EIA expects US natural gas consumption to fall 2.4% in 2023

The US Energy Information Administration (EIA) expects US natural gas consumption to decrease by 2.4% (2 bcfd) in 2023 from 2022 levels due to mild winters and recent low natural gas consumption in the residential and commercial sectors. EIA made the forecast in its March Short-Term Energy Outlook (STEO).

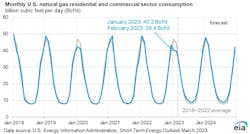

In January and February 2023, below-average US natural gas consumption in the residential and commercial sectors was driven by mild winter weather across large parts of the country, particularly in the Northeast and the Midwest. Based on preliminary data from the National Oceanic and Atmospheric Administration for January and February, the first 2 months of 2023 combined were among the three warmest on record for that period going back to 1895.

In March, EIA expects natural gas consumption in the residential and commercial sectors to average almost 32 bcfd, which is close to the 5-year average, because it expects more normal temperatures in March coupled with a near average number of heating degree days.

Reduced natural gas consumption in January and February slowed withdrawals from natural gas inventories to less than the 5-year average and reduced natural gas prices.

Natural gas spot price at the US benchmark Henry Hub averaged $2.38/MMbtu in February, the lowest monthly average since September 2020. The Henry Hub natural gas spot price in EIA’s forecast averages $3/MMbtu in 2023, down by more than 50% from last year. EIA had expected almost $5/MMbtu in the January STEO forecast.

Although EIA reduced its Henry Hub price forecast from last month’s STEO, the agency still expects natural gas prices to increase in the coming months. Price increases in the forecast result from rising demand from Freeport LNG reopening, which shut down last June due to a fire, and seasonal increases in natural gas demand in the electric power sector. In addition, EIA expects natural gas production will be relatively flat for the rest of 2023 as producers reduce drilling in response to lower prices.

LNG exports

US LNG exports in EIA’s forecast average about 12 bcfd in 2023, up 14% from last year. LNG exports are expected to increase by an additional 5% in 2024. The Freeport LNG export terminal’s return to service and LNG export projects under construction that will come online by end-2024 contribute to rising exports.

The Freeport LNG terminal can produce more than 2.1 bcfd of LNG for export on a peak day, and exports from Freeport averaged 1.9 bcfd from January 2021 through May 2022, prior to the full shutdown in June 2022, according to EIA’s Natural Gas Monthly.

Because of the Freeport shutdown, US LNG exports averaged 10 bcfd from June 2022 through December 2022, after peaking at 11.7 bcfd in March. The new Calcasieu Pass LNG export plant partially offset the decline in exports from Freeport LNG, with exports from Calcasieu Pass averaging 1.2 bcfd since June 2022. This year, once all three trains at Freeport LNG return to service, EIA forecasts US LNG exports to exceed 12 bcfd in most months for the rest of the forecast period. EIA also forecasts that US LNG exports will increase to 14 bcfd by December 2024 because new LNG export capacity from three major projects under construction are scheduled to come online.