EIA: US exports record natural gas volume in first-half 2023

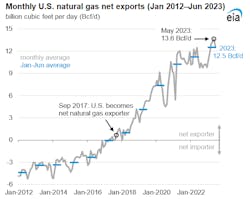

The US exported more natural gas in first-half 2023 than in any other previous 6-month period, averaging 12.5 bcfd, 11% (1.3 bcfd) more than in the same period in 2022, according to the US Energy Information Administration’s Natural Gas Monthly report.

In May, US net natural gas exports as LNG and by pipeline averaged a monthly record high of 13.6 bcfd. In 2017, the US became a net exporter of natural gas (natural gas exports exceeded natural gas imports) for the first time since 1957, primarily because of increased LNG exports.

Growth in LNG exports from the Lower 48 states, which started in 2016 when Sabine Pass LNG—the first LNG export plant in the Lower 48 states—came online, has led to increased US natural gas exports. In first-half 2023, US LNG exports averaged 11.6 bcfd, making the US the world’s top LNG exporting country (OGJ Online, Sept. 12, 2023). US LNG exports in first-half were up 4% (0.5 Bcf/d) compared with a year ago, despite declining in May and June.

In first-half 2023, US natural gas pipeline exports, which go to both Canada and Mexico, averaged 8.8 bcfd, or 4% (0.3 bcfd) more than in first-half 2022. US natural gas exports by pipeline to Mexico reached a monthly high of 6.8 bcfd in June and accounted for about 66% of total US pipeline exports from January through June.

Mexico increased its natural gas imports from the US in this year’s first half to meet electric power sector demand, which has been increasing since 2018, EIA said. Since 2019, natural gas pipeline exports from West Texas to Mexico have grown steadily as more connecting pipelines in Central and Southwest Mexico have been placed in service.

US LNG imports averaged less than 0.1 bcfd in this year’s first half. Almost all LNG imports are delivered into the New England market and can be a key marginal source of supply during periods of high demand, particularly in the winter months of December through February. Warmer-than-average temperatures in the Northeast in the first quarter of 2023 contributed to lower LNG imports compared with the same time in 2022.

US natural gas imports by pipeline, which are primarily from Canada, declined by 5% (0.4 bcfd) in first-half 2023 compared with a year ago. Imports from Canada help support seasonal fluctuations in consumption in the US and generally peak in January or February, with a smaller peak in the summer months. A mild winter, combined with wildfires in Western Canada that disrupted natural gas deliveries to the United States this spring, contributed to lower natural gas imports in first-half 2023 compared with first-half 2022.