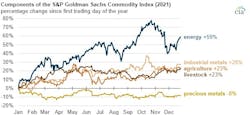

Energy prices rose more than other commodities in 2021

Energy prices used in the S&P Goldman Sachs Commodity Index (GSCI) ended 2021 59% higher than the first trading day of the year, according to an analysis from the US Energy Information Administration (EIA).

Energy price increases were mainly due to increased demand from the initial stages of global economic recovery from the COVID-19 pandemic. By comparison, most other commodity indexes included in the GSCI rose by about 20%. The precious metals index was the only one that fell. The energy index of the GSCI increased more than twice as much as the industrial metals index on a percentage basis during 2021, the second highest commodity index group price change.

The GSCI is a commodity index that tracks the performance of global commodities markets. The index is a weighted average of commodity prices, and the index updates the weight it allocates to each commodity every year. In 2021, the energy index group made up 54% of the GSCI, and two crude oil benchmarks, WTI and Brent crude oil, accounted for approximately 70% of the weighting in the energy sector index. WTI crude oil makes up the largest share of the overall GSCI at more than 21%.

Prices in energy commodity futures markets greatly increased throughout 2021. For example, the futures price of RBOB (a reformulated grade of gasoline used as the benchmark for gasoline trading) increased by 67% during 2021. The only commodity included in the GSCI that increased more was coffee, whose futures price increased by 81% during 2021.

Among energy commodities, prices for petroleum products such as RBOB and ULSD (ultra-low sulfur diesel, which is used as a benchmark for heating oil trading) increased the most during 2021, at 67% and 64%, respectively. Prices for crude oils such as WTI (62%) and Brent (55%) increased by slightly less. Futures prices for gasoil (the name for ULSD in Europe) increased by 54% during 2021. Natural gas prices increased the least among energy commodities, although 38% is still a relatively large increase.