Crude prices continued lower this week amid ongoing uncertainty

Oil, fundamental analysis

Crude prices continued lower this week due to the ongoing tariff uncertainty, a barrage of negative economic signals, demand concerns and supply increases. Large draws in both raw crude and refined gasoline stocks could not support the market. Both grades broke the $60.00/bbl level at some point with WTI remaining below that mark at week’s end.

WTI’s High for the week was Monday’s $63.90/bbl. with the Low of $56.40 on Thursday. Brent crude traded in an almost identical pattern although in a higher range. Its weekly High of $67.60/bbl was also on Monday with its Low of $59.30 on Thursday. The Brent/WTI spread has tightened to ($3.00). Both grades were lower week-on-week.

In the tariff wars, conflicting statements regarding negotiations between the US and China continued this week but China is reportedly evaluating a Trump administration proposal to hold talks.

Appearing to want to regain lost market share and reduce non-OPEC+ production growth, Saudi Arabia has been signaling that it will continue unwinding its output cuts and is ready to handle a prolonged period of lower prices after 5 years of cuts. Output on May 1 increased by 411,000 b/d while the group will meet on May 5 to discuss June 1 output volumes.

Importing countries such as India are enjoying the lower oil prices as they are Russia’s No. 1 market. A lower USD has also helped oil importers. But, while cheaper crude prices can lead to increased consumption, the international Energy Agency (IEA) in Paris has lowered the demand outlook for this year by 400,000 b/d, a 30% decline from the prior expected growth estimate.

Meanwhile, the US Energy Information Administration (EIA) has downwardly revised its forecast for US crude production this year by 100,000 b/d to a 300,000 b/d increase citing uncertainty over the economic impact of the Trump tariffs.

Non-OPEC+ countries such as Canada and Guyana are expected to continue to increase their production. Venezuela’s oil exports fell 20% in April after having to cancel cargoes for Chevron when the latter’s license was canceled by President Trump.

US oil prices staged a one-day rally from the $56.40/bbl Low on Thursday as the Trump administration threatened more sanctions on those buying Iranian crude as talks between the countries that were to begin Saturday have been postponed. China is currently their biggest market. However, the bearish sentiment returned quickly on Friday.

On the economic front, first-quarter 2025 GDP came in at -0.3%, the first negative reading in 3 years. Additionally, the ISM’s manufacturing index was reported to be 48.7%, a 5-month Low and down from the previous 49%. Levels below 50% signal contraction. Consumer confidence fell -7.9 to 86.0 in April, the 5th-straight monthly decline and the lowest level since May 2020. Jobs reports were mixed as weekly claims for unemployment rose unexpectedly rose to 241,000 while forecasts had called for a decline to 221,000. Meanwhile, the private sector added 177,000 jobs last month.

The Energy Information Administration’s Weekly Petroleum Status Report indicated that commercial crude oil inventories for last week decreased -2.7 million Bbl. to a total of 440 Bbl. million, decreasing to

-6% below the 5-year average. The API forecasted a change of +3.8 million bbl. while market analysts called for an increase of +100k bbl. US refinery utilization rose to 88.6% from 88.1%, which represents a +190k bpd. change in inputs to 16.1 million bpd. Total motor gasoline decreased -4.0 million Bbl. to 229.5 million Bbl. and -4% below the 5-year average. Gasoline demand fell -300k bpd to 9.1 million bpd. vs. 9.4 the week prior and 8.62 a year ago. Distillates increased by +0.9 million bbl. to 107.8 million Bbl., holding at -13% below the 5-year average. Inventory at the key Cushing, OK hub changed +680k bbl. to 25.7 million Bbl. or 34% of capacity. The SPR gained +65k bbl. to 398.5 million bbl. Imports of crude oil were -100k bpd. to 5.5 million Bbld. vs. 5.6 the prior week while exports were 4.1 million bpd. vs. 3.5 the prior week. Exports of petroleum products were 6.5 million bpd. last week vs. 6.4 the prior week. Total US oil production held at 13.5 million Bbld. vs. 13.1 last year at this time. The US rig count dropped -3 last week to 584 vs. 605 last year at this time.

AAA’s average US retail gasoline prices at the pump were most recently reported at $3.18/gal., +$0.16/gal. vs. last week, -$0.058/gal. from last month and -$0.49/gal. less than a year ago.

Despite the negative economic indicators, positive earnings reports, mainly from the tech sector, boosted equities this week. all (3) major US stock indexes have moved higher week-on-week. The USD is only slightly higher, which could cap any gains made in crude prices.

Oil, technical analysis

June NYMEX WTI Futures fell below the 8- and 13- and 20-day Moving Averages this week and pierced the Lower-Bollinger Band limit with Thursday’s Low. Volume is 235,000, which is lower than the recent average. The Relative Strength Indicator (RSI), a momentum indicator, is oversold at 36. Resistance is now pegged at the critical $60.00 mark with near-term Support at $57.90 (Lower-Bollinger Band).

Looking ahead

With the postponement of US-Iran talks, the sanctions will continue to add a bullish element to the market. A China-US tariff compromise would lead to optimism for demand with China still the world’s No. 1 importer of crude. The low level of refined product stocks remains a concern but look for US refiners to increase utilization this month to meet summer driving demands and to add to inventories. Markets will also be looking for an announcement from OPEC+ next week as to the exact volume output increase they will put in effect on June 1.

Natural gas, fundamental analysis

June NYMEX natural gas futures staged a 5-day rally this week on a slightly less-than-expected storage injection and increased exports.

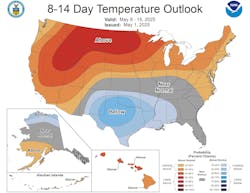

The week’s High of $3.65/MMbtu occurred Friday with the week’s Low of $3.05 set Monday. Supply last week was -0.5 bcfd to 110.8 bcfd vs. 111.3 the prior week. Demand was +0.2 bcfd to 96.0 bcf vs. 95.8 bcfd the week prior, with the biggest increases coming in power and exports which offset a drop in residential consumption on milder weather. Exports to Mexico were 6.9 bcfd (the highest in several months) vs. 6.5 the prior week. LNG exports were 16.4 bcf vs. 16.1 bcfd the prior week. European gas prices were most recently lower at $9.40/MMbtu equivalent despite storage levels at 38% vs. 60% at this time last year. Some LNG cargoes are being diverted from Europe to Asia as prices there have increased.

The EIA’s Weekly Natural Gas Storage Report indicated an injection of 107 bcf, above the forecasted +100 bcf. Total gas in storage is now 2.041 tcf, rising to -17.6% below last year and to 0.2% above the 5-year average.

Natural gas, technical analysis

June 2025 NYMEX Henry Hub Natural Gas futures rose above the 8-, 13- and 20-day Moving Averages this week. Volume was 106,000 and lower than the recent average. The RSI has rebounded to neutral at 56. Support is pegged at $3.45 (20-day MA) with Resistance at $3.65.

Looking ahead

Demand for power generation looks weak over the next 2 weeks but storage refills should grow. Additionally, global demand for LNG for storage should also provide support for pricing. Should the triple-digit storage injections continue in the US, prices could fall on the perception of surplus production.

About the Author

Tom Seng

Dr. Tom Seng is an Assistant Professor of Professional Practice in Energy at the Ralph Lowe Energy Institute, Neeley School of Business, Texas Christian University, in Fort Worth, Tex.