US gas prices sink on rising supply, storage, and LNG export limits

US natural gas prices fell rapidly last week as dry gas supply surged, consumption dropped due to cooler temperatures, and uncertainty remains around the restart of Freeport LNG, said Rystad Energy in a recent research note. Meantime, LNG demand in Europe remains high, but market pressures have eased with improvements in storage inventories within the region.

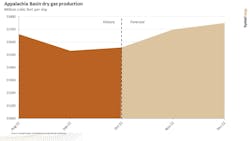

Since the beginning of the shoulder season, domestic dry gas supply has rebounded. Total supply has breached all-time highs at the 100-101 bcfd benchmark, but it has not been sustained for various reasons, according to Rystad Energy.

“The expectations of an uptick of this magnitude are based on historical context; regional operators maintain minimal activity levels during summer due to lower consumption brought about by warmer temperatures,” said Rystad analyst Ade Allen.

Multiple factors influence growth in Appalachia supply, but the prevalent factor is seasonality, about one-third of supply is used to satisfy regional demand needs in the winter, Allen said. To ensure adequate regional supply for residential and commercial sector demand this winter, supply will need to increase soon.

Meantime, if the Northeast region experiences an above-average winter, regional supply will need to increase by about 2 bcfd.

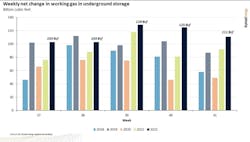

US gas storage benefitted from its fifth-consecutive triple-digit injection last week.

For the week ended Oct. 14, Lower 48 underground storage increased by 111 bcf. The trajectory of End of Season storage has changed, and storage sits at 3.34 tcf—just 5.2% below the 5-year average.

The Pipeline Hazardous Materials and Safety Administration (PHMSA) said on Oct. 19 that Freeport LNG, the second-largest US LNG export plant, which had been idle for 5 months due to fires, must obtain full approval before restarting scheduled for November.