Geopolitical risks outweigh bearish sentiment for oil prices

Oil, fundamental analysis

Crude prices moved higher this week as geopolitical risk entered again with Russia/Ukraine and US/Venezuela both inferring potential losses of supply. The weekly inventory report showed a modest increase in crude but large gains in refined products. However, the dominant bearish sentiment took a back seat to the more bullish signals this week.

WTI prices managed to finally crest the key $60.00/bbl mark with the weekly high of $60.50/bbl on Friday after a low of $58.30 Tuesday. Brent followed a similar pattern, hitting its high of $65.10/bbl on Tuesday with its weekly low of $61.85 on Friday as well. Both grades settled higher vs. last week while the WTI/Brent spread has tightened to ($4.00).

Prospects for a Russia/Ukraine peace agreement dimmed this week as Ukraine continues to attack Russian oil infrastructure. Despite these events, Russia has managed to increase tanker loading this month. However, Kazakhstani exports have been curtailed by as much as 50% due to damage to the Caspian Pipeline Consortium which moves about 80% of Kazakhstan’s exports.

Tensions between the US and Venezuela increased this week as President Donald Trump ordered President Maduro to leave his country, which he has refused to do. The Trump administration appears to be building a case for military action on Venezuelan soil with the USS Gerald Ford Carrier Strike Group situated off the coast.

During its meeting last Sunday, the OPEC+ group agreed to hold output at current levels into early 2026 but pledged to re-assess each member’s maximum sustainable production. Meanwhile, Saudi Arabia has once again lowered its lowest selling price in 5 years to Asia for January, countering some of the bullish sentiment.

On another note, the EU is ironing-out a plan to end all imports of Russian natural gas by 2027 through the imposition of a ban.

The Energy Information Administration’s (EIA) Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week increased while total US oil production was steady at 13.8 million b/d vs. 13.5 last year at this time. The Strategic Petroluem Reserve (SPR) was up 250,000 bbl to 413 million bbl.

Consulting group Challenger, Gray & Christmas reported that there have been 1.1 million layoffs this year, the most since the 2020 pandemic. Meanwhile, the ISM issued its November indexes showing the Services PMI was 52.6 vs. 52.4 in October while new orders were 52.9 vs. October’s 56.2.

Business activity in general was up slightly to 54.5 vs. 54.3 the prior month. The delayed September PCE index showed inflation to be stable at just under 3.0%. While that may not play much into the Fed’s rate decision next week, expectations are for another Fed rate cut this month of 0.0025%. All 3 US major stock indexes are higher week-on-week. The prospect of another rate cut has the USD slightly lower this week, which does support crude prices.

Oil, technical analysis

January 2026 WTI NYMEX futures broke the $60.00 Resistance level this week and are now trading above their 8-, 10- and 20-day Moving Averages. Volume is around the recent average at 220,000. The Relative Strength Indicator (RSI), a momentum indicator, is in neutral territory. Resistance is now pegged at $60.50 (weekly high) while near-term critical Support is $59.25 (20-day MA).

Looking ahead

Crude markets will be looking in several different directions next week as the Russia/Ukraine situation appears to be deteriorating and as Pres. Trump seems set on invading Venezuela.

Additionally, with the seasonal temperatures moving into the high heating oil demand regions, distillate inventories as well as regional heating oil storage, will be closely monitored. Furthermore, another rate cut by the Fed will provide a positive economic outlook for the near-term which translates into greater energy demand.

Natural gas, fundamental analysis

December NYMEX natural gas futures continued higher this week again pushing past the key $5.00/MMBtu level for the first time in 8 months as weather turns more seasonal and LNG exports hit a new output record. And despite a small storage withdrawal reported. The week’s High was $5.50/MMbtu on Friday while the week’s Low was $4.75 on Monday.

Supply/demand data has yet to be restored. However, LNG export volumes reached a new high of 18.2 bcfd last month. In the UK, natural gas prices at the NBP were most recently lower at $10.15/MMbtu while Dutch TTF futures were $9.40 and Asia’s JKM was quoted at $10.90/MMbtu.

The EIA’s Weekly Natural Gas Storage Report indicated a withdrawal of 12 bcf vs. a forecast of -18 bcf. Total gas in storage is now 3.923 tcf, now 0.5% below last year and 5.1% above the 5-year average.

Natural gas, technical analysis

January 2026 NYMEX Henry Hub Natural Gas futures shot past their 8-, 13- & 20-day Moving Averages this week and beyond the Upper-Bollinger Band Limit, a technically significant move. Volume was a new high at 335k. The RSI has moved into overbought territory at 70 on this week’s rally. Support is $5.15 (Upper-Bollinger Band Limit) with key Resistance at $5.50 (week’s high).

Looking ahead

As the US continues to increase its LNG export capacity, Taiwan reported using LNG for 53% of its power generation in October, a new record amount. The run to $5.50/MMbtu for January futures was an over-reaction as storage levels are more than adequate given November is behind us, and we are +5% above the 5-year average.

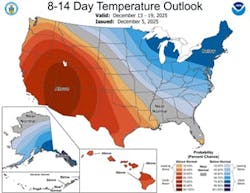

Look for prices to settle back as those with storage use that option rather than pay the higher market prices. Below-normal temperatures are forecasted for a large portion of the major consuming regions of the Northeast and Midwest US in the 8-14-day outlook.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.