Supply contracts for Italy prompt expansions, new construction plans

Iberian and Italian Gas-Conclusion

Warren R. True

Pipeline/Gas Processing Editor

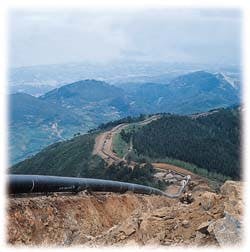

To accommodate greater volumes of Italian demand, the Trans-Mediterranean gas pipeline from Algeria to Italy was expanded in construction that concluded in 1995. Here, welded 48-in. pipe in the southern part of the expansion awaits burial. (Photograph courtesy of SNAM, Milan)

- Stretches of welded 48-in. pipe along the Apennines are lowered-in as part of the Trans-Mediterranean pipeline expansion. (Photograph courtesy of SNAM, Milan) [19,483 bytes]

- In the Liguria region, the Panigaglia LNG receiving and regasification plant, of which this cooling water/seawater exchanger is part, has been expanded to play a larger role in increasing Italian gas imports. (Photograph by Domenico di Liello, courtesy of SNAM, Milan) [11,828 bytes]

Gas demand in Italy, as a share of total energy demand, is likely to grow from slightly more than a quarter in 1996 to more than a third by 2010.

As a result, SNAM is actively negotiating and signing new gas contracts with existing and new suppliers to ensure and diversify gas supply to the peninsula over that period.

This article concludes a two-part series on gas supplies and pipeline infrastructure development for Europe's two southern peninsulas.

Part 1 (OGJ, Feb. 16, 1998, p. 41) set forth pipeline construction and gas-movement developments on the Iberian peninsula. Construction has raced ahead there since completion in late 1996 of Gazoduc Maghreb Europe (GME), the 858-mile pipeline moving gas from Algeria to Córdoba, Spain (OGJ, Dec. 2, 1996, p. 50).

For European supplies to Italy, expansions on two major cross-country pipe lines will have been completed by 2001 along with a third new line in France that will tie into an existing line from The Netherlands.

Additionally, early in the next decade, SNAM could be on its way to laying yet another pipeline across the Mediterranean Sea, setting again yet another deepwater pipelay record.

Growth prospects

The company's plans are driven by prospects through 2010 of vigorous growth in gas demand (Fig. 1 [71,950 bytes]) as well as by recent demand trends. 1Total Italian energy demand for 1996, the most recent year for which data are available, was 171.9 million tons of oil equivalent (toe).

Of this, natural gas met 46.2 million toe (26.9%; 56 billion cu m-bcm); oil, 93.8 million toe (54.6%). The remaining demand was met by coal and electricity (hydro, geo, nuclear, and imported).

SNAM predicts that by 2010, total energy demand will reach 202.1 million toe, up by 30.2 million toe (17.6%). Of this, gas will meet 73.1 million toe (36.1%; 83 bcm); oil, 93.3 million toe (46.2%).

Since 1973, the year of the first major oil-supply disruption, Italian gas demand has more than tripled, from 14.3 million toe (10.2%; 17.2 bcm), while oil demand has dropped from 105.3 million toe (75.3%). Total energy demand in 1973 was 139.8 million toe.

If predictions hold, gas by 2010 will have grown by 58.8 million toe (412%; 65.3 bcm) in 37 years.

SNAM forecasts the rate of demand growth for natural gas will average slightly more than 5%/year from now to 2000, then slow to between 1% and 2%/year until 2010. Most of this growth is expected in the power-generation sector, both public and private (Fig. 2 [57,845 bytes]).

Among the major market sectors-residential/commercial, industrial, electricity generation-growth in the latter, gas-fueled power generation, both public and private, looks to be the most robust. Italy, like the rest of Europe and the developed world, is moving away from fuel oil and, especially, coal as fuels for electricity generation.

SNAM believes that by 2010 gas will be supplying nearly 34 bcm/year to the power-generation market, or as much as 46% of natural-gas demand.

Gas demand for all markets as Italy moved into the 1997-98 European winter heating season was at 55 bcm/year (more than 1.9 trillion cu ft). By 2010, SNAM anticipates demand will have nearly doubled to 90 bcm/year.

Preliminary Italian gas-demand through third quarter 1997, according to SNAM, showed growth in the industrial and power markets with domestic use falling off somewhat when compared to the same period for 1996.

Industrial demand was at 19 bcm by Oct. 1, 1997, up 8% from the same point in 1996. Power-plant demand at the same point in 1997 was at 6.5 bcm, up more than 12% over 1996.

Sources; contracts

Domestic production, primarily from sister ENI affiliate Agip S.p.A., has accounted for approximately a third of supplies into SNAM's domestic trunkline system. In 1996, domestic Italian gas production was 19 bcm (Table 1 [51,241 bytes]).Remaining volumes to SNAM, which supplies more than 80% of Italian gas markets, have come through major international pipeline connections (Table 2 [40,937 bytes]) from three directions: North Africa, former Soviet Union/Russia, and The Netherlands (Fig. 3 [153,429 bytes]).

- Historically, Italy has depended on North African gas, primarily from Algeria with some volumes from Libya. The Trans-Mediterranean pipeline (Transmed) has carried increasing volumes of Algerian gas, beginning in 1985. Transmed's first section is in Algeria: two 48-in. lines, each 550 km long. The second is in Tunisia: a single 48-in., 370-km line with three compressor stations. The Tunisian crossing runs from the Algerian-Tunisian border to the site of El Houaria on the Tunisian coast.2

The final section of the pipeline, in Italy, includes the 48-in., 356-km Sicily crossing, the Messina Strait crossing (three 20-in, 15-km offshore sections), and the Italian mainland (42-48 in., 1,064 km). The Italian section of the line uses five compressor stations.

Under terms of the original agreement between ENI and the Algerian natural-gas company Sonatrach, the natural-gas production facilities and the section of the pipeline located in Algeria are financed, owned, and operated by Sonatrach.

The Italian section of the line is financed, owned, and operated by SNAM. For the Sicily Channel section, a company owned equally by Sonatrach and SNAM was incorporated to build, finance, operate, and own the line.2

Through 1985, when LNG shipments were halted, Libya had been a supplier of declining importance. SNAM's LNG terminal at Panigaglia, opened in 1971 on the Ligurian Sea near La Spezia, was mothballed.

Algeria began picking up an increasing share of supply via Transmed: 8.5 bcm in 1985, 11.1 bcm in 1990, and 19.5 bcm in 1996.1 An expansion of Transmed was completed in 1995, on which more presently.

With an additional 4 bcm/year contracted for Italian electricity provider ENEL, the Transmed is currently running at capacity: nearly 25 bcm/year.

Moreover, in January 1997, the Panigaglia LNG terminal was officially reactivated and began to receive volumes of Algerian gas that will grow to 2 bcm/year. Regasification capacity there is 3.5 bcm/year (338.5 MMcfd) with gas send-out capacity of 1.1 million cu m/day (38.8 MMcfd).

SNAM has been operating with two LNG tankers, each capable of carrying 40,000 cu m.

- Additionally, SNAM through a series of contracts, has been increasing Italy's dependence on gas from, at first, the former Soviet Union, now from Russia. These volumes have been arriving since 1974 through a system that crosses Ukraine, Slovakia, and Austria.

For these supplies, SNAM signed its first contract in 1969 for 6 bcm/year; deliveries started June 1974. The second contract was signed in 1976 for another 1 bcm/year, starting Jan. 1, 1978.

A third contract was finally signed in 1986 bringing the total to 8 bcm/year that started flowing Jan. 1, 1984. Under a 1992 amendment to that contract, deliveries were brought to 13.5 bcm/year to begin arriving Oct. 1, 1995.

In August 1996, SNAM signed a new supply agreement with Gazprom that will increase supplies from the Russian pipeline after Jan. 1, 1999, peaking at 8 bcm/year in 2008.

In 1996, Russian gas met 24% of total Italian gas demand with more than 13.6 bcm. Under the new contract, Russia will therefore be supplying approximately one-third of 2010 Italian gas consumption.

- Supplies of Dutch North Sea gas have held steady between 4.2 bcm (1975) and 6.6 bcm (1980). In 1996, Italy imported 4.5 bcm.1

TENP (Trans Europa Naturgas Pipeline) is owned by Ruhrgas (51%) and SNAM (49%) and came onstream in 1974.

At the Swiss border, TENP connects with Transitgaz (Swissgas 51%, SNAM 46%, and Ruhrgas 3%) which runs through Switzerland and crosses the Alps arriving in Italy through the Col de Gries.

According to Gaz de France, a total of 6.5 bcm/year of Dutch gas currently moves through TENP-Transitgaz; 500 million cu m goes to Swiss markets. Capacity on the line will nearly triple to 18 bcm/year in 2000.3

This increase will be filled by additional volumes of Dutch gas but more importantly, for Italy, by new volumes of Norwegian North Sea gas.

Starting in 2000, supplies of Norwegian gas will begin flowing to Italy under a 25-year contract signed in January 1997 with GFU, the Norwegian gas marketing group.

Accommodating new volumes

To move the increased volumes of newly contracted gas, significant transmission-capacity expansions have recently been completed, are under way, or are planned.Transmed expansion

To accommodate more gas from Algeria, the Transmed underwent a major expansion that opened in 1995.2The first part of this new system included construction of one compressor station along the existing 550-km double line crossing in Algeria. The station was brought on line in 1995; two more stations with the same configuration will be added later.

In Tunisia, a new 48-in. line was installed parallel to the existing line, and compressor horsepower was upgraded at the three existing compressor stations.

In the Sicily Channel, capacity was doubled by addition of two subsea lines, each 26 in. and 155 km.

Finally, system capacity in Italy has been expanded through several looping projects with priority given to the most critical sections. The program also included construction of two new stations and installation of additional horsepower at existing sites.

SNAM says that the new project consists of 1,470 km, 48 in. from Mazara (Sicily) to Minerbio (near Bologna) and two new subsea lines of 30 km, 26 in. in the Messina channel. The project includes additional 140 mw at existing five compressor sites, plus two new compressor stations of about 100 mw total.

Complementing this added capacity from the south will be two new LNG tankers due to join the fleet by early 1998. Each will be capable of carrying 65,000 cu m.

One, the Portovenere, was completed in 1996 but during sea trials late in the year caught fire, killing 6 on board. The vessel's builders, Sestri Cantiere Navale S.p.A., in early 1997 were conducting court-ordered tests on the vessel.

The Portovenere and sister ship Lerici will be 215 m long and use the membrane transport system of Gaz Transport.

Expansion of LNG imports to the peninsula and potentially to neighboring Slovenia were set back in 1996 when SNAM was forced to cancel a planned LNG terminal at Monfalcone, north of Trieste, because of local opposition.

The plant was to have been able to regasify up to 8 bcm/year initially, with as much as 3.5 bcm/year going to ENEL.

But gas imports from the south may receive a major boost shortly after 2001 when SNAM hopes to bring onstream a new, subsea gas pipeline to Sicily from a gas-processing plant on the Libyan coast near Algeria.

Agip is due to develop the NC41 gas and condensate field offshore Libya near the Bouri oil field with twin gas and condensate lines to an onshore gas-treatment plant at Sabratah. To these volumes will be added dry-gas production from the Wafa field, some 400 km to the south.

SNAM expects up to 8 bcm/year of processed gas then to move through a new 500-km, 32-34 in. pipeline to Sicily. The line will be laid in water up to 700 m deep, setting a new subsea pipelay record.

More Russian gas

The new contract volumes due from Russia will be satisfied with expansion, currently being planned, on the section from Slovakia across Austria. The new contract will need a third pipeline of 378 km, 40 in. and an expansion (20 mw) of Baumgarten station. Gas supply will begin in October 1999.A French connection

Volumes moving down from The Netherlands on the TENP-Transitgaz system began to see some added capacity in 1995 when a 15-km loop near Mittelbrunn, Germany, came into service. More looping 37 km south from this expansion and replacement of 95 km of pipe south from Schwarzach, across the border from Strasbourg, with larger 1,200-mm (48-in.) pipe, are planned by 2000. 3Additional expansion of this route, up to double its capacity, is being discussed by SNAM and Ruhrgas.

But a major expansion in delivery capacity from this direction will occur to accommodate up to 10 bcm/year of gas, mostly from contracts with Norway.

SNAM has said that part of the gas will arrive through the North Sea pipeline, NorFra, landing at Dunkerque, on the French coast. Other volumes will travel through Zeepipe, delivered at Blaregnies on the Belgium-France border.

These volumes will merge in a planned new pipeline across France to the Swiss border where it will connect with Transitgaz via a 50-km connection in Switzerland that will join the existing TENP-Transitgaz system.

Gaz de France says engineering is under way for the new French line which will run between Taisni?res-sur-Hon and the French-Swiss border; size of the line will be between 36 and 44 in.

The Transitgaz line across the Alps into Italy will then be in need of expansion. The existing line reaches an altitude of 2,400 m, the highest gas pipeline in Europe. In the 36 km of tunnels needed to cross the Alps, some sections have a gradient of 85% and have been equipped with funicular railways for maintenance.

Expanding capacity through this area with looping of the existing 34-in. line is impossible, given that the tunnels are 6 m in diameter. SNAM says the existing pipeline will therefore be pulled from the tunnels and replaced with 48-in. pipe.

The new agreement, says SNAM, is important because Norway joins the other areas as a new gas supplier to Italy, thus diversifying the country's suppliers.

It is also the first time, says SNAM, that a physical link will exist with the French gas-pipeline network, a further step towards the interconnection of the European networks.

Italian storage

SNAM has eight storage fields available to it, all operated by Agip. As elsewhere in the world, especially North America, these are used to cushion fluctuations in demand, especially from the residential market.The fields, as of the end of 1996, have total capacity of 28 bcm, of which 15 bcm was working gas, the rest cushion gas. Plans call for expansion to reach, shortly after 2000, a working-gas capacity of approximately 20 bcm and peak period delivery date of more than 300 MMcmd.

References

- Marches, Massimiliano, "The Italian Gas Market: Gas Competition, Supply and Diversification," presented to The Future of Natural Gas in the Mediterranean, Madrid, Feb. 27-28, 1997.

- Khene, Djamel Eddine, "Development of Cross Border Gas Transmission Projects Raise Challenging Issues," presented to the 20th World Gas Conference, Copenhagen, June 9-13, 1997.

- "Projects for the Year 2000: TENP-Transitgaz: reinforcing the north-south axis," Gaz du Monde, No. 28 (September 1997), p. 50.

Copyright 1998 Oil & Gas Journal. All Rights Reserved.