OPEC compliance slip triggers price slide

After months of rising oil prices, a sudden fall in early October took the industry by surprise, but behind the slide was a rise in production both inside and outside of the Organization of Petroleum Exporting Countries.

Brent crude futures prices hovered around $24/bbl for a while, as markets saw OPEC's production cutbacks agreement of March 1999 eat into global stocks. However, said London's Centre for Global Energy Studies, Iranian stockpiling of crude and a surge in non-OPEC output have unsettled the market, despite the fact that fundamentals continue to tighten and crude supply is short of demand (OGJ, Oct. 18, 1999, Newsletter).

As stories of increasing output spread, Brent crude for November delivery closed at $20.71/bbl in London trading on Oct. 11; but by close of business on Oct. 18, the Brent December-delivery contract had recovered to $22.41/bbl.

"The price slide was a novel experience after months of relentless upward movement," said CGES. "The main story was a grave deterioration in OPEC's compliance levels in September, due largely to a 200,000 b/d increase in Iranian output."

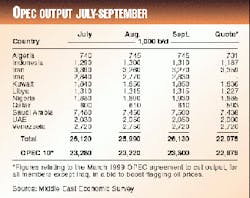

Middle East Economic Survey estimated that average OPEC output amounted to 26.13 million b/d in September, up by 140,000 b/d from August. Of this hike, Iranian output accounted for only 10,000 b/d.

However, MEES noted that its Iranian export figure did not include crude loadings for floating storage: some 12-33 million bbl of crude was thought to have been loaded into 6-14 tankers, which were believed to be at anchor near Kharg Island.

"Iran's true intentions remain obscure," said CGES, "but reports that about 40 million bbl or Iranian crude are being stored on tankers are unsettling.

"Also troubling was the 400,000 b/d surge in non-OPEC output during the third quarter."

Oil stocks

CGES added that the International Energy Agency, Paris, had questioned whether there actually had been any erosion in stock levels in Organization for Economic Cooperation and Development countries during the third quarter.

"Yet, despite this news," said CGES, "we believe that the fundamentals are getting stronger, which explains why the market recovered its composure. More recent information suggests that there was a 700,000 b/d stock-draw in Europe in September, and that the OECD industry's inventories will have declined by around 200,000 b/d in third quarter 1999.

"While hardly setting the market alight, these numbers ought to be seen as an early indication of the physical tightness to come. Moreover, OECD inventories do not tell the whole story. It seems logical for the companies to run down stocks held in third-party storage first and then chip away at their own inventories, aided by a growing backwardation."

With market attention turning to winter weather and subsequent fuel demand changes, CGES said a cold winter would add 200,000 b/d to world oil demand over 6 months, thus tightening the market and boosting the first-quarter 2000 average price for dated Brent to $23.50/bbl.

"With a cold winter," said CGES, "the price of dated Brent would remain above $20/bbl for the whole of next year, assuming OPEC raises its output to 28.2 million b/d from April, yielding an annual average price for 2000 of just below $22/bbl.

"On the other hand, a mild winter, reducing oil demand by 200,000 b/d, would ameliorate the oil price rise over the coming months, with dated Brent averaging $20.50/bbl over the winter.

"Lower oil prices would stimulate oil demand growth later in the year, helping to maintain oil prices at around $18/bbl on average from the second quarter of 2000 onwards and yielding an average price for 2000 of $18.20/bbl for dated Brent."