EIA: US petroleum product exports set another record high in 2023

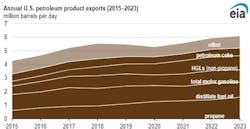

In 2023, US petroleum product exports hit a new high, averaging 6.1 million b/d, a 2.5% increase from the previous year, according to the US Energy Information Administration (EIA)’s Petroleum Supply Monthly. The growth was primarily fueled by increased exports of propane, which offset declines in gasoline and distillate exports.

“Growing 14% in 2023, US propane exports averaged 1.6 million b/d in 2023, establishing an annual record high. Propane exports made up 26% of all US petroleum product exports, more than any other petroleum product. Propane is consumed globally for space heating and is increasingly used as a petrochemical feedstock in East Asia. Propane consumption as a petrochemical feedstock has been driven by propylene production in East Asia,” EIA said. Propylene is a base chemical used to manufacture polypropylene, a fiber used to make car interiors, packaging, and personal protective equipment.

US propane exports to Asia saw a significant 27% increase (equivalent to 204,000 b/d) in 2023, compared with 2022. The majority of US propane exports to Asia were directed towards Japan, South Korea, and China, with China experiencing the highest growth, increasing by 50% (72,000 b/d) in 2023.

Distillate fuel has been the second-highest US petroleum product export since 2020, after propane. However, in 2023, there was an 8% decline in US exports of distillate fuel oil, to 1.1 million b/d.

“The US typically exports more distillate fuel to Central America and South America than to any other region, which was true in 2023, when the region accounted for 54% of all US distillate exports. Despite the region’s top ranking, US exports of distillate to the region were 23% lower in 2023 compared with 2022, decreasing to 602,000 b/d, the lowest since 2015. Mexico remained the top destination country in 2023, when US exports of distillate averaged 291,000 b/d,” EIA said.

According to EIA data, US distillate exports to Brazil declined more than to any other country in 2023, driving the drop in exports to Central America and South America. US distillate exports to Brazil fell 67%, to 45,000 b/d in 2023 from 136,000 b/d in 2022. Trade press reports indicate that Brazil increased distillate imports from Russia. Russia has been looking for destinations outside of Europe to export its oil. Partially offsetting decreasing exports to Brazil, US exports of distillate to the Netherlands grew more than to any other country, rising to 62,000 b/d in 2023 from 36,000 b/d in 2022.

In 2023, total gasoline exports (including finished motor gasoline and motor gasoline blending components) decreased 5% from 2022 and averaged 900,000 b/d. Most US gasoline exports go to Mexico, which was the destination for 56% of all US gasoline exports in 2023. US gasoline exports to Mexico remained essentially flat in 2023, dropping less than 1% and averaging 502,000 b/d. Exports to Brazil fell more than to any other country in 2023, declining 74% (28,000 b/d) compared with 2022. However, overall volumes were relatively small; only 1% of US gasoline exports went to Brazil, EIA said.