Chevron takes over operatorship of block offshore Uruguay

Chevron Corp. has officially taken over operatorship of AREA OFF-1 block in Uruguay and 3D seismic acquisition on the block is expected late in this year’s fourth quarter.

Handover of the South American block occurred in first-half 2025, partner Challenger Energy Group PLC said in a half-year report Sept. 3.

In November 2024, Chevron completed a farm-in with Challenger to acquire a 60% interest in the offshore block, along with “various work streams necessary to prepare for 3D seismic acquisition,” Challenger’s chief executive officer Eytan Uliel told stakeholders.

Uliel noted the start of seismic acquisition is still subject to finalization of permitting by the Uruguayan Ministry of Environment, “a process which is well advanced,” he said.

In July, Challenger said the Ministry has consultations planned ahead of permit issuances, and that a final consultation was expected late that month. At the time, Challenger said it expected permits to be granted in August/September.

Chevron will carry the full cost of the seismic campaign up to a total program cost of $37.5 million.

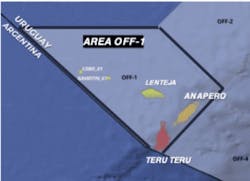

The 14,557-sq km block lies about 100 km offshore in water depths of 80-1,000 m, and holds prospective inventory of about 2 billion bbl of recoverable resource (Pmean) through multiple prospects (Teru Teru, Anapero, Lenteja) in a range of play types, according to Challenger.

Elsewhere in Uruguay, Challenger progressed work at the 13,000 sq km AREA OFF-3 block, substantially completing its planned technical work program in August.

The primary geotechnical work focused on the licensing, reprocessing, and interpretation of a 1,250 sq km 3D seismic data set. Other subsurface studies addressed the geochemistry and further de-risked AREA OFF-3 exploration potential, the company said.

The company began a formal farmout process for the block on Sept. 1.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.