EIA: US natural gas production to hit record highs in 2026-27

US natural gas marketed production is expected to rise 2% to average 120.8 bcfd in 2026, then increase further to a record 122.3 bcfd in 2027, according to the US Energy Information Administration (EIA)’s latest Short-Term Energy Outlook (STEO). About 69% of total forecast output over the next 2 years will come from the Appalachia, Haynesville, and Permian regions.

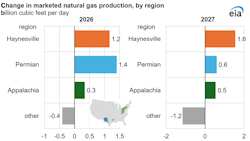

Haynesville output is forecast to increase by 1.2 bcfd in 2026 and by 1.6 bcfd in 2027, supported by relatively strong natural gas prices through the outlook period. EIA expects Henry Hub prices to rise from $3.52/MMbtu in 2025 to $4.31/MMbtu in 2026 and $4.38/MMbtu in 2027, keeping Haynesville drilling economics attractive despite deeper, higher-cost well development. The region’s proximity to LNG export terminals and major industrial consumers along the US Gulf Coast also continues to support activity.

The Permian basin is projected to add 1.4 bcfd of production growth in 2026 and 0.6 bcfd in 2027. Output gains are largely driven by associated gas production from oil drilling. EIA estimates oil-directed rig activity will remain relatively subdued as West Texas Intermediate (WTI) crude prices decline from $65/bbl in 2025 to an average $53/bbl in 2026 and $49/bbl in 2027. Even so, rising gas-to-oil ratios (GOR) are expected to support continued natural gas production growth in the basin.

Appalachia has supplied the largest share of Lower 48 natural gas production in recent years, accounting for about 32% annually since 2016. However, growth has slowed due to pipeline constraints. In June 2024, the Federal Energy Regulatory Commission (FERC) authorized the Mountain Valley Pipeline to begin operations, adding new takeaway capacity. As a result, EIA estimates Appalachian production will increase modestly by 0.3 bcfd in 2026 and by 0.5 bcfd in 2027.