IEA: Global oil surplus masks regional tightness

The global oil balance continues to point to a substantial supply overhang, with rising observed stocks that would normally signal sharper declines in oil prices. Yet benchmark crude prices have fallen only modestly in recent months, while refined product cracks surged to 3-year highs in November.

This apparent disconnect reflects increasingly divergent dynamics across crude oil, NGLs, and refined products, as well as across regions, according to the International Energy Agency (IEA). It is being driven by a combination of sanctioned supply, longer trade routes, and a tight refining system. While crude markets continue to anchor overall oil pricing, developments in products and NGLs impact their differentials to crude, IEA said.

Stock delay where prices are set

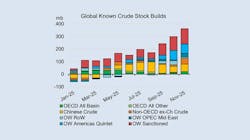

Until September, NGLs accounted for most of the surplus in the global oil balance. Since then, crude oil has taken the lead, with observed stock changes broadly matching the implied surplus. However, much of the incremental crude supply has yet to reach onshore storage, IEA noted.

Instead, according to IEA, excess volumes have accumulated in oil on water and in China. There have been no meaningful stock builds in the Atlantic Basin crude pricing hubs that underpin WTI and Dated Brent. As a result, crude futures have remained in backwardation despite the growing surplus. However, as the overhang shows up in onshore stocks, this would normally weigh on prices and market structure.

Sanctioned exporters—primarily Iran, Russia, and Venezuela—account for more than one-third of the increase in crude oil on water since August. The remainder reflects rising Middle Eastern output and Atlantic Basin barrels increasingly flowing to markets east of Suez.

Crude offshore

Sanctioned oil on water began rising as early as February, following tighter US measures on Russian crude at the end of 2024 and early 2025. The relentless strengthening of US and EU sanctions on Iran, Russia, and Venezuela, combined with a limited number of buyers, resulted in a significant build-up of those volumes afloat, IEA said.

At the same time, rising exports from the Americas have been redirected toward Asia. “More tankers on long voyages raised oil on water by almost 65 million bbl from end-August,” IEA said.

Excluding Russia, Atlantic Basin supply has outpaced regional refinery demand, flipping the region into a marginal surplus. This has pulled North Sea Dated prices below Dubai M1 (the benchmark Middle East crude pricing for prompt delivery in Asia) and kept the arbitrage to Asia open.

“If this overhang persists into first and second-quarter 2026, it could hold the price arbitrage to the East open and delay a stock build in the Atlantic Basin pricing hubs for WTI and Dated Brent,” IEA noted.

China’s stock building

China began building crude stocks in April following the enactment of its new energy law on Jan. 1, 2025, which formally requires both state-owned and private companies to hold strategic reserves. Although stock builds paused in September and October, they resumed in November.

As IEA noted, this new framework for managing strategic reserves is unlikely to result in a smooth, linear build. Instead, stock changes may remain volatile as new tank farms gradually fill to operational levels. These dynamics further complicate the relationship between the global balance and observable pricing signals.

Refined products, NGLs

In contrast to crude, refined product markets have experienced genuine tightness. Swings in the balance for products and biofuels reflect seasonal demand changes and the impact of planned and unplanned refinery outages, IEA said.

Seasonal demand peaks in mid-summer 2025 pushed product balances into deficit, followed by brief builds ahead of refinery turnarounds in September and October when stocks drew.

Looking into 2026, IEA expects that limited spare refining capacity outside China will restrict the ability to rebuild product stocks. In addition, new EU sanctions on imports of products refined from Russian crude are set to disrupt existing trade flows, potentially reinforcing product tightness later in 2026.

According to IEA, NGLs remain the most opaque segment of the oil complex. Since 2024, their surplus has accounted for a growing share of the overall oil balance overhang, helping explain the weak correlation between oil balances and crude prices. However, a widening and unexplained gap has emerged between the NGL balance and known NGL stocks since 2023, IEA noted.

Bottom line

The global oil market is oversupplied on paper, but the surplus is unevenly distributed, according to IEA. Crude oversupply is concentrated offshore and in China rather than in key pricing hubs, refined products remain structurally tight, and NGL balances are poorly understood. Together, these factors explain why oil prices and market structure have remained more resilient than the global balance alone would suggest.