjusted earnings of $507.2 million compared with $326.4 million for third-quarter 2017. This increase was primarily driven by lower laid-in crude costs, which resulted in a consolidated refinery gross margin of $19.40/bbl, a 38% increase from the level of third-quarter 2017.

Crude oil charges were slightly lower compared with a year ago, due to the planned turnaround at El Dorado that began in the last week of September, coupled with Woods Cross running at reduced rates throughout July and August.

Canadian firms

All financial figures in this section are presented in Canadian dollars unless noted otherwise.

Suncor Inc.’s net earnings were $1.81 billion in this year’s third quarter compared with $1.29 billion in the same quarter in 2017. The increase was a result of improved crude oil pricing and increased refinery margins, the addition of sales from the Fort Hills and Hebron projects, and record production from oil sands operations. These factors were partially offset by lower syncrude production and the addition of operating costs at Fort Hills and Hebron.

Net earnings for this year’s third quarter also included an aftertax gain on the sale of the company’s interest in the Joslyn Oil Sands mining project of $60 million and a $195-million unrealized aftertax foreign exchange gain on the revaluation of US dollar denominated debt.

Suncor’s total upstream production was 743,800 boe/d in this year’s third quarter compared with 739,900 boe/d in the same 2017 quarter.

Oil sands operations achieved a new quarterly production record of 476,100 b/d, driven primarily by strong operational reliability and record in situ production.

Refining and marketing delivered record quarterly income from operations of $1.12 billion, with crude throughput of 457,200 b/d, which represents a 99% utilization rate and an average refining margin of $34.45/bbl.

Canadian Natural Resources Ltd.’s net earnings climbed to $1.8 billion in this year’s third quarter, up from $684 million in the same 2017 quarter.

The company’s production volumes in this year’s third quarter averaged 1 million boe/d, an increase of 2% from the comparable quarter in 2017. The increase from a year ago was mainly due to the completion of the Horizon Phase 3 expansion, acquisitions completed in 2017, and production from new wells in the North Sea. These gains were partially offset by declines in gas production along with gas and heavy crude oil shut ins and reduced activity.

TransCanada Corp. reported a net income for this year’s third quarter of $928 million compared with net income of $612 million for the same quarter in 2017. Excluding specific items, comparable earnings for the third quarter were $902 million compared with $614 million for the same quarter in 2017.

The increase was due to higher contribution from US gas pipelines with increased earnings from Columbia Gas and Columbia Gulf growth projects placed in service, additional contract sales on ANR and Great Lakes, and the amortization of net regulatory liabilities recognized from US tax reforms. Liquids pipelines also delivered higher contributions, thanks to earnings from intra-Alberta pipelines placed in service in second-half 2017, increased earnings from liquids marketing activities, and higher volumes on the Keystone Pipeline System.