Rystad: COVID-19 could scrap one quarter of global floater fleet

Restructuring in the already-stretched offshore drilling market will accelerate due to COVID-19, and the global floater fleet, whose utilization has been suffering since the previous downturn, can expect a new round of scrapping as a result, according to Rystad Energy analysis.

An evaluation of active rigs in the global floater fleet reveals that up to 59 of the 213 units are potential candidates for retirement. This equates to one quarter of the floater segment, or 22 drillships and 37 semisubmersibles.

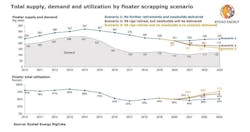

Global demand for floaters, which has just started to recover before the pandemic, is now expected to remain under pressure until 2022. Demand is expected to fall from 129 rig years in 2019 to 110 rig years in 2020 and 103 rig years in 2021, before slowly inching back up to 117 rig years in 2022 and 122 rig years in 2023.

Meanwhile, 25 newbuild floaters are planned for delivery towards 2023. Naturally, weak demand is going to keep utilization at low levels unless there is a meaningful increase in the price of oil. Rystad Energy created three scenarios annualizing supply and demand in rig years, that show the range of expected utilization levels based on rig attrition and newbuild deliveries.

Utilization began plummeting in 2016 and has hovered between 45% and 55% since, with 2020 levels expected to stand at 50%. Utilization could reach 77% in 2023 if all 59 floaters identified by Rystad Energy are retired and no newbuild delivered—an optimistic scenario. Utilization will decline with each newbuild floater delivery, down to 69% if all these units make it out of the shipyard.

In the last scenario, which assumes delivery of the newbuild units but not full retirement of the identified rigs, utilization could fall to as low as 52% depending on how many floaters are scrapped.

“Capacity attrition can set the stage for a comeback in utilization and play a key role as the offshore drilling industry seeks to shore up its finances. After drillers come out of restructuring, we could see more mergers and acquisitions, which again could result in more attrition,” said Jo Friedmann, senior energy service analyst at Rystad Energy.

A reduction in the number of drilling contractors through M&A will cut the number of bidders in any tender process. Rig supply needs to tighten for drilling contractors to regain pricing power, Friedmann said.

Many of the 154 floaters scrapped since the last downturn share common characteristics. Early in the cycle, the only units to be retired were semisubmersibles, while rig owners now see the need to start retiring drillships. Most of the semisubmersibles that were retired at the outset were the oldest, least capable units. Increased operator preference for high specification drillships in benign markets also led to more scrapping in the benign semisubmersible segment of the floater market.

Those units that were cold stacked relatively early on during the prior downturn will be some of the first rigs to be retired in this downturn. Rig owners have been waiting for a recovery that never really took off, and the number of units that have been cold stacked since 2016 are in the double digits.

Reactivation costs can range between $20 million and $35 million for rigs that have been warm stacked for a relatively short period of time to between $40 million and $100 million for rigs that have been cold stacked for longer periods of time. Given current rates and contract durations, most of these cold-stacked units are unlikely to return to work.