Oil market outlook for price pressure shifts more to upside after OPEC meeting

Oil markets have firmed considerably in the past few weeks, and the Organization of Petroleum Exporting Countries' much-coveted $25/bbl watershed is at hand. Moreover, the outlook has shifted more toward the potential for continued upside price pressure in the weeks to come than to the downside.

Today's meeting of ministers for the Organization of Petroleum Exporting Countries is really a pro forma affair, as the group some weeks ago signaled its intent to simply hold the line on production restraint-that is, once the Russians were securely on board. Initial reports are that the group is content with its own efforts to restrain production and pleased with others efforts (read: Russia).

The latest indication now is that, not only are the Russians on board, they are giving OPEC and oil markets distinct signals about aggressively defending price. Comments from Russian Deputy Energy Minister Oleg Gordeev to the UAE media yesterday centered on Russia's apparent willingness to continue its cooperation with OPEC to the end of the year.

Meanwhile, OPEC also says it plans to meet again in June to review market conditions and then decide whether it is necessary to increase production. Ostensibly, that is meant to assuage market watchers worried about the seasonal stockbuild in the third quarter that the oil will be available for that stockbuild needed to meet increased seasonal demand. But the promise of considering a production hike also is intended to assure markets that OPEC will be ready to step in to increase production should there be a major oil supply disruption.

This "preconditioning" of the market has the effect of a self-fulfilling prophecy, albeit in a salutory way. So much of the effect of an oil supply disruption on oil markets is psychological that even the speculation over such a disruption automatically builds a premium into the price. The longest-standing example of this was the Iran-Iraq war of the 1980s-especially the "tanker war" years-when oil prices commanded an extra $2-3/bbl for much of the time during those hostilities even when there were no actual supply disruptions.

So OPEC's preconsideration of a June output hike subtracts much of the disruption-threat premium that will continue to be built into the price of oil while the US builds its case for military action against Iraq. It also will help ease the extreme pressure for severe price spikes should mounting civil strife in Venezuela coincide with an attack on Iraq. The UN review of Iraq's oil-for-aid sales program concludes in May, and the betting here is that the Bush administration will not allow Saddam to play his cat-and-mouse games again, regardless of the objections raised in Europe and elsewhere over the US military threat to Iraq.

But how will OPEC quota compliance hold up under rising oil prices and tightening demand? And how sincere was the Russian deputy energy minister in his pledge that Russia will stay the course to yearend-when it was politically thorny enough just to get the key Russian exporting companies to join in the first quarter cut? Recall the disingenuousness of the Russians with that first quarter cut-which represented a cut in oil export levels that always occurs that time of year, anyway, because of logistical constraints.

It is the likelihood of lax efforts to restrain more oil supply "leakage" from OPEC and non-OPEC exporters as prospective war (or coup) looms that will keep oil prices from rocketing to a level where the result is a short, shallow recession that pulls a double-dip.

And to think it was only a couple of months ago that markets were worried over a market share war between OPEC and Russia spawning an oil price collapse and thinking about the salutary effects of that collapse on oil demand and the global economy.

OGJ Hotline Market Pulse

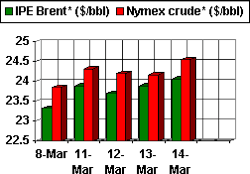

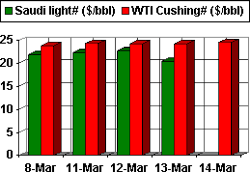

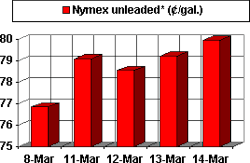

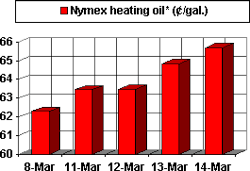

Latest Prices as of Mar. 15, 2002

null

null

Nymex unleaded

null

Nymex heating oil

null

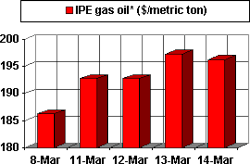

IPE gas oil

null

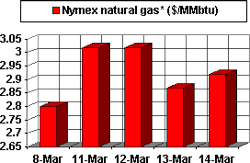

Nymex natural gas

null