Russia’s crude exports signal narrowing buyer pool

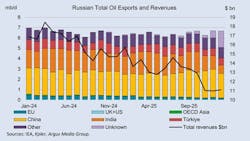

Russian crude and oil product exports fell by 90,000 b/d month-on-month (m-o-m) to 7.5 million b/d in January, according to data from the International Energy Agency (IEA) and shipping companies. Export revenues rose by $130 million from December to $11.1 billion, supported by higher prices, but remained $4.6 billion below year-ago levels.

A growing number of vessels sailing to unknown destinations and a sharp rise in Russian oil held on water—up as much as 49 million bbl since November 2025—suggest a shrinking pool of willing buyers.

Russian crude exports declined by 350,000 b/d m-o-m, reversing most of December’s 360,000 b/d increase. The bulk of the drop came from the Black Sea, while product exports rose by 260,000 b/d, largely driven by heavy product flows (+200,000 b/d). Higher prices boosted revenues across both crude and products. Product revenues climbed by $330 million, more than offsetting a $210 million decline in crude export revenues.

Separately, Russia reported a 24% year-on-year decline in 2025 oil and gas tax revenues to about $110 billion.

Under the European Union (EU)’s revised mechanism, the price cap on Russian crude was lowered to $44.10/bbl as of Feb. 2. Urals Primorsk averaged $40.06/bbl in January. Of total crude exports, 65% were sold by Russian proxy companies, 13% by sanctioned firms, and 21% by other companies. Among the proxy companies, Redwood Global FZE LLC—Rosneft’s substitute—remained the largest crude exporter, supplying 1 million b/d to China and India last month.

Russian crude imports

EU enforcement measures are beginning to reshape trade flows. Since Jan. 21, EU buyers have been required to more rigorously verify the origin of imported products. In 2025, the EU-27 and UK sourced 12% of their middle distillate imports from refineries in India and Türkiye processing Russian crude. India’s Jamnagar refinery halted Russian crude imports in mid-December to comply, as Europe accounted for 40% of its middle distillate exports last year.

As a result, EU and UK reliance on seaborne Russian-origin molecules fell to 1.6% in January, with most cargoes shipped before Jan. 21 and largely originating from Türkiye. Meanwhile, EU middle distillate imports from the US rose by 180,000 b/d to 550,000 b/d, including a record 60,000 b/d of kerosene imports—the highest since 2022.

India imported 100,000 b/d less Russian crude in January, bringing volumes down to 1.1 million b/d, though public-sector refiners and the Rosneft-linked Vadinar refinery increased purchases by 310,000 b/d. China, despite weaker seasonal demand, raised seaborne Russian crude imports by 290,000 b/d to 1.7 million b/d. Urals shipments to China alone climbed by 250,000 b/d to 500,000 b/d, the highest level ever recorded for the grade.

Among non-OECD importers with sufficient refining complexity to process Urals, China remains the main candidate to absorb additional Russian supply, supported by 19.9 million b/d of refining capacity. In 2025, China imported 11.4 million b/d of crude, with Russian barrels accounting for roughly 17%. However, net clean product exports of 290,000 b/d last year indicate the domestic market is already well supplied. Any additional Russian imports would likely require China to displace other suppliers or place more crude into storage. In January, China already reduced Middle East crude imports by 630,000 b/d m-o-m to 5.0 million b/d.