Oil, fundamental analysis

A host of continuing geopolitical situations involving petroleum exporting countries this week provided both bearish and bullish sentiment in global crude markets. The geopolitical risk premium has grown significantly with all of the moving parts.

A large decrease in oil inventory added to the bullish side while significant gains in refined products were bearish. WTI’s weekly high of $59.35/bbl occurred Friday while the low of $55.75 was on Wednesday yet prices still cannot breach the $60/bbl level. Brent followed a similar pattern but hit its high of $63.45/bbl on Friday with its weekly low of $59.75 on Monday. Both grades settled much higher week-on-week. The WTI/Brent spread has widened to ($4.30).

The US conducted an invasion of Venezuela last weekend and arrested its president in what has been described by the administration as a “law enforcement action.” However, President Donald Trump continued to emphasize the oil, and now, the US is claiming control over the country’s production and exports “indefinitely.”

The Sunday evening opening of the February 2026 NYMEX futures market was muted considering the event and actually traded lower on the belief that sanctioned Venezuelan tankers would be free to leave port. Additionally, Pres. Trump’s announcement that US oil companies would go into the country and spend billions to repair its aging infrastructure and increase drilling and production was decidedly bearish in the longer-term.

Furthermore, the current VP of Venezuela pledged 30-50 million bbl of oil to the US in an apparent bid to get to stay in power. But so many questions remain about the future of Venezuela’s oil since the US oil companies have not announced agreement with Pres. Trump’s plans for them. Oil executives are to meet at the White House Friday.

In the meantime, the US has now seized 5 tankers carrying sanctioned oil including one bound for Europe. Chevron has been loading tankers bound for the US feverishly as Venezuelan crude storage is running full due to the sanctions on other shipments.

Ukraine continues to attack Russian oil-related infrastructure as the prospects for peace in the Russia/Ukraine war grow dimmer. Savvy traders should realize that any announcement of a so-called peace agreement or even a ceasefire should be met with great skepticism by now. The US has also seized a Russian-flagged oil tanker in the North Atlantic while the US Senate considers a bill to impose a 500% tariff on countries that purchase Russian Urals.

In Iran, another oil exporting nation, protests have broken out in reaction to the country’s economic troubles and the devaluing of its currency. The government has reacted with force including beating, and, in some cases, shooting those protesting. Internet and phone services have been cut off to millions.

Mohammed Reza Shah Pahlavi, the former crown prince of Iran under his deposed father, has called for the people to take to the streets. Pres. Trump has stated that Iran will be hit “very hard” if the government continues to violently suppress the protestors.

Taking a back seat in oil news this week was last weekend’s OPEC+ meeting where the consortium decided to maintain current output levels.

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week unexpectedly decreased while total US oil production was 13.8 million b/d vs. 13.6 last year at this time. The Strategic Petroleum Reserve was up 200,000 bbl to 413.5 million bbl.

US factory orders for October were -1.3% vs. a forecast of -1.2%. ISM December services PMI was 54.4 vs. an expected 52.6 while its business activity index was 56.0 vs. November’s 54.5. Housing starts for October were -4.6% vs. a consensus forecast of +2.5%. Only 55,000 jobs were added last month while analysts had expected a 73,000 increase but unemployment dipped to 4.4%. Job openings in November alone were down 900,000 from November 2024. For all of 2025, only 585,000 jobs were added to the economy compared with 2.0 million each of the prior years. The Dow, S&P, and NASDAQ are all trading in record territory again this week, up from last week. The USD is higher week-on-week which may cap crude’s current rally.

Oil, technical analysis

February 2026 WTI NYMEX futures shot through their 8-, 10-, and 20-day Moving Averages on this week’s rally and have breached the Upper-Bollinger Band Limit, a Sell signal. Volume is slightly below the recent average at 210. The Relative Strength Indicator (RSI), a momentum indicator, is moving out of neutral territory at 58. Resistance is now pegged at $60.00 while near-term critical Support is $59.40 (Upper-Bollinger Band).

Looking ahead

Look for a technical price reversal this week known as “Reversion to the Mean” since February futures moved well past the Upper-Bollinger Band Limit, a key technical indicator. The “too high, too fast” rule-of-thumb should come into effect. In the near term, all volumes of Venezuelan crude that reach the US will be bearish for prices. Longer term, much has to be decided and planned before there is a substantial increase in the country’s output.

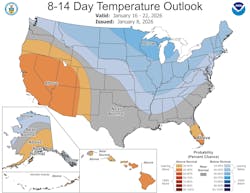

Don’t look for progress in the Russia/Ukraine situation in the coming week. Traders will now be looking to see if Pres. Trump actually does take action in Iran given his threat. Heating oil demand looks good in the 8-14-day period.

Natural gas, fundamental analysis

Without widespread, sustained cold, February NYMEX natural gas futures continue their 3-week downtrend as the storage injection, while near forecasts, turned the total to a surplus above the 5-year average for this time of year. There also have been above-normal temperatures for major sections of the lower-US. The week’s High was $3.65/MMBtu on Wednesday while the week’s Low was $3.25 on Friday.

In the UK, natural gas prices at the NBP were most recently lower at $8.52/MMbtu while Dutch TTF futures were $9.55 and Asia’s JKM was quoted at $9.55/MMbtu. The EIA’s Weekly Natural Gas Storage Report indicated a withdrawal of 119 bcf vs. a forecast of -120 bcf. Total gas in storage is now 3.256 tcf, now 3.6% below last year and 1.0% above the 5-year average.

Natural gas, technical analysis

February 2026 NYMEX Henry Hub Natural Gas futures have now fallen below the 8-, 13-, and 20-day Moving Averages this week and have touched on the Lower-Bollinger Band Limit, a Buy signal. Volume was above average at 230,000. The RSI has moved into oversold territory at 35 on the late week sell-off. Support is $3.30 (Lower-Bollinger Band) with key Resistance at $3.55 (8-day MA).

Looking ahead

Look for a technical reversal but in the opposite direction of crude as natural gas is clearly flashing oversold. As with heating oil, the 8-14-day forecast also looks bullish for natural gas demand. Last week’s storage withdrawal was seasonally low and we now sit at a surplus to the 5-year average. Only a period of sustained cold in high-demand regions can turn this back to a deficit.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.