Rystad: Qatar to return as world’s largest LNG producer by 2030

Qatar’s move to sanction the $30 billion North Field Expansion (NFE) project puts the country on track to return as the world’s largest LNG producer by 2030, according to a Rystad Energy report based on operational and sanctioned projects so far.

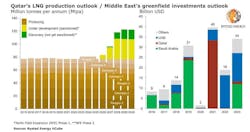

Qatar’s liquefaction capacity will rise to 110 million tonnes/year (tpy), or 18% of the global total, which is for now estimated at 600 million tpy at the end of the decade. Still, more projects are expected to be sanctioned as LNG demand will grow faster than supply.

Utilization rates will not necessarily match the producers’ capacity in 2030. Rystad Energy expects Qatar’s actual production in 2030 to reach 107 million tpy, about 22.5% of the so far sanctioned global supply of 476 million tpy at the end of the decade—a great score with almost full capacity utilization. The US, on the other hand, will likely produce 98 million tonnes of LNG by 2030, equivalent to a yearly utilization rate of 91% of its total capacity. Australia is expected to see a significantly lower utilization rate averaging 86% of currently sanctioned capacity and produce about 76 million tonnes in 2030.

The NFE project makes the Middle East the world’s top region for oil and gas project sanctioning in 2021. Rystad Energy expects rising oil prices to trigger sanctioning of global projects worth about $100 billion this year, of which the Middle East is set to contribute almost 40%, or $40 billion.

More than 26 Middle Eastern projects worth a total of about $50 billion have been delayed over the past year, with NFE making up the lion’s share as it was pushed to 2021. At the year got under way, the region had projects worth $98 billion due for sanctioning from 2021 to 2023.

With NFE now sanctioned, further investment commitments largely depend on developments in the UAE, where ADNOC aims to boost oil and gas production capacity and has a $40 billion project pipeline till 2025, Rystad said. In Saudi Arabia, the oil price downcycle has hit ongoing bidding processes and the giant Zuluf oil development worth $12 billion is expected to be sanctioned in 2023. Recovering prices are also likely to spur sanctioning activity in other parts of the region, especially in Oman, Iraq, and Iran.

Among global LNG producers, Australia currently has the largest operating capacity of 88 million tpy but will be surpassed by Qatar and the US in the coming decade as new liquefaction capacity is commissioned. The only Australian project Rystad expects to reach a final investment decision in 2021 is Woodside’s 4.5 million tpy Pluto Train 2 project, which would be developed together with the Scarborough upstream asset.

The US currently has 107 million tpy of sanctioned LNG capacity, including 36 million tpy under construction. Port Arthur LNG, Driftwood LNG, Plaquemines LNG, and Freeport T4 have all signed long-term contracts or secured equity from LNG buyers, but would still need new deals to secure financing and move forward.

The proposed US LNG projects have a breakeven price of $6.5-7.5/MMbtu delivered to Asia, compared to $4/MMbtu for Qatar Petroleum’s NFE. While the Qatar Petroleum project has a lower breakeven price, US LNG volumes have an advantage in the current large price differential between Henry Hub and Asian spot LNG prices.

According to Rystad Energy’s base case, global LNG demand will reach about 580 million tonnes by 2030, leaving significant room for bringing new LNG projects forward. “WE forecast that 104 million tpy of new LNG supply must be sanctioned in the coming 5 years to meet the gap between actual supply and demand in 2030,” said Sindre Knutsson, vice-president, gas markets, Rystad Energy.

To tap the supply capacity deficit, there are almost 1,000 million tpy of new proposed capacity that will compete to attract buyers and investors to secure financing in the years ahead. After a poor sanctioning year in 2020, optimism may return to the market and more final investment decisions made for LNG projects.

Qatar may also continue to progress, as it aims to increase its LNG output capacity to 126 million tpy from the current 77 million tpy through two North Field expansion phases. The newly sanctioned first phase includes four new liquefaction trains to raise capacity to 110 million tpy, while the second phase will include another two new trains currently in the front-end engineering design stage.

Rystad Energy estimates the two phases collectively to reach the capacity targets by 2028 or 2029, if the second phase also gets the go-ahead.