Oil, gas investments to hit $628 billion in 2022 led by upstream gas and LNG

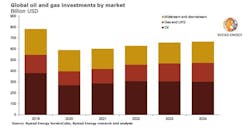

Global oil and gas investment will increase by $26 billion this year as the industry continues its recovery from the worst of the pandemic and the hurdles imposed by the Omicron variant. Overall oil and gas investments will grow 4% to $628 billion this year from $602 billion in 2021, according to Rystad Energy analysis.

A significant contributor is a 14% increase in upstream gas and LNG investments. The segments will be the fastest growing this year, with an investment jump to around $149 billion in 2022 from $131 billion in 2021. While short of pre-pandemic totals, investments in the sector are expected to surpass 2019 levels of $168 billion in just 2 years, reaching $171 billion in 2024.

Upstream oil investments are projected to rise to $307 billion this year from $287 billion in 2021, a 7% increase, while midstream and downstream investments will fall by 6.7% to $172 billion this year.

“The pervasive spread of the Omicron variant will inevitably lead to restrictions on movement in the first quarter of 2022, capping energy demand and recovery in the major crude-consuming sectors of road transport and aviation. But despite the ongoing disruptions caused by COVID-19, the outlook for the global oil and gas market is promising,” said Audun Martinsen, head of energy service research at Rystad Energy.

Global shale investments are forecasted to surge 18% in 2022, reaching $102 billion in 2022 compared with $86 billion in 2021. Offshore investments are set to increase 7%, to $155 billion from $145 billion, while conventional onshore will jump 8%, to $290 billion from $261 billion.

Regionally, Australia and the Middle East stand out, with Australia likely to see a 33% jump in investments thanks to greenfield gas developments. In the Middle East, investments will rise by an anticipated 22% this year as Saudi Arabia boosts its oil export capacity and Qatar expands production and export capacity of LNG.

Sanctioning activity

This year’s investment growth is pre-programmed by $150 billion in greenfield projects sanctioned in 2021, up from $80 billion in 2020. Sanctioning activity in 2022 is likely to closely match 2021 levels, with a similar amount of project spending to be unleashed over the short to medium term.

Sanctioning activity is set to rebound in North America, with over $40 billion worth of projects due for investment decision in 2022. Six LNG projects are expected to receive the green light, five in the US and one in Canada. Offshore projects will also provide opportunities for contractors as TotalEnergies’ North Platte project enters the final stage of its tender process and LLOG Exploration’s Leon and Chevron’s Ballymore developments in the US Gulf of Mexico look to proceed to development phase in 2022. For Africa, however, 2022 is expected to be another quiet year with expected sanctioned projects worth a comparatively small $5 billion.

Offshore, there are around 80 projects worth a total of $85 billion in the global approvals pipeline for 2022. Of these, 10 are floating production storage and offloading units (FPSO), 45 involve subsea tiebacks, and 35 are grounded platforms. Latin America and Europe will be responsible for around 24% each of the total offshore sanctioning values next year, with deepwater expansions expected in Guyana and Brazil and Norway following recent tax changes.

The number of sanctioned offshore projects is expected to rise year-over-year but will remain little changed when measured by capital commitments. A concern for 2022 is execution challenges related to the pandemic and increased inflationary costs for steel and other input factors. These are likely to make operators mildly cautious regarding significant capital commitments. In addition, major offshore operators are being challenged on their portfolio strategy as the energy transition unfolds, with many exploration and production companies already directing investment budgets to low-carbon energy sources.