EIA: Oil market outlook largely unchanged, demand forecasts reduced

In its September Short-Term Energy Outlook (STEO), the US Energy Information Administration’s (EIA) outlook for global oil markets is largely unchanged from last month, and EIA continues to expect Brent prices will average $71/bbl in fourth-quarter 2021, and $66/bbl in 2022.

“In the near term, the impact of Hurricane Ida on US offshore production, reported incidents at Mexican offshore facilities, and lower-than-expected production in several non-OPEC countries have contributed to lower crude oil production offsetting some of the price effects of lower-than-expected oil demand. How the market will continue to process news about further COVID-19 outbreaks, even in countries with rising numbers of vaccinated people, remains an important uncertainty in our forecast. The production decisions of OPEC+ given an evolving demand outlook will also be a key driver of oil price formation in the coming months. Our forecast assumes that OPEC+ will generally produce at a level that achieves a relatively balanced oil market,” EIA wrote in the report.

Brent and WTI prices both decreased in first-half August. Increasing OPEC+ crude oil production and flattening global petroleum demand in response to rising COVID-19 cases contributed to the falling crude oil prices. Both benchmarks reached their low points of the month on Aug. 20: Brent at $65/bbl and WTI at $62/bbl. EIA estimates that 98.4 million b/d of petroleum and liquid fuels was consumed globally in August, an increase of 5.7 million b/d from August 2020 but still 4 million b/d less than in August 2019.

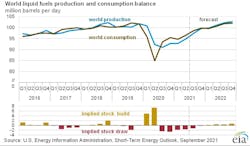

In the September STEO, EIA has revised global oil demand expectations down in 2021, accounting for reactions to the proliferation of the Delta variant. EIA decreased its oil demand expectations primarily in the middle months of 2021 and reduced global oil demand forecast by an average of 500,000 b/d in third-quarter 2021. EIA now expects global oil demand to grow by 5 million b/d in 2021, down from expected growth of 5.3 million b/d in last month’s forecast. EIA also forecasts that global oil consumption will increase an additional 3.6 million b/d in 2022 to average 101 million b/d, almost even with 2019 levels.

US oil production

More than 90% of crude oil production in the Federal Offshore Gulf of Mexico (GOM) was offline in late August following Hurricane Ida. As a result of the outage, GOM production averaged 1.5 million b/d in August, down 300,000 b/d from July. EIA expects that crude oil production in the GOM will gradually come back online during September and average 1.2 million b/d for the month before returning to an average of 1.7 million b/d in fourth-quarter 2021.

Total US crude oil production averaged 11.3 million b/d in June—the most recent monthly historical data point. EIA forecasts it will remain near that level through end 2021 before increasing to an average of 11.7 million b/d in 2022, driven by growth in onshore tight oil production. Growth will result from operators beginning to increase rig additions, offsetting production decline rates.

US gasoline prices

US regular gasoline retail prices averaged $3.16/gal in August, the highest monthly average price since October 2014.

Recent gasoline price increases reflect rising wholesale gasoline margins amid relatively low gasoline inventories. In addition, recent impacts from Hurricane Ida on several US Gulf Coast refineries are adding upward price pressures in the near term.

Estimated gasoline margins surpassed 70¢/gal in late August. EIA expects margins will remain elevated in the coming weeks as refining operations as US Gulf Coast remain disrupted. EIA forecasts that retail gasoline prices will average $3.14/gal in September before falling to $2.91/gal, on average, in fourth-quarter 2021.