First-quarter 2025 earnings down on lower oil prices, refining margins

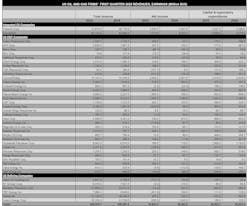

A group of 41 US-based oil and gas producers and refiners posted a total net income of $19.83 billion in first-quarter 2025, compared with net income of $26.39 billion a year earlier. Total revenues were $306.38 billion for the quarter, compared with $308.27 billion a year ago. The decrease in net income reflects the impact of lower oil prices and reduced refining margins.

Want to compare results?

Looking for more detail from Oil & Gas Journal's first-quarter 2024 report on oil and gas producers and refiners for comparison? You can find it here.

Brent crude oil prices averaged $75.81/bbl in first-quarter 2025, compared with $83.0/bbl in first-quarter 2024 and $74.65/bbl in fourth-quarter 2024. West Texas Intermediate (WTI) averaged $71.80/bbl in first-quarter 2025, compared with $77.56/bbl a year earlier and $70.74/bbl in fourth-quarter 2024.

For first-quarter 2025, US crude oil production averaged 13.29 million b/d, compared with 12.94 million b/d a year earlier, according to US Energy Information Administration (EIA) data. US natural gas liquids (NGLs) production averaged 6.99 million b/d during the quarter, compared with 6.51 million b/d a year ago.

US commercial crude oil stock at end-March 2025 was 431 million bbl, compared with 447 million bbl at the end of first-quarter 2024 and a 5-year average of 462 million bbl. US oil product stock at end-March was 772 million bbl, compared with 783 million bbl at the end of first-quarter 2024 and a 5-year average of 787.6 million bbl.

The US Strategic Petroleum Reserve (SPR) at end-March 2025 held 396 million bbl, compared with 363 million bbl at the end of the same quarter a year ago and a 5-year average of 514 million bbl.

For first-quarter 2025, US crude refinery inputs were 15.65 million b/d, compared with 15.39 million b/d the same period a year ago and 16.48 million b/d for the previous quarter. The refinery utilization rate was 86.9%, compared to 85.8% in the previous year's first quarter and 91.6% in fourth-quarter 2024.

Refinery utilization stood at 93% at the start of 2025 but dropped below 90% from mid-January, finishing the quarter at 86%. On the West Coast, utilization declined from 90% to 80% during January and February, ultimately falling below 75% by late March. This decline was influenced by an outage at PBF Energy’s Torrance refinery and a significant outage at the Martinez refinery, both in California.

Meanwhile, East Coast utilization began the year at 83% but fell to under 60% by late February and through March, concluding the quarter at 59%. This decrease was attributed to routine spring maintenance and a significant turnaround at Phillips 66’s Bayway refinery in Linden, NJ.

Refining margins weakened significantly in the US over the first quarter. According to Muse, Stancil & Co., refining cash margins in first-quarter 2025 averaged $13.13/bbl for Middle-West refiners, $16.59/bbl for West Coast refiners, $10.28/bbl for Gulf Coast refiners, and $4.77/bbl for East Coast refiners. In the same quarter of the prior year, these refining margins were $20.79/bbl, $18.52/bbl, $17.18/bbl, and $8.33/bbl, respectively. These lower margins contributed directly to the decline in downstream profitability.

In contrast to oil, the US natural gas market exhibited strong pricing momentum, reflecting a mix of strong winter demand, drawdown in gas storage, and increasing export pressures. Natural gas spot prices at Henry Hub averaged $4.15/MMbtu in first-quarter 2025, up from $2.13/MMbtu for the same quarter a year ago.

US marketed gas production of the quarter ramped up to 115.6 bcfd from 113.4 bcfd a year earlier, according to EIA. Gas inventory ended the quarter at 1,838 bcf, compared with a 5-year average of 1,877 bcf. US LNG exports averaged 14.26 bcfd during the quarter, compared with 12.37 bcfd in the previous year's first quarter.

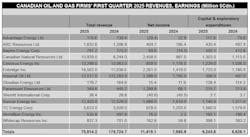

On the Canadian front, a sample of 14 oil and gas producers and pipeline companies with headquarters in Canada announced collective net income of $11.42 billion (Canadian dollar) in first-quarter 2025, compared to net income of $7.89 billion in the prior year’s quarter.

WTI/WCS (Western Canadian Select) spread narrowed from $19.24/bbl in first-quarter 2024 to $12.66/bbl in first-quarter 2025. This improvement stems from expanded export capacity (notably the Trans Mountain expansion) and improved market arbitrage.

US oil, gas producers

ExxonMobil’s first-quarter 2025 earnings came in at $7.7 billion, down slightly year-over-year but ahead of expectations, as strong volumes partially offset weaker oil prices and elevated costs. The company's revenue remained relatively flat year-over-year at $83.13 billion. The company returned $9.1 billion to shareholders.

ExxonMobil continued to reap the rewards of its $60-billion acquisition of Pioneer Natural Resources, reporting its highest first-quarter production in over a decade at 4.6 MMboe/d. This represents a 20% increase compared with production volumes in first-quarter 2024. Upstream earnings increased by $1.1 billion year-over-year due to growth in the Permian basin and Guyana, as well as cost savings. Refining profit of $827 million was down 40% from first-quarter 2024 due to significantly lower refining margins.

Chevron’s reported earnings fell to $3.5 billion, a 36% year-over-year drop, primarily due to lower income from upstream and downstream equity affiliates, lower margins on refined product sales, unfavorable swings in tax items and foreign exchange effects, and lower realizations. Adjusted earnings were $3.8 billion. The company also returned $6.9 billion to shareholders through dividends and buybacks. Capital spending for the quarter was $3.9 billion, down about 5% from $4.1 billion a year ago.

Chevron’s worldwide production was relatively flat from the year-ago level as the impacts of asset sales were mostly offset by volume growth from Tengizchevroil (TCO), the Permian basin, and the Gulf of Mexico. The launch of the Ballymore deepwater project in the Gulf of Mexico marked a positive step forward in upstream growth. During the quarter, Chevron acquired 4.99% of Hess Corp.’s common stock, reflecting continuing confidence in the consummation of the pending acquisition of Hess.

ConocoPhillips reported first-quarter 2025 earnings of $2.85 billion, compared with first-quarter 2024 earnings of $2.6 billion. Excluding special items, first-quarter 2025 adjusted earnings were $2.7 billion, compared with first-quarter 2024 adjusted earnings of $2.4 billion.

The company’s total production reached 2.4 MMboe/d, surpassing the upper limit of guidance. Lower 48 production totaled 1.46 MMboe/d, with significant contributions from the Permian (816,000 boe/d), Eagle Ford (379,000 boe/d), and Bakken (212,000 boe/d). The Eagle Ford region also achieved record drilling performance.

ConocoPhillips also completed $1.3 billion in sales of non-core assets in the Lower 48. Meantime, significant progress was made on the Willow project during the largest winter construction season, reaching key milestones. The company distributed $2.5 billion to shareholders, including $1.5 billion through share repurchases and $1.0 billion through the ordinary dividend.

Occidental Petroleum had net income of $766 million and adjusted income of $860 million for first-quarter 2025. Total average global production for the quarter was 1.39 MMboe/d. Average production for the Permian basin, Rockies and Other Domestic, Gulf of Mexico, and International were 754,000 boe/d, 292,000 boe/d, 121,000 boe/d, and 224,000 boe/d, respectively. Chief executive officer Vicki Hollub highlighted the company's achievements in debt reduction, noting the company has repaid $2.3 billion so far this year, while also keeping domestic operating costs low. The company also closed asset sales of $1.3 billion in the first quarter.

EOG Resources reported first-quarter 2025 earnings of $1.46 billion, down from $1.79 billion a year ago, primarily due to lower commodity prices. Crude oil and condensate production increased compared with the previous quarter and the same quarter last year, reaching 502,000 b/d. Natural gas production remained stable quarter-on-quarter and increased year-on-year.

EOG lowered its full-year 2025 capital plan to $6 billion, down $200 million from the previous estimate. This revised budget is aimed at increasing oil production by 2% and total production by 5%. In the quarter, the company noted a shallow water offshore oil discovery in Trinidad.

EQT Corp. reported its first-quarter 2025 earnings of $242 million, up from $103 million a year ago. The company agreed to acquire Olympus Energy, adding 90,000 net acres in Pennsylvania, underscoring its pivot toward scale in core basins. EQT also reduced its 2025 capital spending to $497 million, 19% below the mid-point of guidance due to lower-than-expected completions, land and midstream spending.

US independent refiners

More on California's refining industry

Want to hear more about refining in California? Listen in to this ICYMI episode of the Oil & Gas Journal ReEnterprised podcast to hear OGJ Downstream Editor Robert Brelsford recap details of Valero’s move to shutter its refinery in Benicia, Calif., and the increased discussion it’s spurred about California’s energy policies.

Valero Energy posted a net loss of $595 million, compared with a net income of $1.2 billion in the same period last year. This loss was partly due to a $1.1 billion pre-tax asset impairment charge related to the company's West Coast operations. Excluding this charge, Valero's adjusted net income was $282 million.

Valero Energy reported throughput of 2.8 million b/d during the quarter, as Gulf Coast operations operated near capacity. Refining margins declined to $9.78/bbl from $14.07/bbl a year earlier, eroding profitability amid a more challenging product market.

Marathon Petroleum similarly recorded a $74 million net loss, compared with earnings of $937 million a year ago, as refining margins dropped to $13.38/bbl from $19.35/bbl, and utilization fell to 89%. Refining operating costs were $5.74/bbl for first-quarter 2025, versus $6.06/bbl for first-quarter 2024.

Phillips 66 reported a 38% decline in realized refining margins to $6.81/bbl. Crude utilization slipped to 80%, down from 92% a year earlier, contributing to a year-over-year earnings drop to $487 million from $748 million.

Canadian firms

All financial figures are presented in Canadian dollars unless noted otherwise.

Canadian Natural Resources reported $2.5 billion in net earnings and $2.4 billion for adjusted earnings. Canadian Natural Resources achieved record quarterly production of about 1.58 MMboe/d, including record liquids and natural gas production. The 2025 capital budget was decreased by $100 million to $6.05 billion, excluding abandonments.

Cenovus Energy posted net income of $859 million, down from $1.2 billion for the first quarter a year ago. Upstream production rose to 818,900 boe/d, while refining throughput reached 665,400 b/d. Canadian refinery utilization exceeded 100%, showcasing operational strength, while US refineries operated at 90%.

Suncor Energy reported its first-quarter 2025 net earnings of $1.69 billion compared with $1.61 billion in the prior year quarter. Despite the decrease in adjusted operating earnings, Suncor achieved record upstream production of 853,200 b/d and record refinery throughput of 482,700 b/d. The company also returned nearly $1.5 billion to shareholders through dividends and share repurchases during the quarter.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.