Threats of an armada heading for Iran rally crude oil prices

Oil, fundamental analysis

President Trump’s announcement that a US Naval “armada” is heading towards Iran fueled a rally in crude prices this week that had otherwise been range-bound on conflicting signals.

Possible progress in Russia/Ukraine talks and across-the-board gains in crude and refine product stocks had dropped prices below the key $60/bbl mark before Trump’s statement on Iran. WTI’s weekly high of $61.26/bbl occurred Friday while the low of $58.55 was on Tuesday. Brent followed a similar pattern with its high of $66.05/bbl on Friday and its weekly low of $63.25 on Monday. Both grades settled higher week-on-week. The WTI/Brent spread has widened to $4.80.

On Thursday, Trump again said he was “watching Iran closely” in regard to governmental actions against protestors there, adding that a US Navy “armada” was heading toward the country, once again raising the geopolitical risk premium in global oil markets as the Strait of Hormuz could again be "in play." On the flip side, in post-Davos comments, the President said he would hold off on the threaten tariff increases on country’s that opposed his planned takeover of Greenland. Furthermore, after US representatives met with the Kremlin in Moscow, there is now a planned meeting in the UAE for the US, Russia, and Ukraine. Ukranian Pres. Zelensky has expressed some optimism regarding the meeting.

Meanwhile, Kazakhstan’s largest oil field halted production Friday due to power issues, adding further bullish sentiment since it represents actual supply curtailment and not perceived disruption.

The market overall still remains bearish with an oversupply outlook despite a report by the International Energy Agency (IEA) raising its global oil demand forecast. The agency foresees positive economic growth but warned that supply will still outpace consumption this year. The economy of the world’s largest importer of oil, China, expanded by +5% last year according to governmental data.

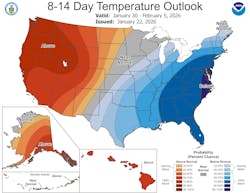

Winter Storm Fern will have an impact on heating oil demand this week as the cold front covers the entire consuming region. HO is also a replacement fuel for many power plants should natural gas freeze-offs curtail supplies. February NYMEX ULSD futures are up +$0.20/gal. this week which is also supporting higher crude prices.

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week increased again. Total US oil production dipped to 13.7 million b/d vs. 13.5 last year at this time while the SPR was up 800,000 bbl to 415 million bbl.

Consumer spending for the third quarter of last year was +3.5% and led the GDP higher to +4.4% which was up from second-quarter 2025's +3.8%. Spending on durable goods such as cars was only up 1.6%. Job creation since last March has only averaged +28,000 per month but unemployment is holding at 4.4%.

The Producer Price Index (PPI) rose 0.2% in November leading to a year-on-year increase of 3.0%. Personal income for November was +0.3% vs. a forecasted +0.4%.The PCE, the Fed’s preferred indication of inflation increased in November by +0.2% to an annual rate of +2.8%. The Fed will hold its first policy meeting of the year next week and there are no expectations of another rate cut at this time. The Dow and S&P are off slightly this week while the NASDAQ saw a small gain. The USD is lower week-on-week which is supportive of oil prices. Investors appear to have moved into hard assets such as silver and gold as the former hit $100/oz. while the latter pushed towards $5,000/oz.

Oil, technical analysis

March 2026 WTI NYMEX futures are trading above their 8-, 10-, and 20-day Moving Averages on this week’s rally. Volume is lower than the recent average at 195,000. The Relative Strength Indicator (RSI), a momentum indicator, is moving out of neutral territory at 59. Resistance is now pegged at $61.95 (Upper-Bollinger Band) while near-term critical Support is $560.35 (8-day MA).

Looking ahead

It’s hard to assume a solid agreement will come out of the US/Russia/Ukraine meeting in the UAE as we’ve “seen this movie before,” so traders will proceed with caution. Likewise, Trump’s threats are generally not followed through with regard to Iran so, the market will have to take a wait-and-see approach with that situation. The reigning theocracy in Iran has pushed back thus far against Trump.

The 8-14-day forecast continues to be bullish for heating oil demand with normal to below-normal temperatures enveloping the consuming regions.

Natural gas, fundamental analysis

Winter Storm Fern has already pushed both February NYMEX natural gas futures and daily cash spot market prices much higher this week despite storage levels that are above the 5-year average for this time of year and the governor of Texas has made a disaster declaration for 134 counties in the state ahead of the storm. A larger-than-expected storage withdrawal last week also supported the rally.

The week’s High was $5.65/MMbtu on Thursday while the week’s Low was $3.40 on Tuesday. In the UK, natural gas prices at the NBP were most recently much higher at $13.20/MMbtu while Dutch TTF futures were $13.85 as US prices have risen on the major winter storm. Asia’s JKM was quoted at $11.15/MMbtu.

The US became the first country ever to export 100 million tonnes of LNG last year. The EIA’s Weekly Natural Gas Storage Report indicated a withdrawal of 120 bcf vs. a forecast of -103 and a 5-year average of -191 bcf. Total gas in storage is now 3.065 tcf, now at 4.8% above last year and 6.1% above the 5-year average.

Natural gas, technical analysis

February 2026 NYMEX Henry Hub Natural Gas futures shot right through the Upper-Bollinger Band limit this week to well-above the 8-, 13-, and 20-day Moving Averages. While volume this week has been strong, Friday’s volume was below average at 90,000 as traders turn their focus to the March contract since February settles next Wednesday. The RSI has moved into 'very overbought' territory at 74. Support is $5.00 with key Resistance at $5.05.

Looking ahead

Winter Storm Fern should create tremendous demand for natural gas leading to a large withdrawal over the next several days. The market will be monitoring well freeze-ups that will impact available daily supplies.

The longer-term forecast still looks bullish for natural gas demand as well. The IEA is projecting a record year for European imports of LNG which will largely come from the US which was the source of 60% of the supply last year. Look for storage volumes to flip to lower than year-ago and 5-year average levels this week and next.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.