Rystad Energy: US shale hedging losses could top $10 billion in 2022

US shale oil producers are in line to suffer more than $10 billion in derivative hedging losses in 2022 if oil prices remain around $100/bbl, Rystad Energy research shows. Many shale operators offset their risk exposure through derivative hedging, helping them raise capital for operations more efficiently. Those who hedged at lower prices last year are in line to suffer significant associated losses as their contracts mean they cannot capitalize on sky-high prices.

Despite these hedging losses, record-high cash flow and net income have been widely reported by US onshore exploration and production (E&P) companies this earnings season. These operators are now adapting their strategies and negotiating contracts for second-half 2022 and 2023 based on current high prices, so if oil prices fall next year, these E&Ps will be able to capitalize and will likely boast even stronger financials.

Anticipating the significant negative impact of these hedges, shale operators made a concerted effort in first-half 2022 to lower their exposure and limit the impact on their balance sheets, Rystad said.

Many operators have successfully negotiated higher ceilings for 2023 contracts and even at a crude price of $100/bbl losses would total just $3 billion based on current reported hedging activity for 2023, a significant drop from this year. At $85/bbl, hedged losses would total $1.5 billion; if it fell further to $65/bbl, hedging activity would be a net earner for operators.

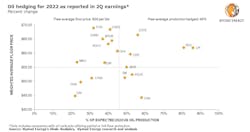

E&Ps typically employ derivative hedging to limit cash flow risks and secure funding for operations. However, commodity derivative hedging is not the only risk management strategy operators use. Rystad Energy’s analysis looked at a peer group of 28 US light tight oil (LTO) producers, whose collective guided 2022 oil production accounts for close to 40% of the expected US shale total. Of this group, 21 operators have detailed their 2022 hedging positions as of August. The group covers all public hedging activity in the sector as supermajors do not employ derivative hedging as a funding strategy, and private operators do not disclose their hedges publicly.

“With huge losses on the table, operators have been frantically adapting their hedging strategies to minimize losses this year and next. As a result, we may not have seen peak cash flow in the industry yet, which is hard to believe given the soaring financials reported in recent weeks,” says Rystad Energy vice president Alisa Lukash.

Operators currently have 42% of their total guided and estimated oil output for 2022 hedged at a WTI average floor of $55/bbl. Overall, producers have hedged 46% of their expected crude oil output for the year. In the second quarter, companies reported an average negative hedging impact of $21/bbl on their realized crude prices, the value they receive for production minus any negative hedging impact.

For operators like Chesapeake Energy Corp. and Laredo Petroleum Inc., the impact has been higher, at more than $35/bbl, according to Rystad. Fewer companies reported any significant effect on their derivatives contracts in the latest quarter compared with the previous 3 months. Still, an analysis of the difference in the hedging impact on realized prices per operator between the first and the second quarters shows that, in most cases, second-quarter losses were stronger by $4/bbl on average.

The US onshore oil and gas industry’s hedging strategy has been closely tracked as a critical barometer for cash flows, particularly given the sharp price volatility over the past few years, allowing investors and lenders to make funding calls. Operators have already increased the cover for their expected oil volumes in 2023 to 17%, with many targeting 20-40% of output to be secured with derivatives, Rystad said.