MARKET WATCH: Oil benchmarks hold flat pending G20, OPEC meetings

Benchmark oil prices for August held fairly flat, gaining only a few cents on the New York and London markets on June 27 as oil investors awaited a weekend meeting between the presidents of the US and China.

The leaders of G20 countries meet June 28-29 in Osaka, Japan. The most closely watched event will be a separate meeting between US President Donald Trump and Chinese President Xi Jinping on June 29 to discuss US-China trade relations, which have been strained all year.

The Organization of Petroleum Exporting Countries has meetings scheduled for Vienna on July 1-2. The Joint Ministerial Monitoring Committee (JMMC) meets first to review oil production levels before the full OPEC meeting to discuss JMMC’s findings.

OPEC and some non-OPEC members meet on July 2 to discuss whether to extend production-cut targets into this year’s second half to support oil prices.

Oil analysts suggest Brent is on course to gain 25% in the first half of this year while light, sweet crude is likely to gain 30%.

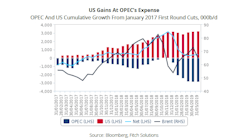

Fitch Solutions Macro Research (a unit of Fitch Group) issued a report saying OPEC+ members face tough decisions. Weakening oil prices build the case to extend 2019 production cuts. Oil prices now are at the same levels as when the first decision to implement cuts was taken in 2017.

Analysts with Fitch Solutions expect OPEC+ will remain broadly compliant as export pipeline issues in Russia look to limit output into the summer, the report said.

“Recent Middle East tensions have boosted prices, but longer-term pressure from rising US shale output raises the specter of both declining market share and sustained price weakness,” Fitch Solutions said.

Helima Croft, global head of commodity strategy for RBC Capital Markets LLC, said the OPEC and OPEC+ meetings “are taking place against an incredibly fraught geopolitical backdrop with oil tankers and critical energy infrastructure being targeted in the Middle East amid a deepening security crisis over Iran.”

Still, RBC Capital Markets analysts believe the actual output decision will be relatively straightforward. Croft expects the existing 1.2 million-b/d production cut will be rolled over for the rest of the year.

“Russia is in a better financial position than many OPEC countries, but is still facing economic headwinds and is not entirely impervious to a fall in oil prices,” Croft said. “In addition, it has gained substantial soft power benefits from the agreements and hence, we maintain that Moscow will retain its place at the head of the Vienna alliance table.”

Croft said she also expects tensions between Iran and its regional rivals will be on full display in Vienna.

Energy prices

Light, sweet crude oil on the New York Mercantile Exchange for August delivery gained 5¢ to $59.43/bbl on June 27 while the September contract rose 6¢ to $59.49/bbl.

NYMEX natural gas for August climbed 5¢ to a rounded $2.32/MMbtu.

Ultralow-sulfur diesel for July fell nearly 2¢ to $1.95/gal. The NYMEX reformulated gasoline blendstock for July decreased 2¢ to a rounded $1.95/gal.

Brent crude for August added 6¢ to $66.55/bbl. The September price decreased 2¢ to settle at $65.67/bbl.

The gas oil contract for July fell $5.25 to $594/tonne on June 27.

The average for OPEC’s basket of crudes was $65.61/bbl on June 27, up 1¢.

Contact Paula Dittrick at [email protected].

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.