Firms submit $159 million in high bids in Lease Sale 253

The US Bureau of Ocean Energy Management reported that its region-wide Gulf of Mexico Lease Sale 253 received 165 bids from 27 companies on 151 of the 14,554 blocks offered, resulting in a total of $159 million in apparent high bids. The sale was held Aug. 21 in New Orleans.

The total amount bid was less than region-wide Lease Sale 252 held in March when BOEM received 257 bids totaling close to $244.3 million in apparent high bids for 227 tracts (OGJ Online, Mar. 20, 2019).

The most sought-after acreage during this most recent sale was in the deepwater and ultradeep water, as blocks in 800-1,600 m of water received 68 bids and blocks in more than 1,600 m of water received 49 bids. The deepest block receiving a bid was Lloyd Ridge Block 149 in 2,979 m of water.

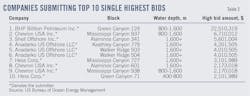

Equinor Gulf of Mexico LLC submitted the greatest number of high bids, submitting 23 apparent high bids for a total of $16.8 million. BP Exploration & Production Inc. came in second with 21 total apparent high bids worth $14.69 million.

Based on the sum of high bids submitted, BHP Billiton Petroleum (Deepwater) Inc. was at the top of the list with 20 total high bids totaling $41.5 million. Anadarko US Offshore LLC placed second on that list with 14 apparent high bids for a total of $23.4 million. Chevron USA Inc. came in third with $22.6 million for 17 high total high bids.

Mississippi Canyon Block 253 received the most bids with 4 submitted. The highest bid on a block came from BHP Billiton Petroleum. The company—the only firm to submit a bid on Green Canyon Block 124—bid $22.5 million.

The high bid comes after bids for the block were previously rejected by BOEM’s fair market value process, said Mike Celata, director of BOEM’s New Orleans Office, in a press call Aug. 21 to announce sale results.

BOEM reviews all high bids received and evaluates all blocks using either tract-specific bidding factors or detailed tract-specific analytical factors to ensure that FMV is received for each OCS lease issued.

“Overall, we had 15 rejects from the past that were bid on in this sale,” said Celata, resulting in a $47 million return. The FMV process can sometimes draw additional interest by companies looking at potential opportunities, he said.

While companies look for opportunities near existing fields, they’re also looking for future prospects, Celata said. In the lower Tertiary East Breaks, companies are pushing boundaries. In Lloyd Ridge, where companies have historically drilled in shallow Miocene, Celata pointed to the potential for presalt plays on the edge of DeSoto Canyon as the Norphlet geologic play develops.

Offering $6.71 million for Mississippi Canyon Block 937, Chevron USA Inc. submitted the second-highest single bid of the sale. Shell Offshore Inc. also was among the top-ranked companies submitting single-highest bids, with a bid of $5.6 million for Alaminos Canyon Block 341.

Lease Sale 253 comprised about 14,554 unleased blocks in a range of 3-231 miles offshore across the gulf’s western, central, and eastern planning areas in 9-11,115 ft of water.

This was the fifth offshore sale in the Department of Energy’s Outer Continental Shelf 2017-22 program, which plans a total of 10 sales.

BOEM previously said the Lease Sale 253 could net 48 billion bbl of undiscovered technically recoverable oil and 141 tcf of undiscovered technically recoverable gas.

Capital discipline is key

Capital discipline remains key for offshore operators, judging by the results of this most recent region-wide gulf lease sale, said a research analyst at Wood Mackenzie.

“While this is a decrease of about $85 million (35%) from the last region-wide lease sale in March 2019, total 2019 lease high bids were the most since 2015,” WoodMac said.

Michael Murphy, WoodMac research analyst, said, “With the total price per acre remaining relatively flat and an overall decrease in spend compared to the previous lease sale, capital discipline remains at the forefront in the Gulf of Mexico.”

WoodMac cited a “notable participant” in Anadarko Petroleum, fresh from being acquired by Occidental Petroleum Corp., with the top five by number of bids, leasing acreage in the Lower Tertiary trend. Equinor and BP continued to build on their potential Lower Tertiary and Norphlet inventory in the East Breaks and Lloyd Ridge protraction areas, respectively, WoodMac said.

“While we saw companies pick up acreage near remote areas, the infrastructure-rich Mississippi Canyon was the bid engine of the sale, capturing roughly 25% of total bids. Infrastructure-led exploration continues to be a theme that companies are playing into,” Murphy said.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.