US LNG project sanctions hit record high in 2025 as industry bets on long-term demand

Key Highlights

- Over 90 bcm/year of new LNG capacity was approved in 2025.

- The US accounts for more than 80 bcm of this capacity.

- By 2030, the US could supply around one-third of global LNG, up from 20% in 2024.

- The US and Qatar together will contribute about 70% of the nearly 300 bcm of new LNG capacity expected worldwide by 2030.

- A potential LNG surplus of 65 bcm could emerge due to demand growth not keeping pace with supply.

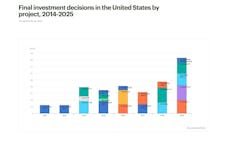

Despite lingering macroeconomic uncertainties, 2025 has seen the second highest amount of LNG liquefaction capacity reaching final investment decision (FID) in a single year, underscoring investor confidence in long-term global gas demand, according to the International Energy Agency (IEA)’s Gas 2025 report. So far in 2025, over 90 billion cu m/year (bcmy) of new capacity has been approved.

The US has accounted for a large share. Over 80 bcmy of liquefaction capacity has been approved year-to-date in the US, an all-time high for the US LNG sector. The projects include Louisiana LNG, Corpus Christi LNG Trains 8-9, CP2 Phase 1, Rio Grande LNG Trains 4-5, and Port Arthur Phase 2.

“The amount of LNG projects reaching FID highlights the industry’s confidence that demand for LNG will continue to expand strongly, reflecting the supportive policy environment in the US for natural gas projects. This new wave of LNG projects is set to further solidify the US’ position as the world’s largest LNG exporter. By the end of the decade, the US could provide around one-third of global LNG supply, up from around 20% in 2024,” IEA said in the report.

Global LNG expansion

The expansion is not limited to the US. Together, the US and Qatar account for about 70% of the roughly 300 bcmy of new LNG liquefaction capacity expected to come online worldwide by 2030, according to IEA. This is based on the official timelines of projects that have reached FID or are under construction.

“The scaling up of LNG supply is playing a key role in rebalancing global gas markets, enhancing supply security and making natural gas more affordable for importing countries,” IEA said.

Once fully operational, the upcoming projects could boost global LNG supply by a net 250 bcm by 2030, even after accounting for declining LNG output from certain legacy producers, according to IEA. To illustrate the scale, that increase is roughly equivalent to 7% of Asia’s thermal coal demand.

In contrast, long-distance pipeline gas trade is projected to decline by nearly 55 bcm between 2024 and 2030, mainly due to reduced pipeline deliveries to Europe.

However, IEA warned that “when considering price trajectories informed by current forward curves, global LNG demand growth is not expected to absorb all incremental LNG supply over the 2024-30 period in the base case. This could result in around 65 bcm of surplus supply.”

In the base case, IEA expects global natural gas demand (excluding bunkers) to increase at an average annual rate of nearly 1.5% between 2024 and 2030. This translates into an increase of 380 bcm by 2030. The Asia Pacific region accounts for almost 80% of this additional demand.