OPEC+ protectionism helping US shale industry in 2021

West Texas Intermediate (WTI) crude prices exceeded the $50/bbl mark, helped by the OPEC+ decision to continue shielding the global oil market by curtailing its output plus an additional self-imposed cut by Saudi Arabia of 1 million b/d. The resulting increase in oil prices is set to create a chain reaction in the US, where shale operators will see cash from operations boosted by 32% in 2021, allowing for increased spending this year, according to a Rystad Energy research note.

The price recovery has significantly aided oil producers’ cash flow since second-quarter 2020. In the US, the rebound in prices—even before WTI hit $50/bbl—helped shale producers generate record high free cash flow in third-quarter 2020.

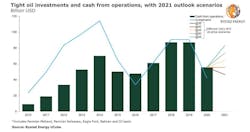

Cash from operations is a key driver for US tight oil activity. The figure correlates with cash available for E&P companies to invest in new wells and represents the revenue minus operational costs, royalty payments, and gross and net taxes.

At WTI of $40/bbl for 2021, cash from operations is expected to remain flat, Rystad said. However, at the current $50/bbl, that cash it is expected to grow some 32%. If companies continue to operate within cash flows, the current $50/bbl would provide enough cash flow for an increase in investments and a surge in US tight oil activity this year.

“This increased activity has already started to manifest itself, with rig activity for tight oil up 60% since the low point in August last year. Completion activity is also recovering, measured by the number of wells started to be completed by month,” said Espen Erlingsen, head of upstream research at Rystad Energy.

The low point in completion in 2020 occurred in May with 330 wells, down 75% from January 2020. The recovery in activity became apparent in the later months of the year, and by December, completion activity had doubled since May to more than 700 wells.

“The production cuts from OPEC+ have definitely fulfilled their purpose by balancing the market and supporting higher oil prices. At the same time, higher oil prices have reactivated the US tight oil industry. With the current budgeting season and improved cash flows, Rystad Energy expects to see a further increase in US tight oil activity,” Erlingsen said.

Cash from operations of shale operators in the US Permian Midland, Permian Delaware, Eagle Ford, Bakken, and DJ basins in 2019 reached $87 billion, but the downturn brought by the COVID-19 pandemic caused the figure to fall to $55.7 billion in 2020 by Rystad Energy estimates. This year, if the positive trend persists and WTI averages $50/bbl, the year’s cash from operations is expected to rise to $73.6 billion.