US exports record natural gas volumes to Mexico in 2025 amid growing demand

Key Highlights

- US natural gas exports to Mexico via pipeline hit a record 7.5 bcfd in May 2025, reflecting increased demand, especially in the electric power sector.

- Mexico's natural gas consumption increased to 8.6 bcfd in 2024, with infrastructure constraints prompting expansion plans for pipelines and storage.

- The South Texas corridor, primarily from the Permian basin, accounts for 91% of US exports to Mexico, with ongoing pipeline projects enhancing capacity.

- Mexico is developing new pipelines and LNG terminals to support growing natural gas needs.

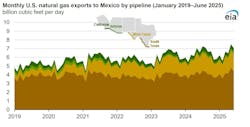

US natural gas pipeline exports to Mexico averaged 7.5 bcfd in May 2025, the most of any month on record, the US Energy Information Administration (EIA) said in a brief analysis Oct. 22.

The record comes as Mexico’s demand for natural gas, particularly in the electric power sector, increases, EIA said.

US natural gas pipeline exports to Mexico, on an annual basis, averaged 6.4 bcfd in 2024, a 25% increase compared with 2019, and the highest on record in data going back as early as 1975, EIA said.

During the same timeframe, total natural gas consumption in Mexico increased to 8.6 bcfd from 7.7 bcfd, with most growth concentrated in Mexico’s electric power sector.

Natural gas exports from the US enter Mexico along four main corridors—South Texas, West Texas, Arizona, and California—with a combined capacity of about 14.8 bcfd and an approximate utilization rate of 43% in 2024.

Factors limiting US natural gas exports to Mexico include constraints in Mexico's pipeline infrastructure, including new pipeline construction and permitting delays, and limited natural gas storage capacity in the country.

In 2024, pipeline exports from West and South Texas collectively accounted for 91% of US natural gas pipeline exports to Mexico. The South Texas corridor connects from the Agua Dulce Hub into northeastern Mexico. Natural gas from the Permian basin in West Texas primarily serves northwestern, central, and southwestern Mexico through various natural gas systems in Mexico, EIA said.

Exports from West Texas increased to 1.8 bcfd in 2024 from 0.6 bcfd in 2019, facilitated by the commissioning of additional connecting pipelines in central and southwestern Mexico in recent years.

The country is continuing plans to expand its domestic pipeline network to meet potential demand growth. Natural gas imported from the South Texas corridor through the Sur de Texas–Tuxpan pipeline has access to LNG terminals, power plants, and other uses of demand, and the pipeline connects with the Gasoducto Puerta al Sureste (Southeast Gateway Gas pipeline), an offshore pipeline completed in 2025 and designed to supply natural gas to new power plants in the Yucatan Peninsula.

In 2022, sections of the Tula–Villa de Reyes and Tuxpan–Tula pipelines began partial operation, with full service anticipated this year. The Energia Mayakan pipeline is expected to expand natural gas infrastructure on the Yucatán Peninsula by 2025. Developers of the Centauro del Norte pipeline, which will provide additional pipeline capacity to northwestern Mexico's combined-cycle power plants, began construction in 2025.

LNG was first exported from Mexico in August 2024 from the Fast LNG Altamira Floating Liquefied Natural Gas (FLNG) 1. Two additional LNG export projects, Fast LNG Altamira FLNG 2 and Energía Costa Azul, are currently under construction with a combined capacity of 0.6 bcfd, drawing supply from US natural gas imports, EIA noted. Supporting pipelines, such as the Sur de Texas–Tuxpan and Gasoducto Rosarito expansion enable the LNG export projects.