Oil, fundamental analysis

Last week’s crude rally, which had started on the announcement of an armada heading towards Iran, gained further momentum this week on President Trump’s re-emphasis of the US demands and the approaching naval fleet. An unexpected inventory draw, along with Winter Storm Fern fueling heating oil demand and causing freeze-offs, served to add fundamental support for the uptrend.

Prices for the US grade have broken through the technically important Upper-Bollinger Band limit, a Sell signal. Bearish news came in the form of the restart of Kazakhstan’s production and the announcement of the lifting of most sanctions on Venezuelan’s production and exports.

WTI’s weekly high of $66.50/bbl occurred Thursday while the low of $60.15 was on Tuesday. Brent followed a similar pattern with its high of $71.90/bbl on Thursday and its weekly low of $65.00 on Tuesday. Both grades settled higher week-on-week. The WTI/Brent spread has widened to ($5.70). Prices have not been this high since late September 2025.

Pres. Trump has stated that he has given Iran a deadline to make a deal over its nuclear program, ballistic missiles, and other issues, but would not reveal that date. He emphasized that the naval armada was larger than the one sent to Venezuela. While a direct attack on Iran does not seem likely in the near-term, a naval skirmish in the Strait of Hormuz would interrupt a vast supply of crude exports in the region. According to Pakistani sources, Iran plans on conducting a live fire drill next week in the Strait and has warned ships at sea there. Traders have valued this rising risk premium at around $3-4.00/bbl.

Venezuela’s National Assembly approved the partial reform of its Organic Hydrocarbons Law that will ease oil and gas sector regulations and encourage private foreign investment. Coinciding with this legislation, the US Treasury Department issued General Rule 46 authorizing broad transactions with Venezuela and PDVSA having to do with marketing and transport of Venezuelan oil. Established US entities are authorized but Russia, Iran, North Korea, and Cuba are excluded. Additionally, the US has lifted the air travel restrictions that have been in place since 2019.

China’s PetroChina has ordered its traders not to buy Venezuelan crude after the US invasion, preferring to seek out Canadian supplies. China’s record stockpiling of crude last year is said to have provided a floor for global oil prices and this activity is expected to carry into 2026 as it builds another 94 million bbl of storage capacity. This does, however, underscore a vastly over-supplied global crude oil market.

Meanwhile, India’s Reliance will resume imports of Russian Urals while Brazil signs agreements to sell oil to various Indian refiners. Mexico’s Pemex has now reversed course and will not send its latest shipment of oil to Cuba perhaps feeling pressure from the Trump administration.

The OPEC+ group will meet this weekend and market observers don’t expect any decision to increase output quotas. And, in the US, Winter Storm Fern curtailed an estimated 2.0 million b/d of oil and 10 bcfd of natural gas caused by a combination of power outages and freeze-offs.

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week declined while production held at 13.7 million b/d. The SPR was +520,000 bbl to 415 million bbl.

The Federal Reserve declined to make another reduction in interest rates this week citing an improving economy and the start of stabilization in the job market. Claims for unemployment benefits fell last week while new hiring remains lackluster. However, Amazon, UPS, and Dow have all announced thousands of layoffs coming. Meanwhile, the US trade deficit rose 95% in November to $56.8 billion, the largest 1-month increase since 1992. Third-quarter 2025 GDP rose 4.4%. The Dow is lower week-on-week while the S&P and NASDAQ have posted slight gains. The USD is lower week-on-week which is supportive of oil prices. Gold has come off of its recent highs and is back below the $5,000/oz. level.

Oil, technical analysis

March 2026 WTI NYMEX futures are still trading above their 8-, 10-, and 20-day Moving Averages on this week’s rally and have breached the Upper-Bollinger Band limit, a Sell signal. Volume is around the recent average at 365,000 after Thursday’s 530,000. The Relative Strength Indicator (RSI), a momentum indicator, is in overbought territory at 67. Resistance is now pegged at $66.50 (Thursday’s High) while near-term critical Support is $65.10 (Upper-Bollinger Band).

Looking ahead

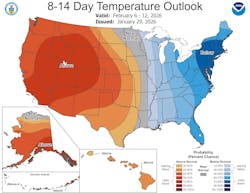

Threats have been made and supposedly deadline has been given. The market will now be watching closely to see if Iran seeks a deal or if Trump follows through on his threats. Predictive markets favor an invasion of Iran by June. Supply increases are coming in the form of dropped sanctions on Venezuela and the restart of Kazakhstani production. A bomb cyclone coming on the heels of Winter Storm Fern has brought more cold to the East Coast and Southeast. And the 8-14-day forecast is bullish for heating oil demand in the Northeast.

Natural gas, fundamental analysis

Extreme cold brought on by Winter Storm Fern and a resultant above-forecast draw in storage sent natural gas prices for February rocketing higher. February 2026 NYMEX natural gas futures settled at a 3-year High of $6.80/MMbtu Wednesday after hitting a contract High of $7.85. The March 2026 contract became the prompt month on Thursday, leading to a $4.00 decline on the Open.

The week’s High was $7.85/MMbtu on Wednesday (February) while the week’s Low was $3.75 (March) on Thursday. Natural gas demand this week has been estimated at up to 156 bcfd, higher than January’s 5-year average of 137 bcfd. Production was thought to be 109 bcfd.

In the UK, natural gas prices at the NBP were most recently higher at $13.35/MMbtu while Dutch TTF futures were $13.90 as US prices have risen on the major winter storm. Asia’s JKM was quoted at $11.50/MMbtu. US LNG exports were about 18.7 bcfd last week. The EIA’s Weekly Natural Gas Storage Report indicated a withdrawal of 242 bcf vs. a forecast of -233 and a 5-year average of -206 bcf. Total gas in storage is now 2.83 tcf, now 7.9% above last year and 5.3% above the 5-year average.

Natural gas, technical analysis

March 2026 NYMEX Henry Hub Natural Gas futures shot right through the Upper-Bollinger Band limit this week to well-above the 8-, 13-, and 20-day Moving Averages on February’s momentum and the continuing cold. Volume was about average at 300,000. The RSI has moved into very overbought territory at 73. Support is $4.25 (Upper-Bollinger Band) with key Resistance at $4.50.

Looking ahead

The new cold wave that came down as part of the bomb cyclone is again bullish for natural gas demand. Expect freeze-offs to continue as sub-freezing temperatures remain in some producing areas. This week’s demand will be reflected in next week’s storage report. Look for the withdrawal to exceed this week’s amount and flip the current surpluses to a deficit vs. last year and the 5-year averages.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.