Reforms, Environmental Concerns Spurring Growth Opportunities For Gas, Electricity In U.S., Europe

Margaret Carson

Enron Corp.

Houston

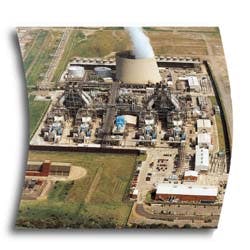

The 1,875-MW Teesside Power Project operated by Enron International in Northeast England is the largest, privately owned gas-fired combined heat and power plant in the world. Fed by North Sea natural gas, the project is an example of the growth opportunities available in Europe as a result of regulatory change that is fostering the convergence of the natural gas and power industries. Photo courtesy of Enron.As we approach the 21st century, deregulation of developed economies, economic liberalization, and an emphasis on cleaner fuels are creating significant growth opportunities for electricity, natural gas, and other forms of energy on both sides of the Atlantic Ocean.

Electric industry restructuring is driven by a growing recognition, especially in the U.S. and Europe, that competitive markets produce better results for national competitiveness, industry participants, and consumers than rigid, regulated monopoly structures.

Steve Kean, Senior Vice-president of Government Affairs for Enron Corp., at the Public Utility Commission (PUC) of Texas workshop in January 1998 said, "Enron's position is simple: Anything that can be provided by competitors should be. Regulated utilities should only provide services that are truly natural monopolies."

In 1997, the U.S. Energy Information Administration of the Department of Energy, in its "Electricity Prices in a Competitive Environment" market study, estimated price savings within 2 years of 6-13% as a result of U.S. electric industry restructuring and long-term energy savings of 8-24%, depending on the intensity of competition.

In 1996, the Brookings Institution published a study by Robert Crandall and Jerry Ellig that had examined five industries to measure the results of restructuring. The report covered the U.S. telecom, airlines, trucking, rail, and natural gas pipeline industries. The analysis documents short and medium-term savings of 14-22% and long-term savings of 30-40%.

As of Feb. 19, 1999, about 25 % of large industrial electricity users across Europe will have the opportunity to change their supplier and shift from regulated tariffs to market prices. Finland, Spain, Sweden, and the U.K. are liberalized already, and Denmark, Germany, and the Netherlands are opening fast. In the U.S., however, the trend is characterized by the sell-off of unbundled generating assets in select states and some reduced government involvement in the electric utility business. The value today represented by the 16 most active states in the U.S. restructuring their electricity markets-that have passed electricity deregulation laws or are deregulating under state public utility commission (PUC) orders-is $89 billion, or about 40 % of the U.S. $220 billion/year electricity market. But the uneven speed with which the shift to liberalization is occurring throughout the world is indicative of: (a) the benefits that the early adopters and participants see and (b) the objections by others of the fairness and painfulness of its consequences.

U.S. status

Most states are watching California's rocky transition to electricity open access.The sales of generation assets in California are moving along, and the Independent System Operator (ISO) finalized its computer systems and started up Mar. 31, 1998. California power generation companies are actively buying assets in other states such as Texas, New York, and across New England. Others are purchasing California's plants.

Transition cost recovery issues and cost reduction concerns abound in all the states. States that will achieve full retail competition in 1998 are California, New York, Massachusetts, and New Hampshire. A law passed in Maine to allow retail competition was effective Mar. 31, 1998. Maryland's regulation order provides for choice by April 1999 for certain customers.

The Federal Energy Regulation Commission is leading the deregulation efforts in the U.S. on the wholesale level, while retail competition is largely being driven by the state Public Utility Commissions (PUCs).

Arizona's deregulation order was swift, but not without challenge in the courts. Those opposed to deregulation are challenging the state's target of opening access to 30% of the market. By Jan. 1, 1999, the allotment of half of the large Arizona industrials to operate within the open markets is planned, as is increasing the overall level of market access to 50 % by 2001.

States such as Idaho and Washington that have a typically low-cost power surplus (i.e., about 3¢/kw-hr for industrials) are moving slower due to less industrial user pressure than in higher-cost states, but this may not be an optimum strategy over the medium-to-long term. Utah, like other states, needs to resolve a plan to handle its stranded costs before restructuring occurs. Montana has passed legislation for electricity deregulation. Idaho has an industrial pilot program ongoing.

In Nevada, non-utility providers include several co-ops and marketers that will begin selling power Jan. 1, 1999, and two large Nevada investor-owned utilities will be required to offer choice by Dec. 31, 1999. The Nevada Commission will establish a transaction fee for alternative sellers.

Oregon, a low-cost power state, has proposed customer choice programs and timetables and is assessing effects of take-or-pay purchase contracts with the Bonnneville Power Authority and other potential stranded cost issues. Enron Corp. subsidiary Portland General Electric (PGE) is active in a 50,000-customer pilot to offer choice in Oregon and has filed with the Oregon PUC to bring choice to 685,000 Oregon customers in the future. At the onset of nationwide electricity deregulation, PGE is maintaining its commitment to service while assisting with the formation of a competitive electricity market in the Northwest. Its Customer Choice Implementation Proposal was filed with the Oregon Public Utilities Commission (OPUC) in December 1997, and an introductory program has been put in place.

PGE's proposal addresses five key principles: bringing true market conditions to the industry, separating the regulated and non-regulated portions of utility services, removing the incumbent utility advantage, transferring commercial customer relationships to competitive energy services providers, and allowing the market to determine the cost of the transition from a regulated to a competitive environment. The proposal, if approved by the OPUC, will create one of the nation's first regulated electricity transmission and distribution companies focused on delivering, not selling, power. In the proposed new environment, regulated electric companies would conduct business similar to regulated natural gas pipelines. As a regulated electric company, PGE would continue to operate and maintain the electricity delivery system and handle outages, while other competitive companies, such as Enron's and other wholesale and retail businesses, would market power to customers over that system. This proposal serves as a model for electric utilities across the nation.

Oklahoma has enacted restructuring legislation that provides for a rate freeze and full competition by July 1, 2002. New Mexico has proposed a pilot program for third-party electricity sales as part of its restructuring efforts.

East of the Mississippi, states with pilot programs to provide customers alternative electric suppliers exist in Michigan, Missouri, New Jersey, Ohio, Pennsylvania, and Rhode Island. Electricity competition for sales to businesses in Illinois begins in 1998. The Pennsylvania model outlined in its decision on Philadelphia Electric Company's (PECO) restructuring proceeding will provide for enhanced savings and faster introduction of energy-related services and products as the PUC finishes the job of opening electricity markets to competition. Across the U.S., a wide variety of changes are under way. Choices in fuels used to generate electricity are also changing based on economic and environmental conditions.

European vs. U.S. fuel use

In Europe, electricity use has been increasing about 1.6 %/year since 1990 vs. a 2.5%/year growth in the U.S., according to DOE data.Today, power plants in Europe, reports the Organization for Economic Cooperation and Development (OECD), generate 2.85 trillion kw-hr of power, the second largest electricity market in the world after the U.S. at 3.345 trillion kw-hr, reported by Edison Electric Institute (EEI). Electricity use in the European Union (EU) is 6,280 kw-hr per capita versus 10,275 kw-hr in the U.S.

Clear patterns in the fossil fuel mix in the EU have resulted in a recent shift away from solid fuels decreasing at 0.3 %/year. The U.K., in its "dash for gas," has been a pacesetter. In the U.S., gas for power plants has replaced fuel oil and has been growing 0.6%/year since 1990, although it is off from a 1995 peak, according to EEI and DOE data.

In Europe, coal, oil, hydro, natural gas, and LNG use have been growing at 1.1%/year for power plant use since 1985, according to Cambridge Energy Research Associates (Table 1 [15,394 bytes]). This compares with U.S. historical 1985-95 fuel use growth rate for power plants of 3.4 %/year, according to EEI data. Enron forecasts that gas use by all U.S. consuming segments, not just power generation, will grow 2.3 %/year (Table 2 [13,650 bytes]) vs. 1.3%/year for all fuels.

Enron forecasts that gas use for electricity generation will grow 4.5%/year as electricity competition intensifies from more-efficient merchant plants (Table 3 [13,422 bytes]).

Essentially, all of the coal used in the U.S. in 1996, at a total of about 19.7 quadrillion BTU (quads) was consumed in power plants. This is almost three times the Western European rate of 6.9 quads. As a result, much greater efficiencies in energy consumption in the U.S. and even greater dependence on gas and renewables will be required to approach the Kyoto global carbon emission targets, because of the high CO2 content of emissions from coal combustion. These targets stipulated 8% and 7% reductions for CO2 in Europe and the U.S., respectively, by 2010.

Dominant fuels vs. strategies

On a country-by-country basis, the dominant fuel used for power generation, the size of the generation surplus, and the role of independent private power (IPP) all have a considerable bearing on the relative openness of electricity markets.France and Belgium, which are nuclear power-oriented, are more closed to access. Both of these markets seek increased power export opportunities, however. Finland, Norway, and Sweden, all hydro-based power-oriented, are favorably positioned to wheel surplus power to northern tier European industrial markets as they open (Table 4 [20,782 byters]).

The Netherlands, with a high percentage of gas-fired power plants, is setting an outward electricity marketing export strategy, as is Germany with a majority of coal-fired power plants.

The current European generation capacity of 626 GW is dominated by the large, privately held utilities in Germany and slow-to-liberalize power generation in France, representing 37% of European generation capacity combined (Table 5 [13,092 bytes]).

The EU Power Directive only calls for economic parity as far as the actual level of market opening is concerned. It does not direct member states to privatize their utilities. How each country organizes or privatizes its electricity industry differs a great deal among EU nations. EU member states may elect one of three policy tools to provide for open access: the single buyer model, negotiated third-party access, or regulated third-party access. But, according to the EU directive, these forms shall lead to equivalent economic results in member states. This in turn results in: (1) a comparable opening up across electricity markets, and (2) a minimum degree of access to electricity markets in Phase I of the directive by 1999.

Some member states have been slow to embrace liberalization, although France, Germany, the Netherlands, and Spain have made admirable strides to encompass the basic components of the EU Power Directive. Belgium, Greece, and Ireland requested and obtained delays from the Power Directive of 1, 2, and 1 years, respectively. Delays that are accompanied by strong moves toward increasing efficiency and lowering costs may turn out to be acceptable delays after the fact. Those that are burdened by freezing the status quo and failing to restructure or improve average unit costs and efficiencies will be destined to suffer a competitive disadvantage: the dual hardship of non-competitive energy prices coupled with market share losses once rapid inroads by increasingly efficient competitors begins. Cost cutting, job losses, divestiture, new product development, and retraining are very difficult-but protecting wasteful spending practices or inefficient processes and structures is a poor alternative to training up an effective organization and shaping the asset portfolio for future competition.

Deregulation of the electric industry is moving in the individual states in the U.S. and the countries in Europe at very different speeds. The U.K. and the Scandinavian countries are advanced in the liberalization of the electricity market. The rest of Europe, under the European Directive, will progressively open the electricity market for primarily large industrial customers by 1999 and phase in others over time.

In the U.S., California is the most active state in the U.S. in restructuring its electric industry, opening all the sectors of its electricity market to competition in 1998. Yet, California's requirements for the state's power generators to sell power into a power pool will have the effect of offering more "average" savings and allowing some inefficiencies and inexactitude to exist. They will not be able to achieve the highs or lows that ration power dispatch and the efficiencies that freely negotiated electricity prices between counterparties can offer.

There is a closer identity in Europe between utility policy and national government policy than in the U.S. In the U.S., many analysts believe that a fully competitive electric supply industry will be more efficient and, thereby, will lower electricity prices by about 10-30% for consumers. It is also believed that the restructured industry can offer on a broad basis many more new products and services than are available at present. These products include "green" kilowatts, weather-sensitive services, "talking" digital meters that interact with users' personal computer control centers, and smarter thermostats, to name a few. The possibilities are endless. Much of Europe also seeks to achieve such price reduction and new product objectives.

The level of structure and the changes in transmission tariffs will be a key means to control the speed and the impacts of regulatory change in the EU. Low transmission and distribution tariffs encourage rapid development of power trading, while high tariffs can be a barrier. All EU member state system operators will need to develop, set in place, and publish open-access tariffs. Some tariffs may be able to include levels of public service obligations-for low income, hardship, and green power costs-others may not. The transmission tariff levels will reflect, by country, the balance of power between the power companies, the industrial beneficiaries, the new entrants, and the government regulators. The EU intent is that no serious obstacle shall last for long so that eligible EU customers will not be disadvantaged. The eligible industrial customers are the biggest forces for change and the earliest beneficiaries of savings. A state or utility that tries to protect itself by slowing the process puts its own industrial customers at a disadvantage. A market cannot long have competing utilities that retain different classes of customers: one economically disadvantaged, lacking choice and options, and the other just across the border, with improved economics and levels of services.

Fuel use trends

European power generation by fuel type is dominated by thermal (coal, gas, or oil) plants at 48% (Table 5). Nuclear generation in 1995 was 31 %.By 2010, gas-fired power plant capacity in Europe, according to Enron, is forecast to nearly double from 8% today to 15% of power plant capacity.

On a fuel-use basis today, coal, oil, and hydro generate 32%, 8%, and 20% of Europe's power, respectively. Nuclear is 31%. Natural gas generates about 8% of Europe's electricity. Renewables combined represent a 1% share.

It is likely that more private power plant investors will choose gas for power plant fuel, based on 50% lower capital costs for combined-cycle gas plants compared with coal plants, and the environmental advantages of decreases in emissions of 99% for SOx, 81% for NOx, and 58% for CO2. The higher utilization rates-up to 95%-of these combined-cycle units offer much greater fuel to kilowatt-hour efficiency compared with 75-80% utilization rates for coal plants, which require greater maintenance downtime.

Warmer weather and higher hydro levels due to greater snowfalls in 1997 resulted in a 1.5% decrease in gas demand for heat and power in Europe (Table 6 [22,236 bytes]). Still, gas use growth rose rapidly in Spain, Ireland, Italy, and Denmark.

In the U.S., power plant fuel use is dominated by coal at 51% (Table 7 [12,285 bytes]). About 27 % of the kilowatt-hours generated in 1996 are from clean sources: gas, hydro, and renewables combined.

Opportunities for electricity growth

The low rate of growth in electricity in most markets in Europe may be a reflection of tight regulatory control in the past.In Germany, for example, the fragmented structure of regional monopolies can appear to some observers to be resistant to timely change. But since there are portions of the country with costs too high and out of balance, a change appears necessary. German industry and banking support the draft legislation along the EU lines. As industrial rates on the continent decrease by 10-30% from the current 7-9¢/kw-hr levels, these new revenue sources can shift back into the hands of the industrials to deploy in new investments and for export product and trade development. This will improve industrial competitiveness, not only in Germany, but across the EU region.

France sees the opportunities to sell power and invest outward into the northern industrial tier of Europe (where electricity costs are often higher and overcapacity exists), but fears losses of market at home-the quid pro quo. The U.K. and the Nord Pool offer opportunities for spot transactions in the industrial tier north, where industrials may seek partial supplies from the Nord Pool. Spain already has a pool in operation as of Jan. 1, 1998. The Netherlands also has a power pool under consideration. The pools will have both generator-sourced players and "non-genco" but "trading skill-based" brokers. As of March 1998, only the Spanish Pool and Nord Pool allow bilateral trading.

In the U.S. and Europe, contract sales and spot sales will be combined and changed to meet buyers' needs in an electricity supply and services portfolio. Complexity in pricing, terms, options, and quantities, and qualities will increase. Incumbents are cutting prices to retain markets. New entrants will offer competitive prices and new products to win markets-both putting downward pressures on price and increasing complexity and volatility. Markets in Europe and the U.S. are expected to greatly increase the type and number of emissions trading transactions to help manage environmental protection risk in the power sector. The market will develop new kinds of transactions, such as swaps, spot markets, a futures market for power, new supply interconnect channels, new participants, the rise of electronic power trading networks (that occurred in the U.S. in just over 2 years), and tolling, where traders offer fuel and get kilowatt-hours or other fuels back.

Trends, observations

The benefits of competition and liberalization depicted outweigh the near-term challenges of restructuring and change.As eligible customers and sellers rebundle delivered power, they will establish new terms, paths, and methods for brokering transportation and distribution. Buying and selling both the commodity and the financial instruments will offer opportunities to earn margins on both kinds of trading as well as earn or arbitrage on the value of commodities or related assets. The market for trading emissions credits will grow and globalize over time. Fuel use decisions will be increasingly market-oriented, flexible, and require more environmental factors to be taken into account.

Innovation and new talent will be developed and new automated systems will be built to manage electric commodity price risk of the industrial companies and the traders' portfolios alike.

Asset-based profits can rise or fall in a capacity-long or -short market, and the borders of how markets are defined will shift and vary over time.

The overall change for increased market efficiency in the electric industry structure, coupled with the skill-based talents of its participants, will add value and provide a new growth paradigm in these evolving markets on both sides of the Atlantic.

The Author

Margaret M. Carson is director of corporate strategy and competitive analysis for Enron Corp., Houston. She joined Enron in 1987. A graduate of the University of Pittsburgh, she also holds an MS in management from Houston Baptist University.

Trillion dollar international independent power market slows

Growth in the international independent power (IIP) market has slowed.Characterizing this market as more than 3,000 projects outside the U.S. and Canada featuring a combined potential power capacity of about 1,067 GW, Hagler Bailly Inc., in a new study, noted that the rate of increase both in capacity and in the number of projects in 1997 lagged that of the preceding year.

The study lays the blame for this reversal at the doorstep of Asia's economic crisis and a softening in Europe's power market in 1997.

The Arlington, Va.-based consultant's observations are based on its proprietary database that tracks more than 3,010 current greenfield and privatization initiatives in non-utility generation in 107 countries outside the U.S. and Canada.

Non-utility transmission and distribution opportunities are also monitored in more than 40 of these countries.

The potential value of these non-utility investments exceeds $1 trillion, according to Bailly analysts.

1997 slowdown

Although the past year saw a 47% drop in IIP greenfield additions, which were 7.2 GW below 1996's record 19 GW, 1997 posted 20% growth when compared with 1995, said Bailly analyst Mark Symonds.The number of generation privatizations also declined last year, by 30%: 23.7 GW in 1997 vs. 33.5 GW a year earlier. As a result, the volume of total generation-related closings dropped by 40% in 1997 to $29 billion from $48 billion in 1996.

About 70% of that slowdown can be attributed to the Asian crisis, with the balance due to a somewhat weaker European market, claimed Symonds.

Although these figures demonstrate a recent slowdown, which is expected to continue into 1998, the underlying depth of the IIP market remains, Symonds said. About 77 GW of greenfield capacity is now operating, accounting for nearly 9% of the total greenfield capacity in operation. This represents a 17% increase in just the last 6 months. Over this same period, another 13 GW was privatized, an 18% increase, bringing the total capacity of generation assets privatized to 86 GW.

Asia leading

Symonds said that Asia is the region with the largest potential future growth and accounts for 72% of new greenfield project capacity under development worldwide at 594 GW from 1,339 projects.He said Europe, Latin America, and Africa/Middle East have only 81 GW, 74 GW, and 72 GW, respectively, of greenfield project activity in development. Their shares of capacity under development are 10%, 9%, and 9%.

Fossil fuel-fired projects, he added, continue to dominate greenfield development with 1,356 projects accounting for 636 GW, or 78% of the capacity in development stages. Although there are more gas/oil-fired projects than coal-fired projects (39% vs. 22%), each of the two categories represents about 40% of IIP capacity.

In the past 6 months, there has been a 17% increase in the total number of privatization initiatives, and a 10% increase in the capacity represented. The total number of privatized generation assets is now 147.

Latin America, where 29 GW of capacity has changed hands through 65 transactions, continues to lead in this category, relative to Europe and Asia, which have seen fewer transactions-36 and 41, respectively. Latin America has the most pending privatization activity-41 projects representing 36 GW-while fewer projects have been offered to the private market in Europe and Asia.

Demand growth

The demand for new power generation resources is underscored by the fact that there are more than 600 open solicitations to develop new greenfield projects, and there are 150 invitations to privatize generation assets in 82 countries.The pace of solicitation announcements remains strong: 65 GW of new solicitation activity in 1993, a further 38 GW announced in 1994, followed by 64 GW in 1995, and 95 GW (an all-time high) of new solicited demand in 1996. However, new solicitation announcements in 1997 slowed to 72 GW for the full year.

About 90% of IIP demand is found in the top 25 country markets. The most active of these countries are India and China, with 268 outstanding solicitations for new capacity and privatization requests combined.

On the solicitation side, these two nations continue to reflect vastly different project size trends: China is seeking 156 GW with fewer solicitations than India, which is requesting 77 GW. Bailly's analysis indicates that 85% of the capacity solicited in China is for projects larger than 1,000 MW, while a large portion of the capacity sought by India falls into smaller size ranges: 18% in projects under 500 MW (46% under 1,000 MW).

Other countries with a very active total demand include Brazil 52 GW, Ukraine 32 GW, Pakistan 30 GW, and Turkey 23 GW, the study showed. Collectively, the top six countries represent 66% of the total capacity solicited in the IIP market.

Copyright 1998 Oil & Gas Journal. All Rights Reserved.