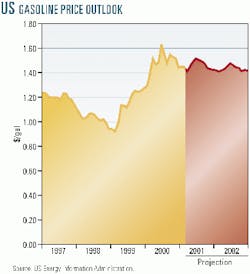

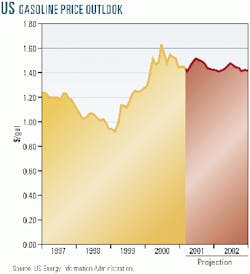

EIA expects summer gasoline prices in the US to stay high

US retail gasoline prices will average $1.49/gal this summer, lower than last year's average of $1.53/gal but still the second highest summer average on record, according to the US Energy Information Administration.

The forecast reiterated testimony the agency gave last month before Congress (OGJ Online, Mar. 30, 2001).

EIA's latest short-term forecast assumes no unplanned refinery outages or distribution bottlenecks.

The agency said that lower-than-normal crude and gasoline inventories may also contribute to price volatility this summer.

"While there are reasons to believe that summer gasoline costs may not rise much above current levels, some of the same conditions that contributed to sharply rising prices last year are reappearing this spring, such as low inventories and high crude oil costs," EIA said.

Other highlights

Other highlights of the EIA forecast include:

- The average cost of imported oil to US refiners is expected to be about $25/bbl in 2001 and about $26/bbl in 2002. EIA noted that the continued slowing US economy and increasing inventories should have resulted in softer oil prices, but these factors have largely been offset by production cuts by the Organization of Petroleum Exporting Countries.

- Spot natural gas prices are now projected at $4-5/MMbtu through the end of summer. EIA said record low underground storage levels are to blame. In addition, prices will be sensitive to variations in summer weather conditions that could lead to high electricity demand and competition for gas needed for storage injections. "Only sharply higher-than-expected production performance or a sharper-than-anticipated downturn in industrial activity this year will ease continued upward pressure on gas spot prices," EIA cautioned. "Bolstering the strength of underlying gas demand are the expectations that hydroelectric and nuclear power availability this summer are likely to fall below levels seen during the summer of 2000, due to low precipitation rates and plant outages due to required maintenance."

- Summer electricity demand in 2001 will have slower growth than that seen last summer, mainly because of the slowed economy, EIA said. A more important factor in this expectation is a dramatically lower rate of growth in the economy.

"We are currently pegging year-to-year growth in real GDP for the summer at 1.5% compared with a rate last summer that exceeded 5.5%, EIA said.

But the agency cautioned that any growth at all may strain power resources that are already near the limit, the US West being a prime example. "The fact that California has already experienced blackouts in 2001 does not bode well for the chances of getting through the summer without serious power supply problems in at least one key area of the country," EIA said.