Oil prices facing another wild rollercoaster ride in 2002

The question of the moment is: Will oil prices jump or remain soft in 2002?

The answer is: Yes.

The state of the oil market depends to a great degree on the state of the global economy. If, as many economists believe, the global economy will bounce back in second half 2002, then the production cuts by the Organization of Petroleum Exporting Countries and non-OPEC countries will have served to tighten markets and nudge up prices even if no other factors are considered.

If, as some analysts believe, the economy may be headed for a second recession after an initial recovery, then the outlook for oil demand for the full year is not any better than last's stagnation.

Ironically, the very thing that could cause oil prices to spike unexpectedly by midyear-a Persian Gulf oil supply disruption-could also be the thing that triggers the second phase of that "double-dip" recession. And the geopolitical stars are aligning to suggest that such a supply disruption is all but inevitable. It's just a question of when and for how long.

Thus it's easy-if not pleasant-to contemplate another wild rollercoaster ride for oil prices this year: remaining soft into the second quarter, then spiking up during the third quarter with the supply disruption, then falling back-perhaps into a serious freefall-with the second recessionary dip. Whether the last part of that scenario occurs, of course, depends on the duration of the supply disruption. If it is a serious and protracted supply disruption, oil prices will remain high and thus increase the risk of causing a deep and lengthy recession, which eventually would bring about an oil market crash. If the disruption is short-lived, prospects improve not only for economic recovery but also for returning a measure of relative price stability to oil markets not seen since before the 1990-91 Persian Gulf crisis.

OPEC, non-OPEC cuts

For the moment, it's a waiting game. Oil markets are watching OPEC to see how closely its members toe the line on pledges to cut output. At the same time, they're keeping an eye on non-OPEC oil exporters-with an especially close eye on Russia-to see if those cuts come through as promised.

Russia is the chief concern here, as the threat of a market share war late last arose mainly over Saudi ire at Russia's growing market share. Another factor is that Russia's pledge of cuts may prove to be a bit disingenuous, because there is always a seasonal decline in Russian exports this time of year with weather-related logistical constraints. And Vladimir Putin seems to be playing a cagey end game with the US and Saudi Arabia-ostensibly deferring to the Saudis with what amounts to moot cuts while courting the US over the situation with Iraq and positioning his country as a reliable oil supply alternative to the Middle East. With US-Saudi tensions already simmering, Riyadh's patience with this end game may be thinning.

OPEC members are unlikely to fully comply with the pledged cuts, especially if Brent stays near $18/bbl, says Centre for Global Energy Studies. But that may be just as well, the London think tank says, because the global economy needs a period of lower prices to stimulate growth.

What OPEC's action accomplished was to put the brakes on a looming oil price collapse. OPEC ministers have claimed that the cuts were needed not so much to spike prices up to their targeted price band level but to keep oil stocks from increasing too fast in the first quarter and sending oil prices crashing toward $10/bbl in the second quarter. The group has suspended its $22-28/bbl price band mechanism for now.

CGES says OPEC's fears of a price crash were unfounded, "...but clearly OPEC needed to cut output if it was to realize its policy up towards the $20/bbl level needed by its largest members.

"Whether or not such a policy is in thebest longer-term interests of OPEC, short-term revenue needs are the only thing driving the organization's action at present.

CGES reckons OPEC's actual cuts are likely to be about 1 million b/d from fourth quarter 2001 levels, bringing the group's (Iraq included) total output this quarter to a little over 25 million b/d. That's well below the pledged 1.5 million b/d, but CGES thinks it will be enough to cause a drawdown of stocks of more than 1 million b/d in the first half. Also helping OPEC's cause is the US decision to replenish the Strategic Petroleum Reserve with royalty in-kind oil totaling 100 milion bbl beginning in April. This scenario has Brent stabilizing at $18/bbl in the first quarter and the stock draws catching up with the market in second quarter, when Brent could average $21/bbl.

"Having taken so much oil oout of the market, OPEC would then need to increase its output in 3Q02 and again in 4Q02 to prevent stocks from falling to dangerously low levels that would overheat the market," CGES said.

Even after restoring as much as 2.5 million b/d of oil supply in the second half, revived demand could tighten the market enough for oil prices to test the upper end of its price band.

Full compliance with pledged cuts would make it almost impossible to prevent a price explosion the second half, CGES warns.

Will OPEC overreach and push prices up to a point where the economy recovery is stillborn?

The worrisome thing for OPEC is a protracted recesssion, especially considering that the current recession has already caused the expected rise in global oil demand of 1 million b/d at the first of the year to evaporate

Economic recovery this year would enable oil demand to recover, registering a modest rate of growth. The Organization for Economic Cooperation and Development projects US gross domestic product will contract by 0.1% in the first half, followed by a surge in growth of 3.8% in the second half. For the OECD countries as a whole, the organization projects GDP growth of 1% for the full year.

However the OPEC scenarios pan out, there remains the Iraqi situation and the increasing likelihood of a US-led military campaign there. Another dispute over terms of the UN-brokered oil-for-aid program looks pretty much certain in May or June, especially if the new-found US-Russian rapprochement on the Iraq sanctions issue holds. Even without an actual outbreak of hostilities, a disgruntled Saddam is certain not to accept a change in the sanctions regime that includes weapons inspections (the focus of the US-Russian accord), and he is likely to pull his oil off the market in protest. So the odds for a supply disruption are increasing now; just the timing seems to be in question now. And an extended disruption would have the same effect as OPEC overreaching.

But, to paraphrase many a bumper sticker, if the US and allies "finish the job this time" as quickly as the US-led coalition ousted Iraq from Kuwait in 1991 and Saddam doesn't get the chance to wreak havoc on his country's or the region's oil fields (the prospect of, say, detonating a "dirty nuke" over Gahwar oil field is especially frightening for the long term and not out of them realm of possibility), then the biggest single oil supply disruption wild card is removed from the picture. That would make it easier for OPEC-in collaboration with non-OPEC exporters-to calibrate oil supplies in response to market factors. The likelihood would then be more of a moderate oil price outlook with a reduction in intrayear volatility.

OGJ Hotline Market Pulse

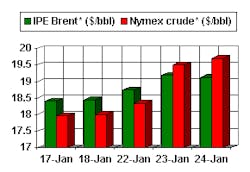

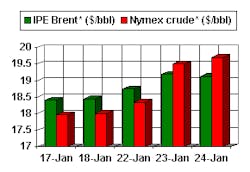

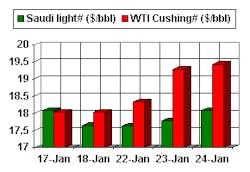

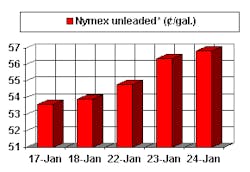

Latest Prices as of Jan. 25, 2002

null

null

Nymex unleaded

null

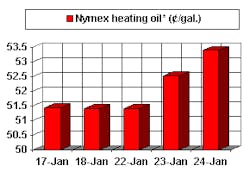

Nymex heating oil

null

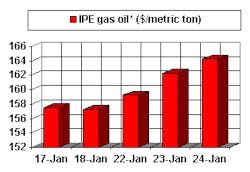

IPE Gas oil

null

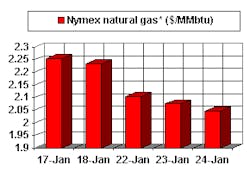

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.