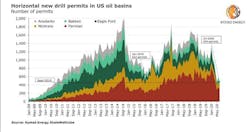

New US horizontal drilling permits hit 10-year low, 2020 activity rebound unlikely

Horizontal drilling activity in US oil basins, which has plummeted due to the COVID-19 pandemic, is unlikely to materially recover this year, Rystad Energy analysis shows. Drilling permits, increasingly reliable indicators of future activity levels, dipped to a 10-year monthly low in July, with only 454 awards.

July’s drilling permits number is the lowest since September 2010 when horizontal permits in oil basins amounted to 438. Unlike the current situation, activity then was increasing. The current downturn is still underway. During the previous downturn, the lowest count was recorded in January 2016 when only 622 permits were awarded.

Drilling permits have generally been viewed as low quality predictors of future drilling activity, as operators tend to overbuild their inventory of permits. However, the quality of predictions based on permits has improved considerably as producers have become more disciplined in the current capital environment and market downturn.

After a collapse in permit activity between March and May, June was the first month to see recovery in permits across all oil basins, driven by the Permian. This signaled that the decline in the rig count was bottoming out, with the outlook subsequently stabilizing in July. Permitting activity, however, slowed again in July.

“This signals the continuity of reduced activity levels throughout the remainder of 2020 at the current strip prices. Unless WTI oil prices move towards $50/bbl in the next few weeks, a rig activity rebound is unlikely before the first half of 2021,” said Artem Abramov, head of shale research at Rystad Energy.

An analysis of Baker Hughes data shows that the horizontal oil rig count in the US declined by 75% from the peak of 620 rigs in early March 2020 and has hovered around 150-160 since early-July. Gas-focused horizontal rigs have been flat at 55-60 over the last few weeks, 62% lower than in June 2019. The Permian basin now accounts for 78% of the total onshore oil-focused rig count, increasing from a share of 62% in February 2020.

A flat rig count does not imply that there have been no weekly changes in the total. Some weekly changes are registered from the movement and reallocation of rigs. Some operators continue to gradually lower rig programs (e.g. ExxonMobil in the Permian), while others restore modest drilling operations (e.g. Parsley Energy). The extent of changes in the last few weeks, however, corresponds to normal fluctuations seen when activity levels are steady.

The number of active counties (i.e. counties with at least one horizontal oil-focused rig) in the US increased to 32 from 30 last week. Drilling operations were restored in Ward, Borden, and Glasscock counties in Texas (all within the Permian basin). However, Gonzales County in the core of the Eagle Ford saw the departure of its last active rig. The active county tally in the Permian increased to 16 from 13, and half of active oil-focused counties in the US are now in the Permian basin.