Morgan Stanley: US shut-ins likely regardless of possible supply cuts

An oil production cut by Russia and Saudi Arabia of 10-15 million b/d, or 10-15% of global supply, anticipated by President Trump as evidenced by an Apr. 2 tweet, is unlikely to 'fix' near-term oversupply, Morgan Stanley analysis shows. Either way, US production is facing shut-in risks due to infrastructure constraints and low prices.

Global oil markets are in the midst of an unprecedented period: demand headwinds from COVID-19 have compounded oversupply from the dissolution of the OPEC+ agreement. According to Morgan Stanley oil strategist Martijn Rats, the demand decline will be 5 times more than the loss during the financial crisis.

Last week, the EIA reported the second largest crude oil build in history, and without coordinated supply cuts, inventories will most likely exhaust the world's storage capacity sometime in late second quarter. As a result, oil prices will need to decline to levels that force shut-ins of already producing fields.

“Despite headlines of an emergency OPEC+ meeting and potential coordinated production cuts, we remain cautious due to the sheer magnitude of global oversupply. Moreover, a near-term return to production cuts still seems unlikely, and we are skeptical that such a large coalition could be put together……If global production cuts are on the table, the US could participate.”

Concurrently, the Texas Railroad Commission said it would convene via virtual meeting in mid-April to discuss employing its authority in order to implement statewide production controls, which were last exercised in the 1970s.

Pressures for US shale producers

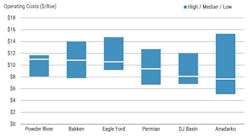

Oil prices across the key oil shale plays are depressed relative to the US WTI benchmark (Cushing, OK): $20/bbl in the Permian (about $5 below WTI), $12/bbl in the Bakken ($13 below WTI), and $17/bbl in the Eagle Ford ($8 below WTI).

“Local infrastructure and storage constraints, refinery run cuts, and softening demand from export markets have driven the price dislocations. For some producers in our coverage, these prices are approaching cash production costs, which range from $5-$15/bbl.”

As a result, even without mandated cuts, economics and downstream constraints likely drive a near-term US supply response. Only 7 million b/d of global oil supply has a short-run marginal cost of more than $10/bbl (Martijn estimates oversupply of 18 million b/d and full year 2020 of 7.6 million b/d). As a marginal producer globally, some of the necessary shut-ins are likely to occur in the US due purely to market forces. Legacy production from older wells appears most at risk, where costs are higher than basin averages. Already, some industry participants (PXD, PE) have requested that regulators constrain production, noting supply interruptions are imminent.